Equidam partner Venturerock is a digital venture capital platform and ecosystem of founders, backers & builders building the next generation of global tech companies. They invest in early-stage ventures active at the cross point of novel technology infrastructures – blockchain, AI and IoT – and the first industries of impact – FinTech, HealthTech and Smart City.

We spoke to Marc Wesselink, Co-Founder of Venturerock, to understand more about how they are changing how venture funding works and increasing the odds for founders.

“We have combined technology and our expertise in accelerating 700+ startups to design a new investment protocol that enables founders and their teams to focus on execution, instead of fundraising.”

What is Venturerock?

We are changing the way we invest and finance seed stage companies by automating the entire process. Based on real time audited progress, we increase the investment amount so we can detect failure early on and increase the success rate dramatically.

We are focusing on Europe & Asia for now but franchising our approach towards MENA & USA next year. Every vertical has its own network, and currently we have FinTech & HealthTech up and running.

90% of startups fail in the first 3 years. How does Venturerock help founders beat those odds?

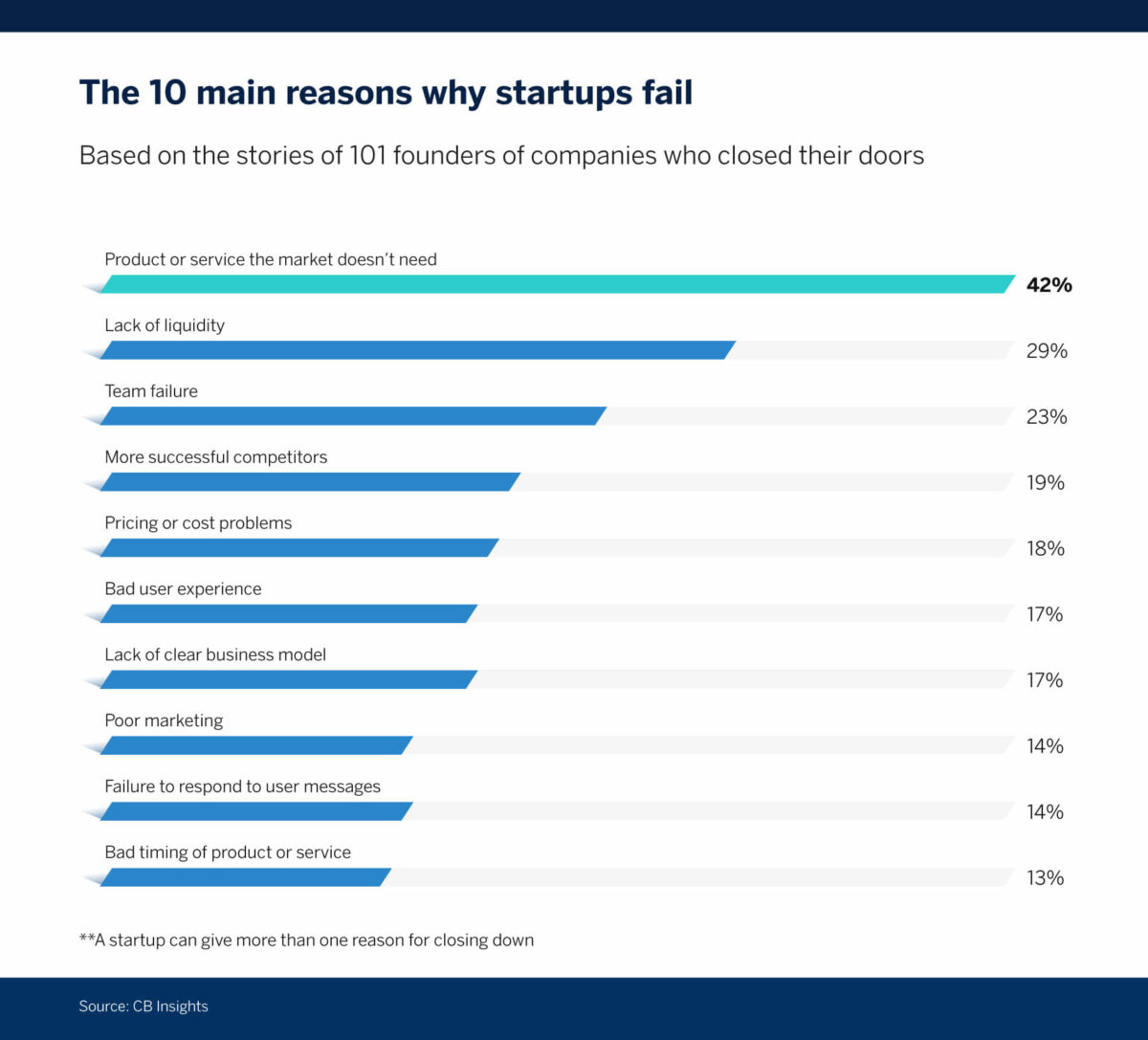

42% of the startups are failing because of poor Product / Market fit.

Our methodology is based on a 72 step approach, and through the course of these 72 steps we release the funds so the founders can focus on finding a problem worth solving instead of building something nobody wants.

Founders need to prove that they are able to add value, if not, they can be removed from the team. This solves another big reason why startups are failing (23% of them fail because of team issues).

We’ve all heard of the SPAC trend, but what is Venturerock’s SPIC?

A SPIC stands for Special Purpose Investment Company and is based on our methodology. It acts like a network to support the startups. All parts of the network are coming from a specific vertical and include investors, experts & founders. Together they become much more powerful and increase the chances of success of the company. The entire SPIC is digitized and we use internal tokens to distribute the value of the assets (Units).

What part does Equidam play there?

The network receives an update on every company on a quarterly basis and based on that update, we calculate the Net Asset Value of the company with Equidam. In this way we can show an updated price per Unit since everyone owns a piece of the SPIC.