A question that comes up fairly often in our workshops: “What is a good valuation for my startup?”.

It may seem simplistic, but the question recognises that the process of valuation has some inherent flexibility. On one hand, you’ll face some expectations from investors about fitting in a certain range based on your stage and industry. On the other hand, the valuation is ultimately a subjective reflection of your own ambition for the company.

So what is a ‘good’ valuation?

Is it the highest valuation that you can justify, or is it the valuation that gets the round closed most quickly? Should you be playing investors off each other and using FOMO to drive up your price, or should you dial-up their incentive to help with a healthy amount of ownership?

Let’s start with the basics.

What is valuation?

At the heart of every investment decision are the concepts of risk and return. The purchase price – whether it’s a property, a commodity, or a share in a company – represents the cost of the potential return discounted for the associated risk. Valuation is how you ascertain that price.

When valuation is the focal point of investment negotiations, it is implicit that the two sides have to broadly agree on the exit potential (the point at which the returns are realized) and the confidence in getting there (the risks of failure before getting there). Generally, the name of the game in venture capital is massive returns and very little confidence, but depending on portfolio construction and how they have balanced that risk/ return, investors may be willing to sacrifice one for the other, situationally.

The ideal valuation

The best way to approach your valuation is to think of it as a part of a coherent fundraising story which encompasses all of your communication with investors. The valuation is essentially your pitch, the future vision of your startup, translated into numbers.

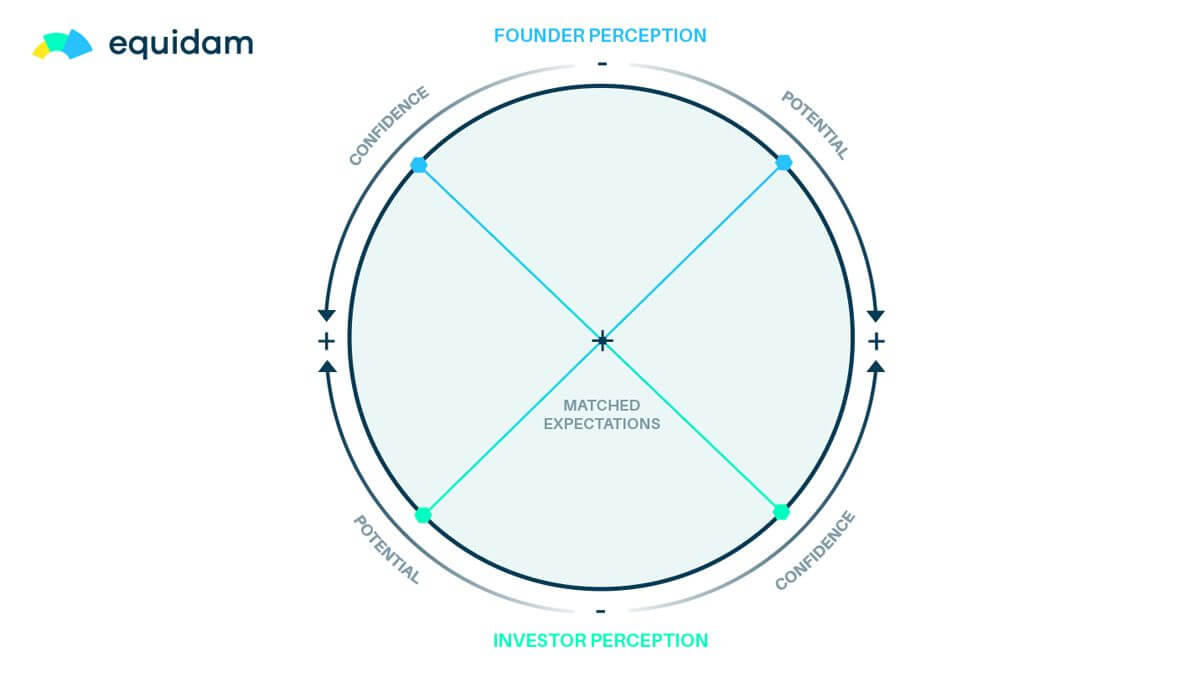

In an ideal world, that story is so thorough and compelling that it aligns both sides perfectly on those two crucial factors of risk and return, represented here as confidence and potential:

- Confidence: Shared anticipation of the ups and downs that the company is likely to experience. Neither side will be shocked if a major assumption is proven incorrect, and will be ready and willing to adjust course as needed.

- Potential: Mutual understanding of the growth required to hit the objective which underpins the investment. Neither side will find that the desired metrics and milestones along that journey are unreasonable.

It’s not unusual that in the process of performing a valuation you may find that there is a disconnect between the pitch (what is laid out as the ambition) and the valuation itself (the reality of that vision). For example, your pitch may promise investors that the startup is tackling a powerful opportunity in a large market, implying rapid growth and an attractive exit. When looked at through the lens of market data and financials, it may turn out that the outcome is limited by the market, or that the growth needed to achieve it is unreasonable. In these case, the two must be reconciled into a more rational vision.

Aligning both sides on the future

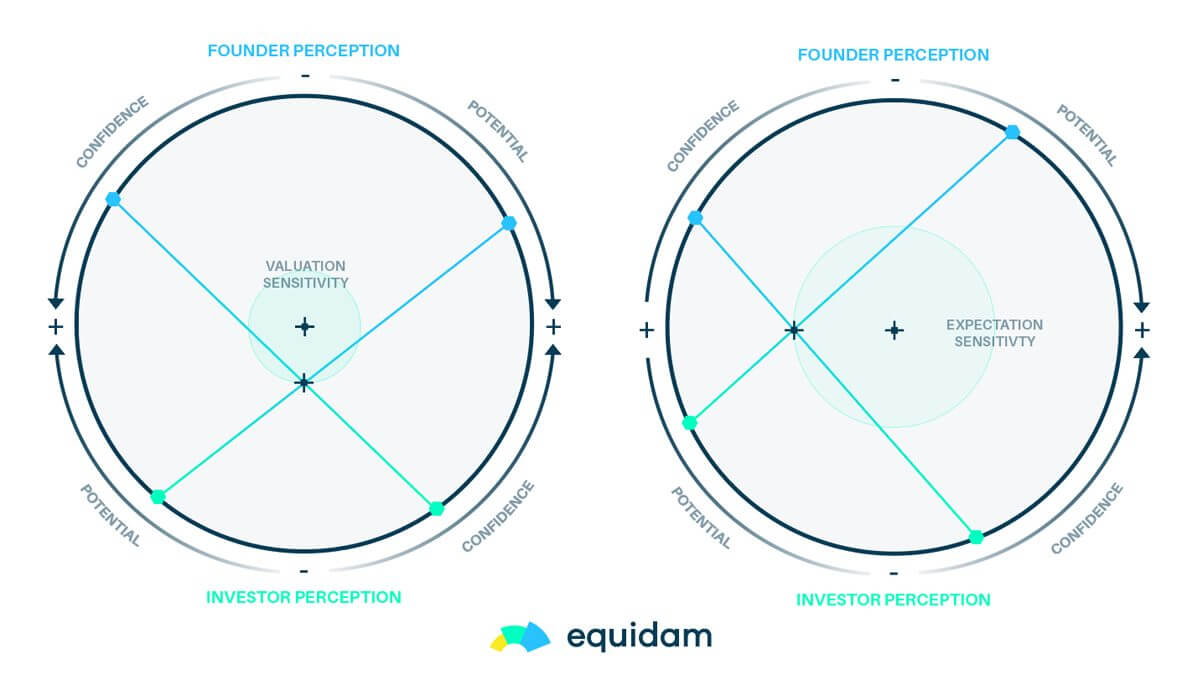

In this context, there are two main ways that your negotiations with investors can go awry:

- Valuation sensitivity: Mismatched optimism is the most common issue, which occurs one side has a more positive outlook on the future of a startup. This produces a disconnect between the two parties on the value of the company, indicating that some part of that story didn’t have the intended impact.

- Expectation sensitivity: Misaligned expectations are also possible, in that the two side may broadly agree on value, but disagree on the balance of risk and reward. e.g. where investors lack confidence in the viability of an idea, the founder may attempt to compensate by exaggerating the potential. Alternatively, an investor who doesn’t quite believe potential may attempt to talk it down by focusing on the perceived risks.

In both cases, the solution is transparency, scrutiny, and a constructive conversation about the various assumptions that drive the valuation. The first case is easy to identify via valuation, while the second can be obscured if that conversation is rushed, or too superficial. It bears repeating that it is crucial for both sides to understand the drivers of growth and the key assumptions, in order to have a meaningful shared vision of the future.

A “good” valuation

Ultimately, a “good” valuation is the result which best aligns both sides of the negotiation.

This means both sides – you and your investors – are correctly incentivised, and have the best interests of the startup in mind. You maintain enough ownership to secure the startup’s future and your own stake in that success, and the investors are similarly rewarded with an amount of ownership proportional to the risk they are taking and the support they will offer.

The goal of this exercise is to secure the outcome that ensures the best future for the company. For founders, reducing dilution is good – but it is only a part of the story, so you don’t just want the valuation to be as high as possible. For investors, increasing ownership is good, but not if it damages the morale of founders and limits their ability to incentivise future investors and employees. Therefore, you should approach valuation as an opportunity to build that critical shared vision of the future, and determine a fair price for the investment based on those aligned interests.

External forces on these judgements

Another consideration is the potential for external influences on the perceptions of either side, which again may produce a disconnect.

A recent example of that may be the notoriously ‘frothy’ market of 2021/22, where capital was easy to come by for VC firms – which had a follow-on effect of lowering their sensitivity to the risk of individual investments. It happened at a time of extreme optimism about technology and economic growth, which also would have shaped the perception of startup potential – perhaps with different results for the two sides. Similarly, many investors have backed off from the market in the last year for a number of reasons including the impact of inflation on their own ability to raise, as well as general economic pessimism. This has pushed investors towards startups which have already obtained much more proof for their business model, in the form of revenue generation and margins. Meanwhile, early stages companies – who are largely disconnected from macroeconomic woes – may feel surprised that these factors have a significant influence investment decisions.

On the other hand, founders may feel more in-tune with specific technology trends or industry growth and have a different perspective on the factors at play here – typically adding more optimism to their vision for the future and the potential of this solution. Cryptocurrency and web3 are examples of sectors where founders’ belief that the technology is majorly transformative has generally outpaced investor enthusiasm. Conversely, AI may be an example of a sector where investors have unrealistic optimism about the current capacity of the technology, thanks to the ‘hype factor’, while practitioners in the sector have enough direct exposure to remain more clear-headed.

This is why both sides have to ‘read the room’ when it comes to investment conversations. They have to be willing to talk through all of these factors, to share their insights and seek better alignment. The more transparent and well-meaning these conversations are, the more likely that the two sides will come either to a positively aligned vision of the future, or to an amicable decision to not proceed. Either way, the result is improved.

Benefits to the whole ecosystem

Finally, it’s worth considering how this attitude impacts the value chain of venture capital investment.

On one side, you have startups who can better calibrate their own view on the risk/return of their company, and the various factors at work, based on feedback from investors. This translates greater internal confidence in the vision, and therefore a more competent strategy, which ultimately benefits employees and customers of the company.

On the other side, investors now have a more holistic understanding of the companies they are investing in, a better understanding of the nuances of industry and technology, and are therefore better able to learn from the impact of their own decisions, as well as providing more useful reporting and feedback to their own investors – the limited partners.

Transparency creates confidence, and – in an asset class that is inherently high risk – confidence is crucial to the proper allocation of capital.