As the founder of a startup, you know that raising money from investors is sometimes crucial for growth and success. However, with so many startups competing for those investment dollars, it can be challenging to stand out from the crowd. To capture the attention of investors and convince them to invest in your startup, you need to share a compelling vision for the future and give them confidence in your ability to execute on that potential.

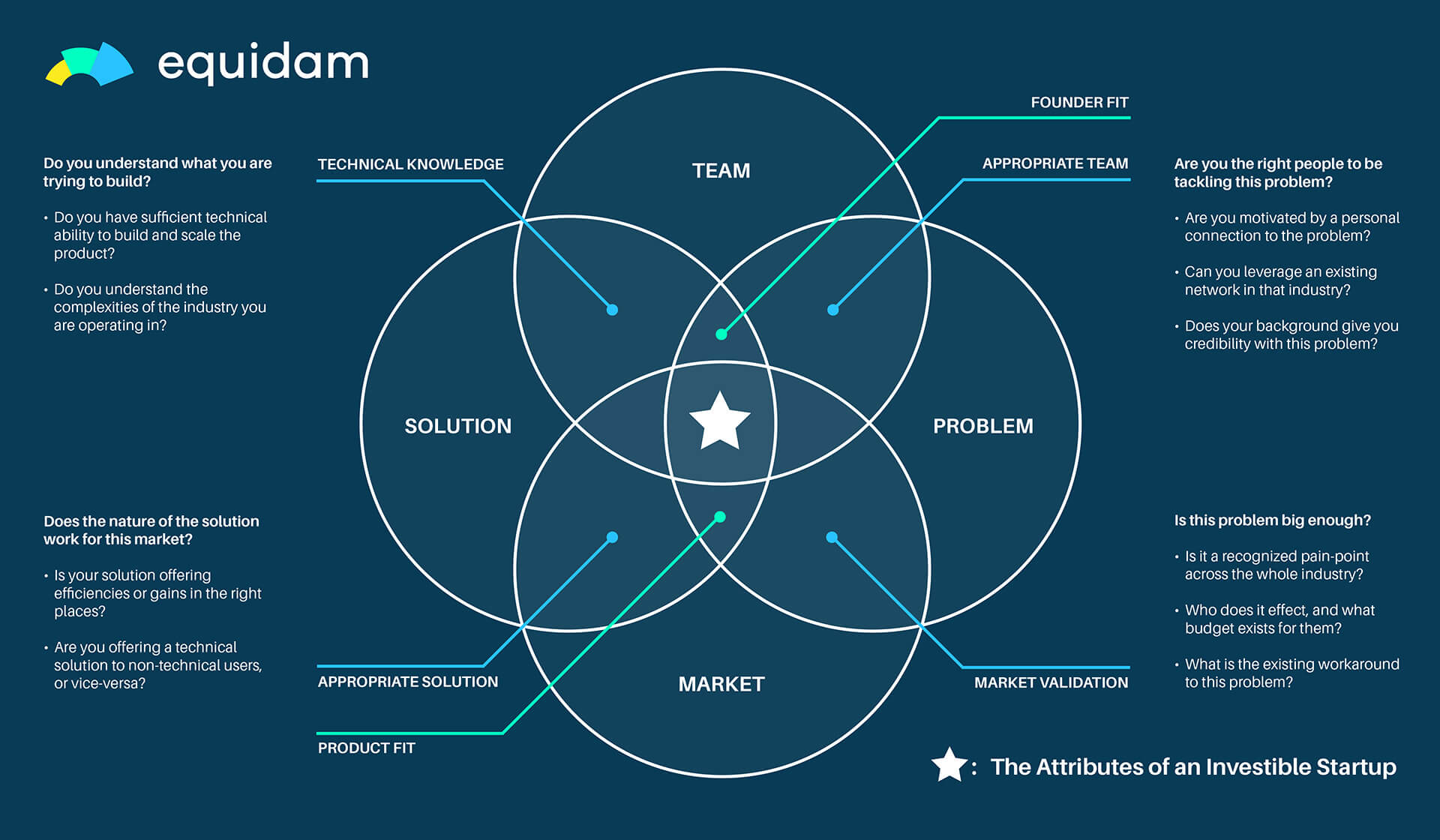

There are six overlapping areas that you need to focus on to demonstrate your startup’s potential:

Appropriate People

Investors want to see that your team has a deep understanding of the problem you’re trying to solve and the customers you’re targeting. You need to demonstrate that you have the right team in place to solve the problem and create a solution that meets your target audience’s needs.

e.g. if you’re building a healthcare startup, investors will look for evidence that your team has experience and connections in the medical industry.

Appropriate Solution

Investors want to see that your solution is correctly tailored to your target market, with both users and buyers finding it practical and compelling. You can demonstrate this by conducting market research and surveys, and by having a deep understanding of your target audience’s pain points and needs.

e.g. if you’re building a fintech startup, investors will look for evidence that your solution addresses a gap in the market and solves a real problem for users.

Market Validation

Investors want to see that your solution has been validated in the market. They need to see that you have a clear path to market entry and that there is a real demand for your product or service. You can showcase this by demonstrating your traction and customer acquisition, as well as your growth projections.

e.g. if you’re building a food delivery startup, investors will look for evidence that your solution has been successfully launched in a test market, and that customers are using and recommending it.

Technical Knowledge

Investors want to see that your team has the necessary technical skills and expertise to develop and innovate your product or service.

e.g. if you’re building a software solution, investors will look for evidence of your team’s development skills. You can showcase this by highlighting the team’s experience and education, as well as any previous successful projects.

Founder Fit

Investors want to see that the founders have the necessary skills and experience to solve the problem and a deep understanding of the market they’re targeting. They need to see that the founders are passionate about the problem and have a clear vision and strategy for the startup. You can showcase this by sharing your personal story and experiences, as well as your background and expertise in the industry.

e.g. if you’re building a social media startup, investors will look for evidence that the founders have experience in marketing and communication, and a deep understanding of how to build an engaged online community.

Product Fit

Investors want to see that your product or service has strong product-market fit and a unique value proposition that sets it apart from competitors. You need to demonstrate that your solution addresses a significant market need and that it provides real value to users. You can showcase this by highlighting your unique features and benefits, as well as your competitive advantages.

e.g. if you’re building a travel booking startup, investors will look for evidence that your solution provides a faster, easier, or more affordable way to book travel than existing competitors.

In summary, to showcase your startup’s potential to investors, you need to:

- Demonstrate your team’s technical skills and expertise

- Show that you have the right team in place to solve the problem and create a solution that meets your target audience’s needs

- Validate your solution in the market and show that there is a real demand for it

- Demonstrate your traction and customer acquisition, as well as your growth

These factors are crucial to telling a coherent and compelling story that aligns with your financial projections and valuation, providing prospective investors with as complete a view as possible on your potential.