Streamline valuation operations retaining flexibility and transparency

Systematically value portfolio companies with unparalleled speed, transparency, and consistency.

Update valuations instantly

Every time you make an update, our platform recalculates the valuation immediately. Equidam makes sure you are always working on the most recent parameters, providing a real-time view of portfolio performance.

Update valuations instantly

Every time you make an update, our platform recalculates the valuation immediately. Equidam makes sure you are always working on the most recent parameters, providing a real-time view of portfolio performance.

Easily upload data from Excel

Upload your financial data directly from your working Excel file. Eliminate the need for manual data entry, reduce the risk of errors and make updates achievable in seconds.

Easily upload data from Excel

Upload your financial data directly from your working Excel file. Eliminate the need for manual data entry, reduce the risk of errors and make updates achievable in seconds.

Simplify data collection from your startups

Consistently collect and organise data over time with our templates. Offer the valuation output to your startups as a reward for collecting the needed data.

Simplify data collection from your startups

Consistently collect and organise data over time with our templates. Offer the valuation output to your startups as a reward for collecting the needed data.

Empower founders with valuation as a KPI

Help your startups stay engaged by providing them with their own valuation reports. Gather data more easily and add value through the process.

Effortlessly follow valuation best practices

Conduct valuations with a methodology backed by the latest research, using updated parameters and benchmark data, powered by Equidam.

1,800

Investors using equidam

140,000

Startups valued

300,000

Data points

2

Parameter updates per year

Valuation methodology

Equidam's approach to valuation is designed to offer precision, efficiency, and ease-of-use. Our methodology is tailored to high-growth-potential companies, but applicable to most stages and industries.

Our role in audits

Equidam's platform is designed to significantly reduce the headache of audits, by providing an efficient, transparent and explainable output based on robust valuation standards. Our methodology and data sources are backend up, but we remain an aid in the calculation of valuation. Chat with us to learn more.

Analyse and report on the fly

Extract valuation data in Excel for your whole portfolio. Build custom analyses and dashboards to fine-tune your strategy and update your stakeholders

For a recent glimpse into Equidam’s benchmarks, see our Startup Valuation Delta – H1 2025 report. It summarises median valuations, capital requirements and dilution trends from data of the first half of 2025.

Fund Metrics

Use the data from across your portfolio to provide sensible and explainable reporting on fund performance

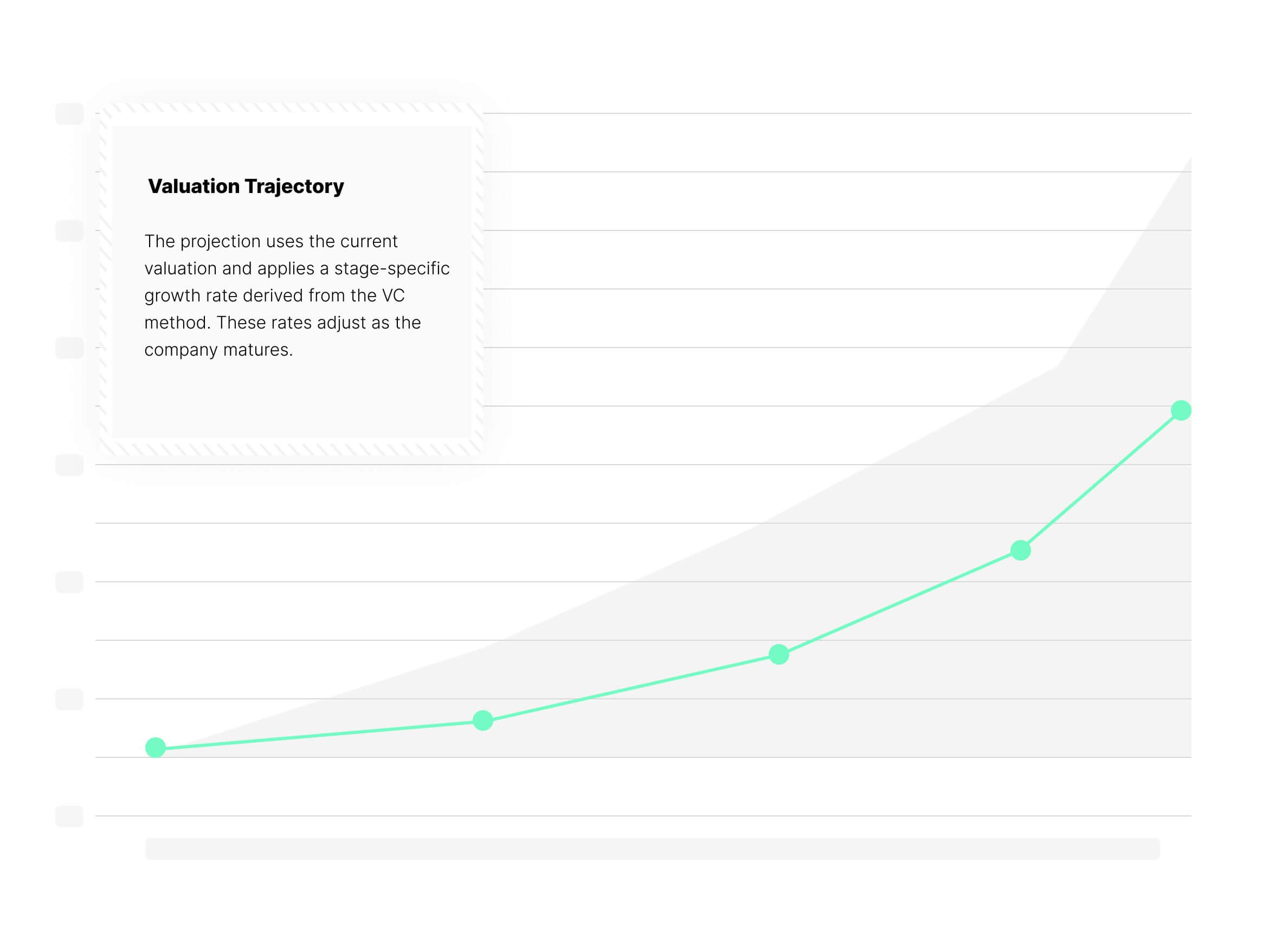

Valuation Trajectory

Watch your startup’s evolution over the next few years. Using your forecasts and the VC method so investors understand.

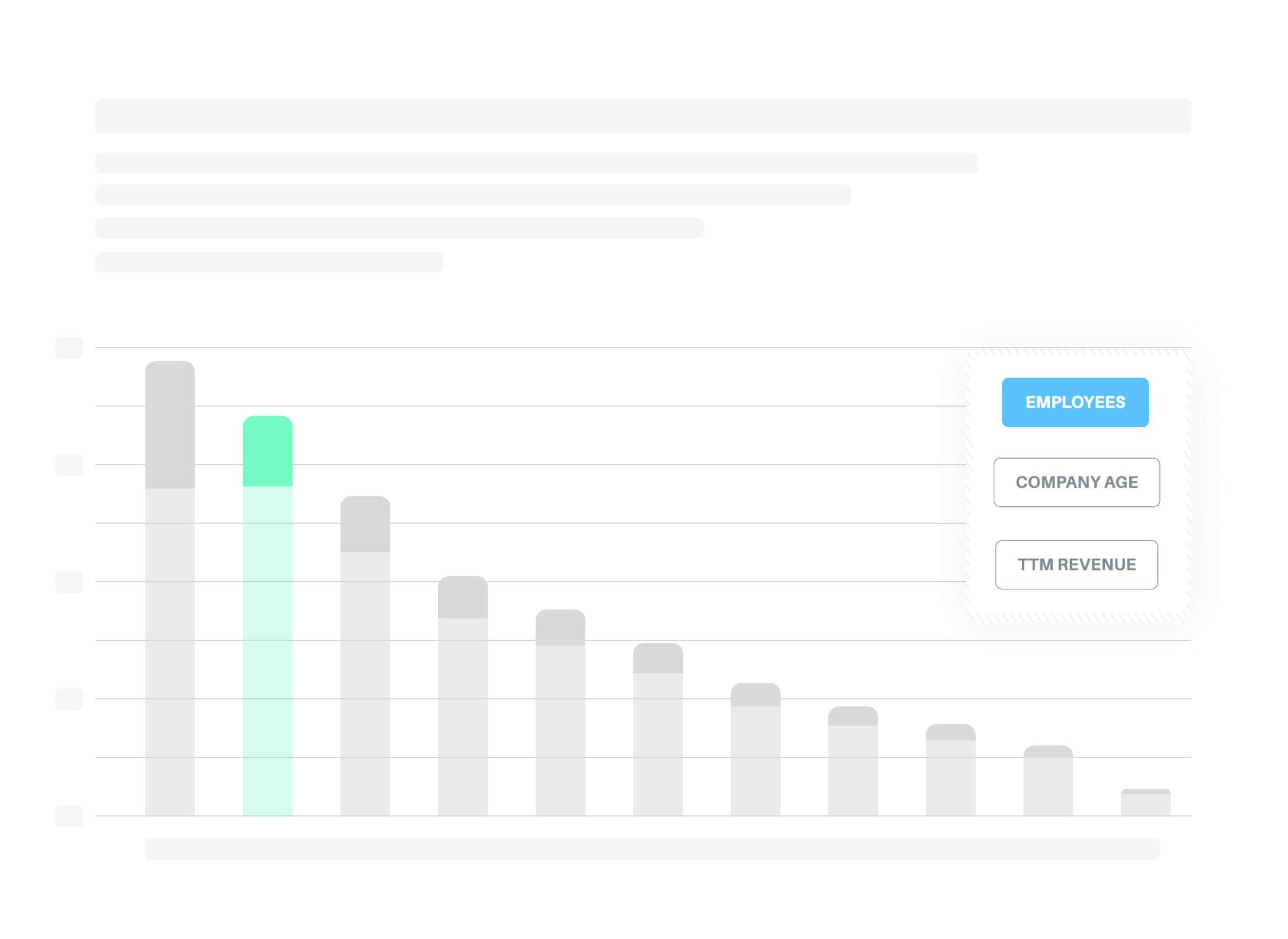

Compare Performance

Understand the relative growth of portfolio companies, be a responsive partner for those that may need support

Maximize your team's expertise

Fully integrate your team’s knowledge, experience and practices into the valuation process. Spend time where it adds value, not proofreading reports.

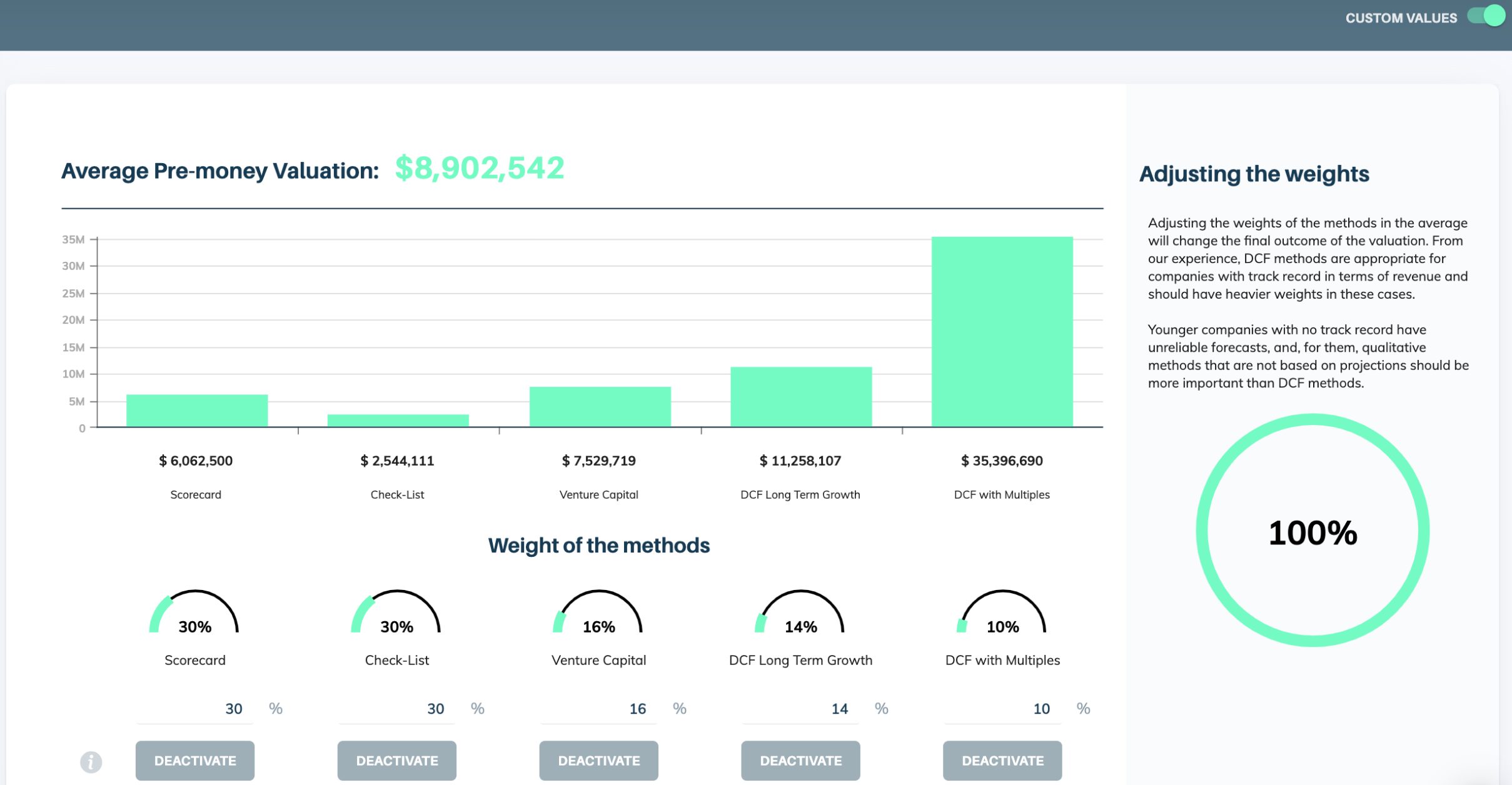

Customise all parameters

The flexibility to adjust an extensive range of valuation parameters, including the discount rate, multiple, qualitative factors, and more. Tailor every aspect of your analysis to align with your strategic insights and codify your experience.

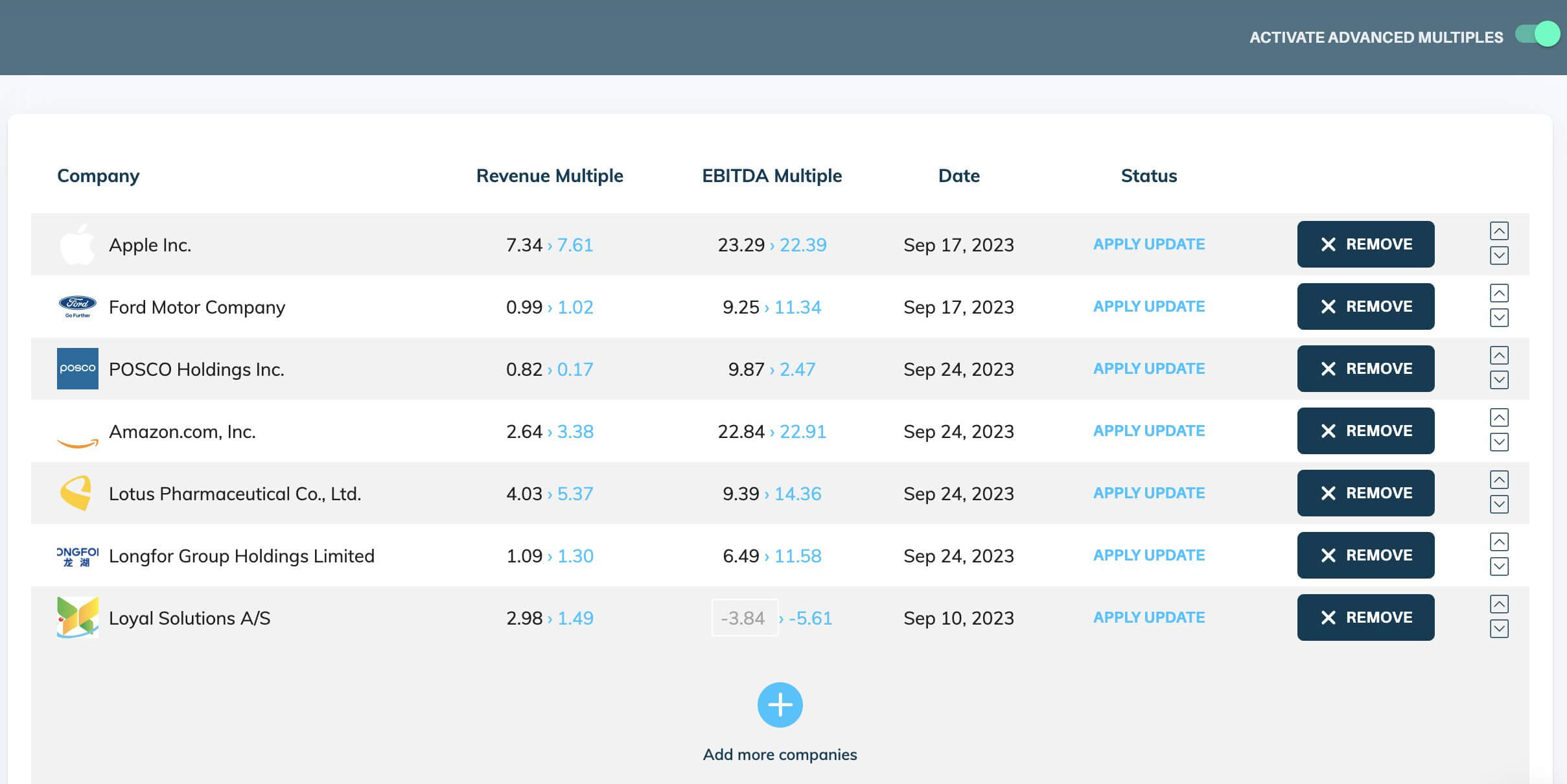

Access 30.000+ company multiples

The Advanced Multiples tool enables you to create a tailored set of comparable public or private companies. Use our searchable index of public company EBITDA and revenue multiples to craft precise and relevant benchmarks tailored to your specific needs.