At this year’s Rome Startup Week, a notable panel titled “The State of Funding in Southern Europe” drew attention from entrepreneurs, investors, and industry experts alike. The panel, moderated by Vittorio Verardi—freelance consultant and president of the Needs Startup Association—delved deep into the current state of funding and valuation trends across Southern Europe.

Featuring commentary from Daniel Faloppa, founder and CEO of Equidam, alongside Francesca Catalano from BizPlace and Ilaria Fava, co-founder and CEO of B-yond Venture, the discussion shed light on important developments shaping the funding landscape.

The Panelists

Daniel brought Equidam’s analysis of data surrounding startup valuation and funding trends in Southern Europe to the table, with a comprehensive view of how Italy and its Southern European neighbors have fared in the broader context of the European Union (EU) startup ecosystem. Francesca Catalano, with her expertise in M&A and startup strategy at BizPlace, offered an on-the-ground perspective on the nuances of startup deals and investment trends, while Ilaria Fava, heading Beyond Venture, shared first-hand experience of the challenges and opportunities faced by startups in the region.

The discussion was framed around key questions: How is Southern Europe positioned in terms of startup funding? How does Italy’s startup ecosystem compare to the rest of Europe? What trends have emerged over the past three years?

1. Fundraising in Southern Europe vs. the EU

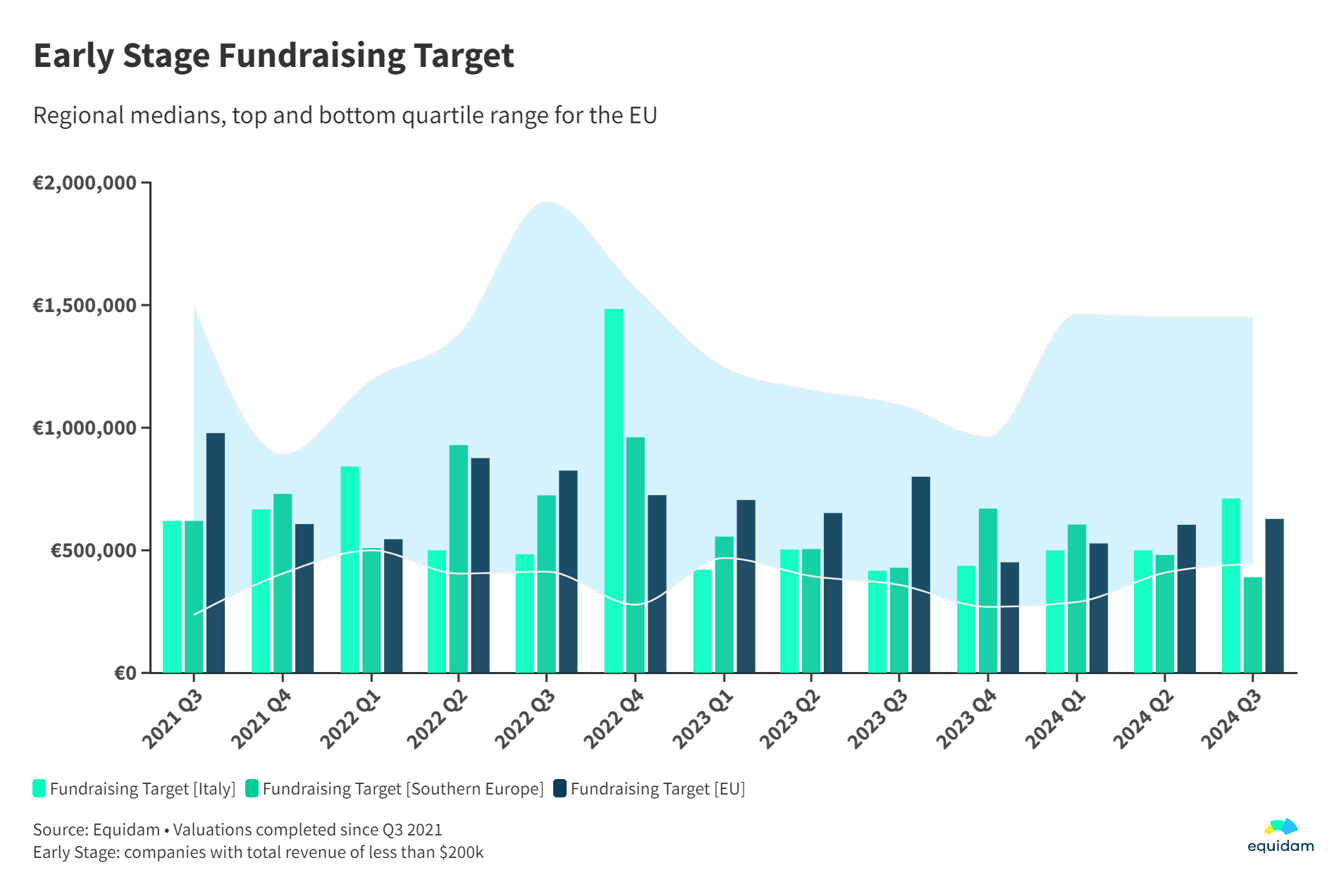

From Q3 2021 to Q3 2024, early-stage startups in Italy, Southern Europe, and the EU experienced noticeable shifts in fundraising targets. Italy has shown a more conservative fundraising approach post-Q4 2022, with a gradual decline in targets that reflect the challenging fundraising environment in the region. The EU, however, displayed slightly higher ambitions with median fundraising targets consistently surpassing those in Southern Europe.

This trend suggests that startups in the broader EU region may have found more favorable funding conditions, especially in countries benefiting from emerging technologies like AI. The conservative targets from Italian and Southern European startups highlight a cautious attitude towards growth in the face of macroeconomic headwinds.

2. Valuation Trends: A Comparative Perspective

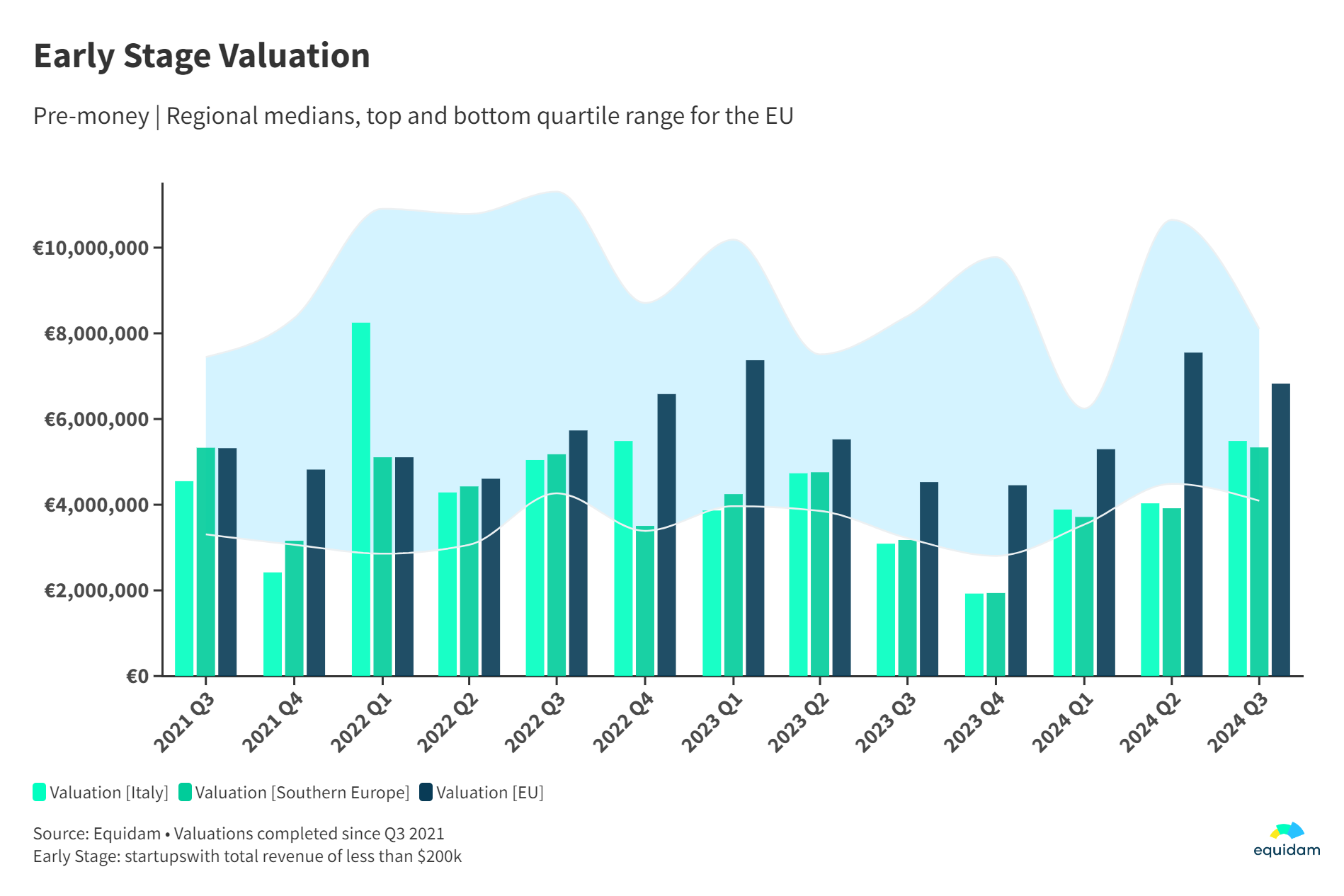

Valuation trends show a stark contrast between Italy, Southern Europe, and the EU during and after the startup fundraising boom. Italian startups reached their peak valuations in Q1 2022, with a median pre-money valuation of over €8 million. However, by Q4 2022, valuations in Italy and Southern Europe saw a marked decline. EU-wide valuations, though experiencing the same downturn, remained comparatively higher than those in Southern Europe, especially after the boom.

This difference is largely driven by the success of sectors like AI in countries such as France and Sweden, which have pulled the EU median valuation upward, signaling investor confidence in technology-driven startups. The graph highlights the divergence between regions, where Southern European valuations have struggled to keep pace with the broader EU recovery.

3. Dilution: A Signal of Power Shifts?

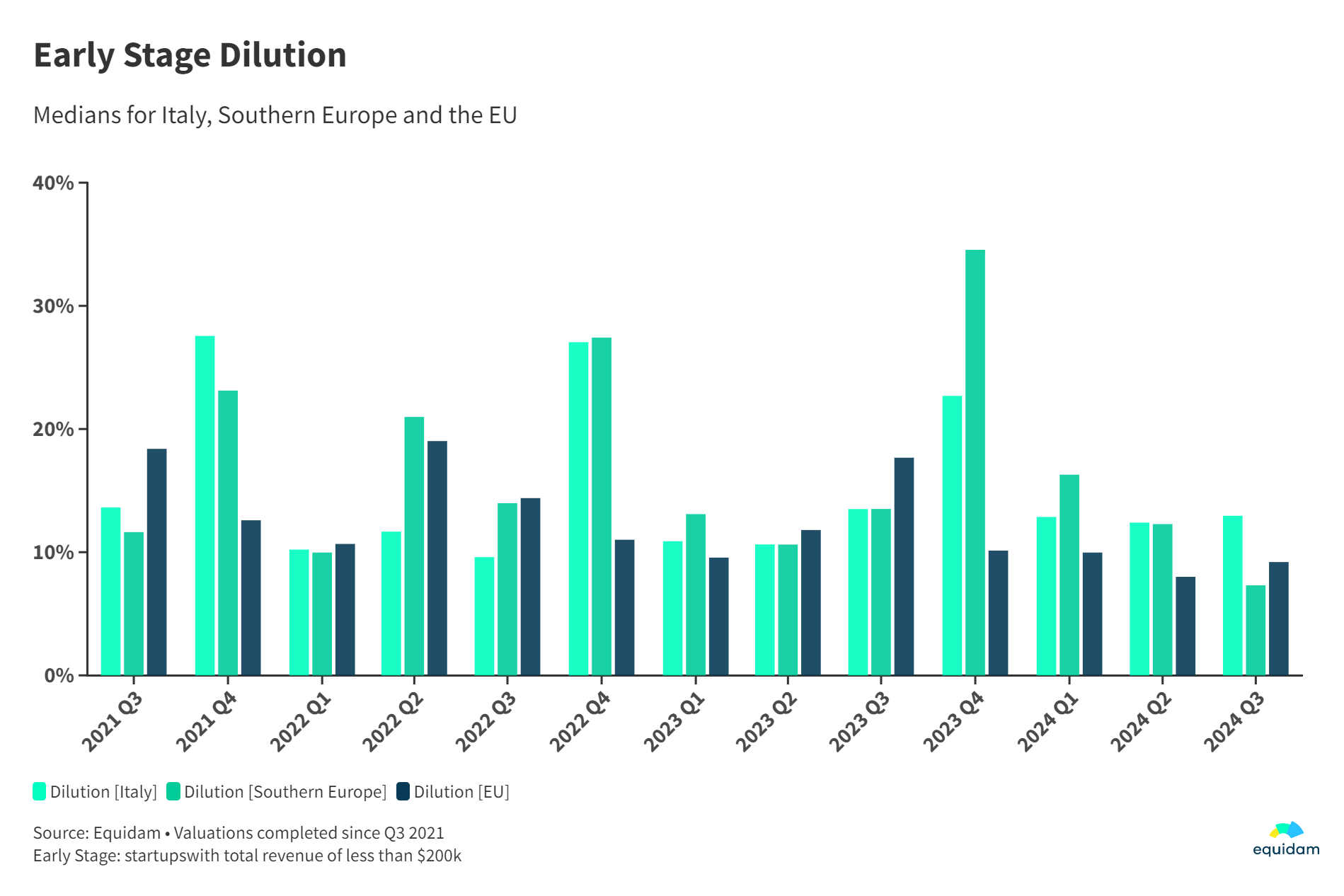

Dilution rates provide an additional layer of insight into the startup ecosystem, with Southern Europe and Italy experiencing steeper dilution in certain periods, especially during Q4. The peak in dilution in Southern Europe at the end of 2022 underscores the difficulty in securing capital without offering significant equity. In contrast, the EU’s dilution rates remained more stable, albeit higher than Italy and Southern Europe.

For founders in Italy and Southern Europe, this means that raising funds in these regions may come at a higher equity cost compared to the broader EU. The trends suggest that investors in these regions demand more equity in return for capital, reflecting both market conditions and investor caution during the post-boom phase.

What This Means for Founders and Investors

The insights from the panel at Rome Startup Week reveal a nuanced picture for founders and investors alike. While Southern Europe—especially Italy—continues to lag behind some of the more mature startup ecosystems in the EU, the region is showing signs of resilience and growth. For founders, the data suggests that while the fundraising environment may be challenging, there is a stabilizing trend in valuations, and the upward pressure on dilution is starting to ease. For investors, Southern Europe represents an emerging opportunity, with valuations that still offer potential upside and a startup ecosystem that is maturing.

In the words of Daniel Faloppa, “The Southern European startup ecosystem has shown that it can adapt and thrive even in uncertain times. While the road ahead will continue to present challenges, there are clear signals that the region is positioned for growth, and the gap with other EU markets is closing.”

As we look to the future, it will be important to continue monitoring these trends, particularly as Southern European startups begin to attract more international attention and investment. For now, both founders and investors should approach the market with cautious optimism—armed with data, ready to navigate a dynamic landscape.