Today we release our Quick Startup Valuation Estimate GPT, built on top of OpenAI’s ChatGPT LLM interface and Equidam’s API, which is accessible for ChatGPT users with a Plus or Team account.

This GPT-powered chat interface is based on the same logic as the initial estimate in a valuation calculated on Equidam, through which we provide a quick calculation based on 10 questions. This limited set of information allows us to algorithmically enrich your company data, using our database to provide comparisons and benchmarks, and then apply our full methodology to this expanded view for a quick and efficient valuation.

Why use a GPT for Startup Valuation?

Usually, a simple form is the most efficient way to enter information, particularly if you are confident about the inputs and familiar with the process. A GPT allows you to ask questions about the process, as well as inferring answers from broader contextual information where you may be unsure yourself. Essentially, it’s like going through a basic valuation calculation with an advisor there to provide some guidance.

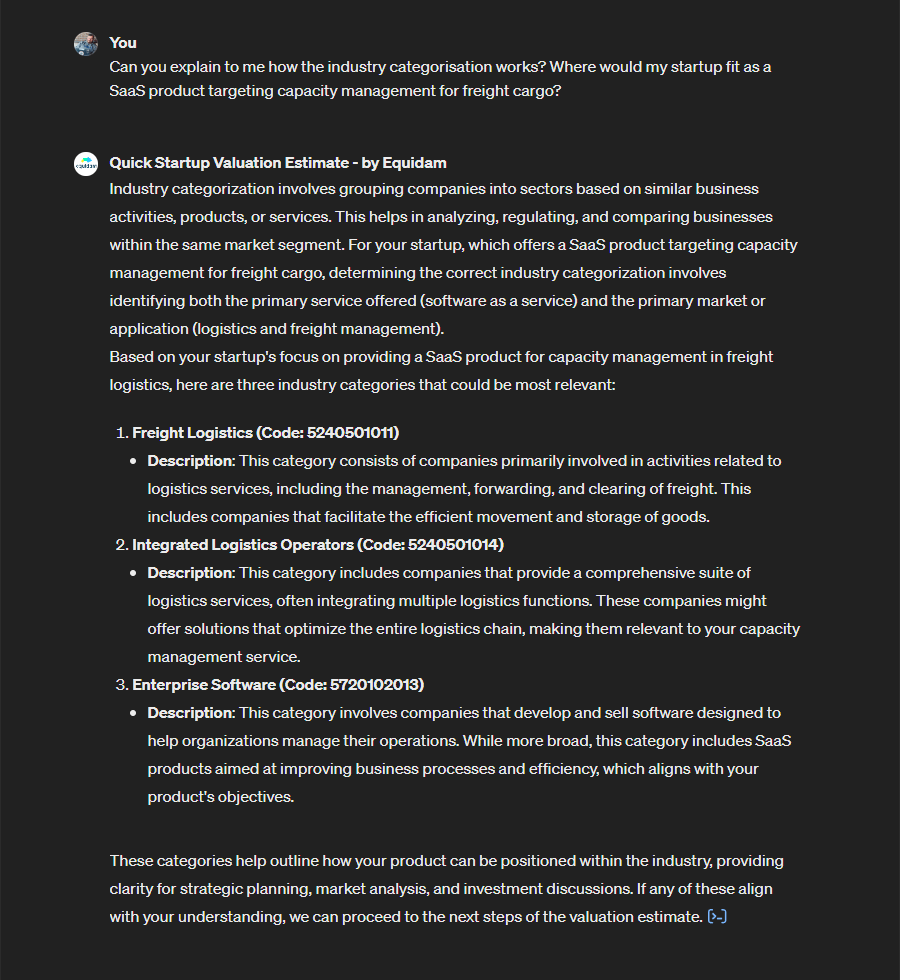

- Not sure which industry category you fit into? Tell the GPT a bit about what you do, and the type of customers you serve, and it will help you make the right choice.

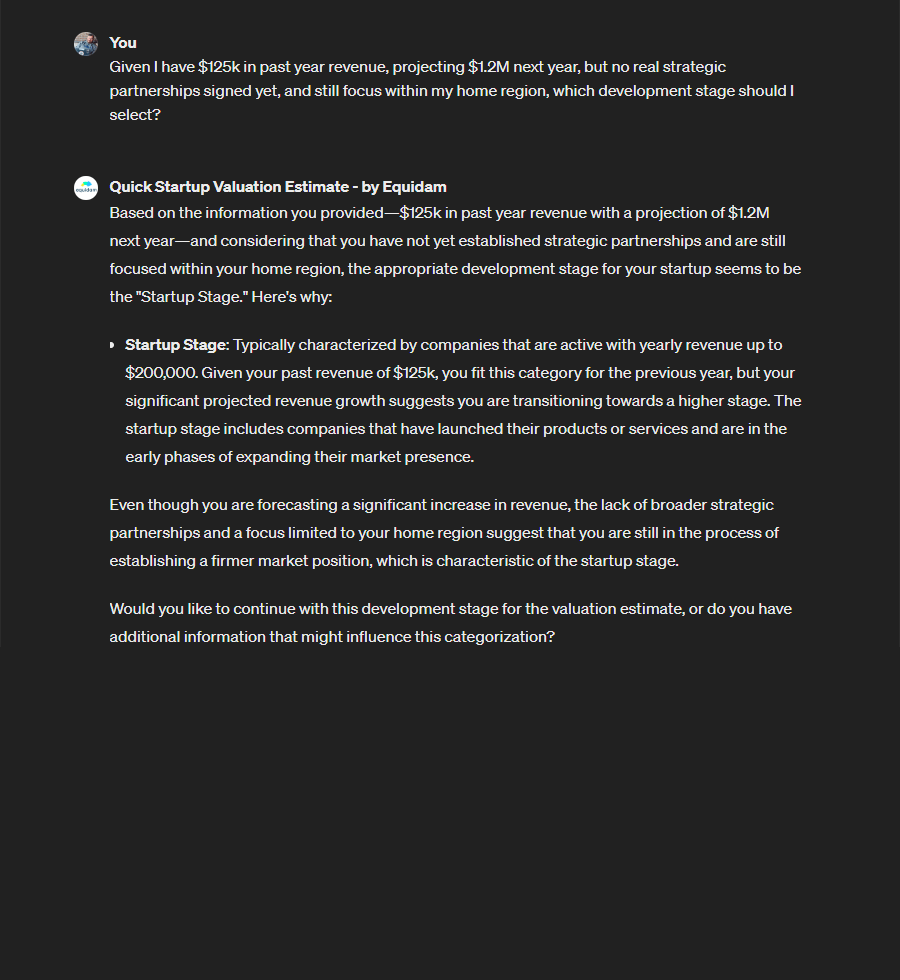

- Unclear about the development stage you should pick? The GPT can break down each in more detail, and suggest which might be the best fit for you based on your development milestones.

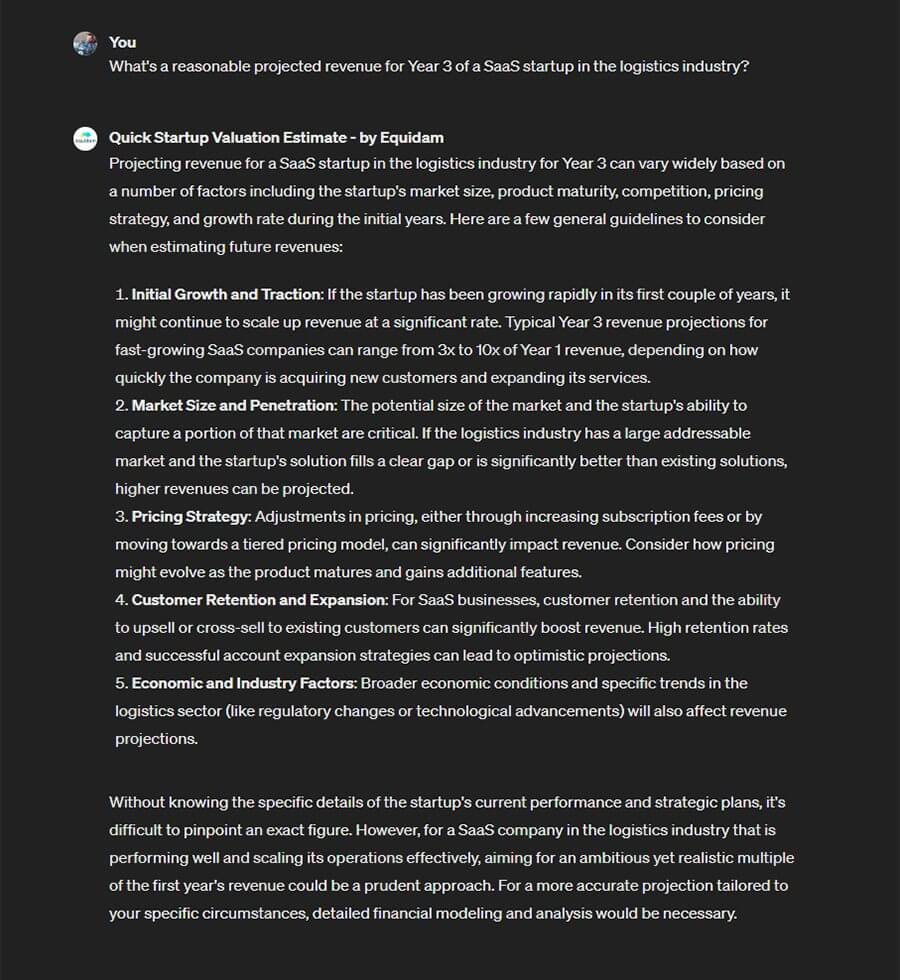

- Struggling with your revenue projections? You can give the GPT some details about your startup, and progress so far, and ask it for some guidance and key points to consider.

Much of this reflects content in our knowledge base, articles or workshops, which we have always made available for founders free of charge, and now it’s built directly into the process.

By combining ChatGPT’s ability to wrangle large data sets with Equidam’s Startup Valuation API, we offer the best of both worlds: a streamlined interface that can provide personalized guidance, alongside a transparent and proven methodology.

What’s in the estimate?

This approach to valuation is not just about applying averages, but understanding and communicating how a specific company differs from those averages. The methodology is designed to give a balanced, well-reasoned estimate that respects the unique aspects of each company while grounding the valuation in solid data analysis.

This limited data input serves as a strategic entry point for the valuation algorithm. Once the initial data points are gathered, the machine learning algorithm identifies the top 30 companies from Equidam’s proprietary database that share the most similarities with the startup being analyzed. This selection is based on the critical factors identified from the initial 10 questions, ensuring a relevant comparison. Subsequently, this data is used not only to benchmark but also to generate detailed financial projections and qualitative assessments. This “data expansion engine” extrapolates necessary financial ratios and qualitative data from the similar companies to construct a comprehensive financial forecast and valuation, tailoring the outputs specifically to the unique characteristics of the startup in question.

The output is not just a superficial estimate; rather, it utilizes the full capabilities of Equidam’s up-to-date valuation algorithm, which incorporates current data and methods used in the valuation field. It is also the starting point for a full, detailed valuation report, which you can generate on the Equidam platform.

GPT as a Startup Valuation guide

As well as calculating the valuation, our Startup Valuation GPT can also answer questions about the process itself, helping you to understand the inputs, and refine your output. For many founders, especially first time founders, valuation can be an intimidating question — and we have always aimed to make it clearer and more accessible. The GPT is one more step in that direction.

It’s important to understand the limitations of a model like ChatGPT for a use-case like this: it has a strong understanding of averages and broad concepts, but it is up to you that the valuation is a good representation of your company. Balancing the context provided by averages with specificity and precision is a key part of valuation, and why we connect to our API for the actual calculation.

That said, it’s free, and deliberately easy to experiment with. You can get to grips with some of the main drivers of valuation, ahead of getting stuck into a more detailed valuation exercise on Equidam.

You can even use it to develop and run scenarios that are themselves generated with ChatGPT, such as the recent ‘Valuation Speedrun’ we posted on YouTube! Have fun, and let us know what you think!