In a difficult environment for founders and investors, AI startups have been the obvious outlier with their ability to raise capital on generous terms. The excitement for what AI offers in the near future has concentrated interest from investors, many of whom are reeling from poor decisions made over the last decade.

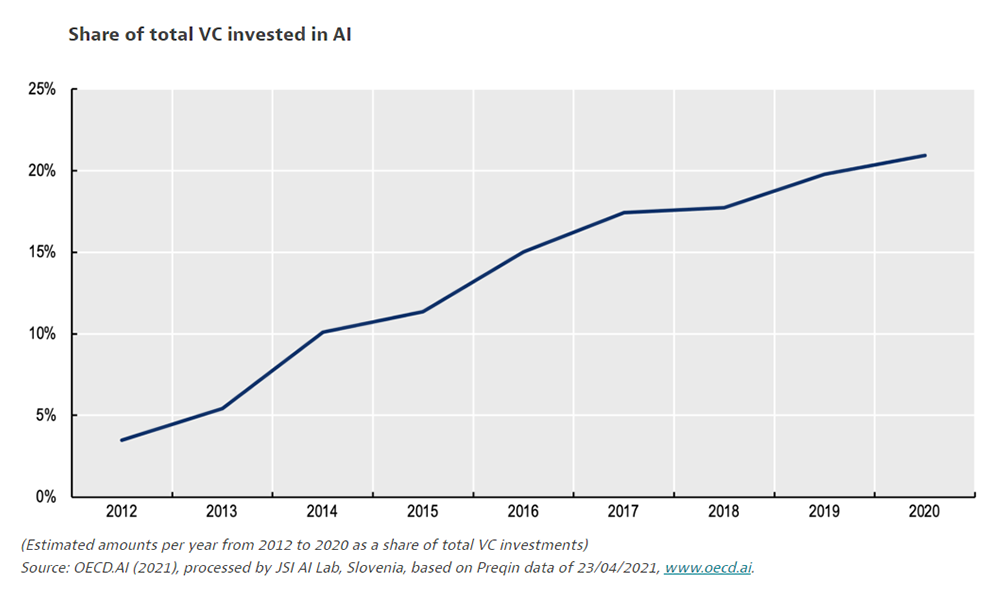

It would be easy to assume that we are amidst an incredible new wave of innovation, producing such a flare of enthusiastic capital deployment and dominating conversations in tech. The reality is a little different: Venture capital investment in AI related startups has been steadily increasing for a long time, representing about 4% of investment dollars in 2012, to about 26% today.

The history of public interest tells an interesting story, as well. Search comparisons on Google Trends shows the extent to which ‘generative AI’ is a rebrand of terminology used to describe the underlying tech: machine learning, neural networks, big data. While companies like OpenAI and Meta are working with giant datasets, on incredible hardware, today’s LLMs and diffusion models are an evolution — not a revolution — of ongoing work.

Today’s inflection point is a result of the viable commercialization of generative AI products, and the associated attention, economic energy, and potential future returns — not necessarily a step-change in technology. It is through that lens that we should consider measuring value.

Taking the temperature of AI startups

While AI startups are raising at higher valuations than their peers today, they are also raising at disproportionately higher valuations than they would have managed just a few years ago. Analysis of valuations on Equidam shows early-stage AI startups had an average valuation of $25.1M in the four years up to 2021, and $44.7M from 2021 onwards. That’s a remarkable shift, given valuations have been largely flat (ZIRP turbulence aside) during that period.

That has two possible implications:

- First, it could be that AI startups are forecasting more ambitious growth and financial performance, reflecting the belief that recent developments in generative AI (or growing market interest) will allow them to capture market share more quickly.

- The second possibility is that AI founders know they can extract higher valuations from VCs, and so are inflating financial prospects in order to take on less dilution today. If this is the case, it’s short-sighted as missed revenue growth milestones will be a giveaway.

How, and to what extent, can we assign future value to the promise of AI? Let’s consider a hypothetical startup looking to raise capital: a CRM solution for B2B SMEs that has added generative AI functionality which summarizes communication as notes and automatically drafts individually personalized drip campaigns to prospects.

- In scenario one, this startup treats the generative AI as an addition to their technology stack. They still target the same market opportunity, but are now able to demonstrate better retention figures in response to the improved experience, as well as a lower acquisition cost. The result is increased EBITDA in their projections, yielding a slightly higher valuation — from $8M to $10M.

- In scenario two, the startup now bills itself as an AI company, and spends a few thousand dollars on a new .ai domain name. This repositioning means fundraising from a slightly different set of investors, using a different set of comparables. Suddenly, this startup is catching heat, and an oversubscribed round allows the founders to raise at a valuation of $22M.

In reality, the second scenario is probably the most common, as founders seek any way to remove friction from the grind of fundraising. The outcome (when it works) is usually an unsustainable inflation of value, leading to down rounds, restructuring, or simple failure when reality kicks in a little further down the line. A fundamental truth for startups is that valuation converges with financial performance as you mature towards an exit, so it’s worth maintaining a reasonable relationship between the two along the way. This is a concept well understood by William Falcon, CEO of Lightning AI, who shared his concerns about valuation sustainability with Fortune Magazine:

“When we raise our Series C next, it’s likely our valuation will go up—the question is, is it in line with the revenue so that the next time it will continue to go up? If it is, that’s fine. If not, we’re back to the same problem.” [source]

A pragmatic understanding of value

As illustrated in the example, it’s important to consider the technology’s practical applications and the startups’ ability to execute on their promises. generative AI has demonstrated its potential across a wide range of industries, from customer service to content generation, but translating this potential into tangible, scalable business models is another challenge altogether.

One of the key factors in startup success is the recognition of sufficiently painful issues, usually constraints on financial performance. In these cases, a startup can aim to address the problem, unlocking that new economic energy, from which they can extract their own fees. Startups that can successfully bridge the gap between technological innovation and market demand are more likely to justify their high valuations.

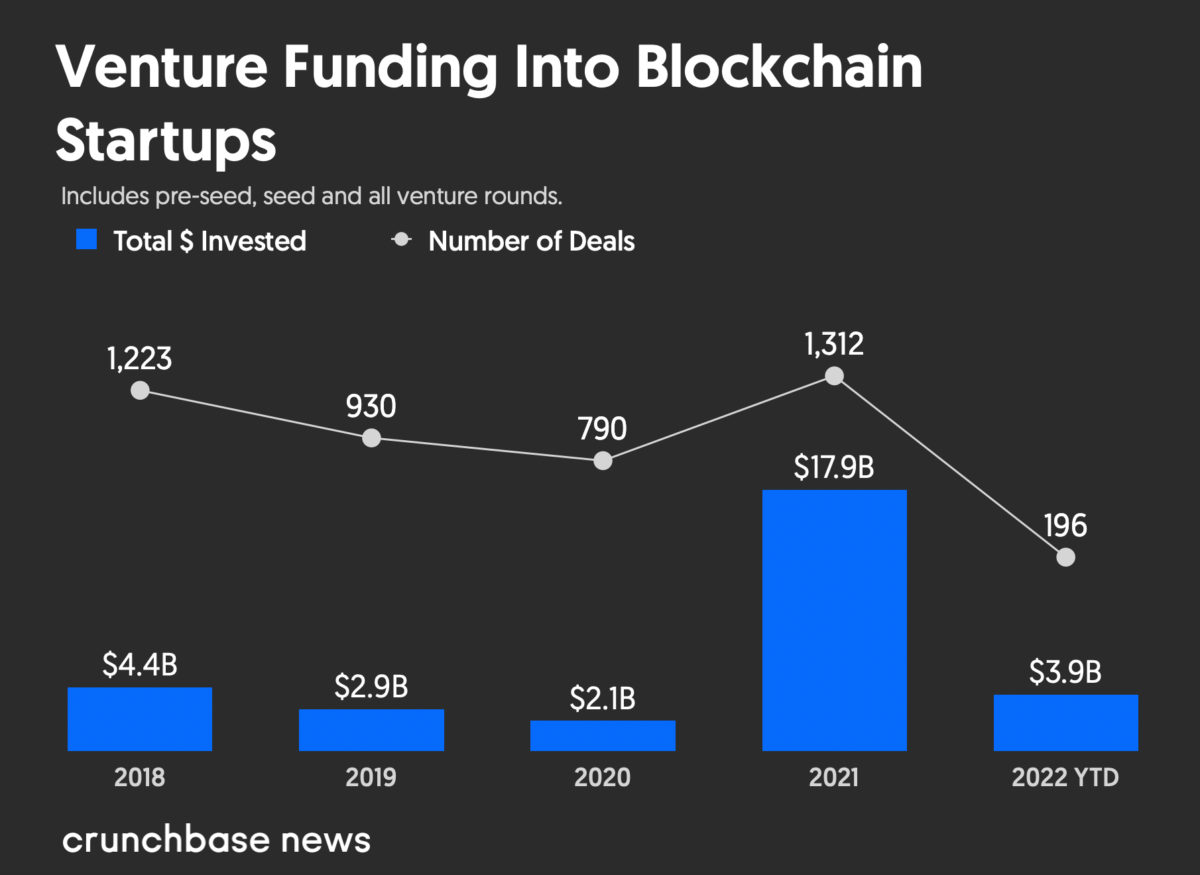

As an example, we can look back at Web3 as a great flash in the pan for venture capital. The problem was that while Web3’s decentralized view of the world offered a lot of theoretical benefits it simply didn’t connect with real-world pains. There was no great unlock of economic energy to support Web3 startups and provide sustainable growth in value.

This is not a direct comparison to generative AI, which appears to have clearer applications and revenue opportunities, but it does raise some important questions that founders will need to address about the sustainability of their venture.

It’s also important for founders to consider the dangers of hitching themselves to a trend, even if it seems unstoppable at the moment. With a wholesale pivot to artificial intelligence, raising money on that identity, you are now at the whims of more temperamental market forces.

Given the speed of development, there are a number of possible scenarios whereby the value of generative AI startups may fall. For example:

- Incumbents like Microsoft, Google and Apple have unbelievable distribution, with product lines that touch virtually all sectors of the economy. The native integration of generative AI capability may zero-out a huge number of startups.

- The emergence of high-performing open source generative AI models can pose a significant threat to startups in the space. These open-source models, such as Meta’s Llama 3, are available for free and can provide a cost-effective alternative for businesses looking to integrate AI

- A significant ‘priced-in’ amount of adoption for generative AI solutions, consumer or business, may simply never materialize. It’s possible that it simply doesn’t solve enough business-critical problems to merit a broad increase in valuation, or that one or two market leaders like OpenAI capture the vast majority of the interest.

In addition to all of the risks associated with raising inflated valuations based on hype, if you chose to align your startup with the generative AI market when it was on the way up, you will find yourself aligned with it on the way down as well. There is very little upside, especially if you desire to work with smart investors who will be good partners in the future of your company. This is a sentiment shared by Tim Guleri, managing director of Sierra Ventures, in comments he gave to Pitchbook:

“The high valuations being paid for generative AI investments is high-stakes poker. You cannot drive sustainable venture returns from this.” [source]

Don’t get lost in the sauce

In summary, the valuation of today’s AI startups is a complex issue that includes considerations for technology, market demand, and investor sentiment. While the potential for generative AI to transform industries is undeniable, the reality of integrating this technology into scalable, profitable business models remains the fundamental challenge. Founders should focus on distinguishing between genuine value driven by technological innovation and market applicability, versus superficial value boosts from rebranding or aligning with current investment trends. We shared a few basic principles on that, specifically for AI startups, in this article.

Moreover, the looming presence of major tech incumbents and the proliferation of open-source AI technologies serve as reminders that high valuations today do not guarantee long-term success. As our understanding of generative AI develops, startups need to be agile, strategically minded, and, above all, attuned to the real-world problems their startups can solve. This approach will not only help in achieving sustainable growth but also in avoiding the pitfalls of overvaluation that have befallen many in the tech sector.

Important lessons can be learned from similar moments in history, such as the dotcom bubble. Research into venture returns from that period shows that while a huge amount of wealth was destroyed, a small number of huge winners did enable an aggregate return. The research also highlights that the earlier startups, who raised on more modest terms, before pricing spiralled out of control, tended to be the ones that found lasting success:

“The results indicate that dot-coms are funded at relatively low rates during the beginning of the internet boom, and these early entrants exhibit high success rates and create substantial long-term value. However, the majority of venture-backed dot-coms are funded well after public market values rise sharply, and these dot-com investments perform far worse.” [source]