First Principles Fundraising #1

For many founders, venture capital (VC) is often perceived as the ultimate path to scaling a startup. The high valuations, rapid growth, and expansive network opportunities make it look attractive. But venture capital is also a “performance enhancer” of sorts, boosting growth but demanding a price that not every company should pay. For founders, understanding venture capital’s benefits, requirements, and significant drawbacks is critical to making an informed decision.

Kicking off our series of articles looking at the principles behind startup fundraising, here’s an in-depth look at the factors at play to help founders determine if VC is the right fit.

- Part 1 – Is fundraising the right move for your startup?

- Part 2 – Are you investment ready?

- Part 3 – How to choose the right investor

- Part 4 – How to run a tight fundraising process

- Part 5 – How to make the most of investor meetings

Who Needs Venture Capital?

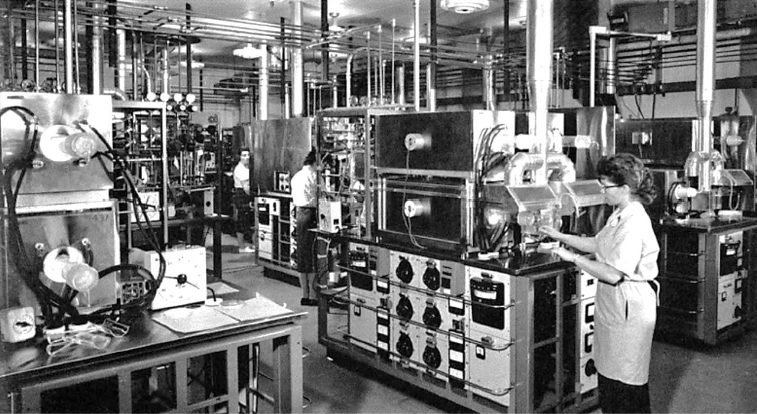

Venture capital originated as a financing tool for industries with prohibitive costs and high levels of risk—areas banks and traditional lenders typically avoid. In the late 1950s and 1960s, early venture capital focused on sectors such as semiconductors, where capital requirements for R&D, manufacturing, and market entry were too great for founders to bear alone. Venture capital evolved to support companies that couldn’t survive without substantial upfront investment.

In today’s environment, there are two main categories of businesses that look for venture capital funding:

Capital-Intensive Projects

These are industries with massive research, development, and infrastructure costs before revenue is feasible—think biotech, hardware, and other “deep tech” sectors. Founders in these fields generally have no other option but to seek venture capital if they want to develop a disruptive product that requires significant resources before revenue can flow.

Growth-Intensive Projects

With the rapid expansion of digital markets, another type of startup has joined the ranks of companies needing VC support. SaaS, for example, offers a low capital expenditure (CapEx) model but needs fast growth to capture market share. This category includes sectors like SaaS, fintech, or direct-to-consumer (DTC) businesses, where winning market share early translates directly into long-term dominance. Here, VCs look for founders who can grow fast, reach a significant valuation, and sustain scalability.

What VCs Look for in an Investment

Finding “100x” Investments

Venture capital operates on a power-law model, where the few outliers in a fund portfolio make up for the majority of underperforming investments. So even though a standard VC target is around a 3x return on fund capital, this is not what they are looking for from individual investments. In practice, they need a few companies to perform at 50-100x levels to balance their portfolio. To assess this potential, they often look for a few signals:

Path to $100 Million ARR

VCs evaluate whether a startup has the potential to reach $100 million in annual recurring revenue (ARR) within a reasonable timeframe. For example, SaaS companies that can project $100 million ARR indicate that they could reach a “venture scale” outcome—whether that’s a billion-dollar valuation, a significant acquisition, or an IPO.

The T2D3 Formula

VCs also look at early revenue growth using benchmarks like “T2D3”—a formula where startups are expected to triple their revenue for the first two years, then double it for the next three. This fast pace is a rule of thumb for reaching $100 million ARR in around five years. Startups that can exhibit such growth are generally attractive as they demonstrate the exponential potential VCs need.

The Downsides of Venture Capital

Equity Dilution and Control

A significant cost of venture capital is the dilution of ownership. Typically, VC investors take 10-20% of equity in the early stages and continue to increase their stake with subsequent rounds. For founders, this means every round reduces their control and eventually, the influence they have over their own company. This dilution is accompanied by more assertive oversight from investors, who now have “skin in the game” and vested interests in the company’s direction.

Case in Point: A high-profile example of VC influence over company direction is Uber, where investors eventually ousted founder Travis Kalanick, replacing him with an external CEO due to conflicts around growth and strategic decisions. While rare, founders should understand that venture capital can come with this level of intervention when the company’s objectives and VC expectations clash.

The VC “Treadmill”

Once a company raises venture capital, it often commits itself to a path of continuous fundraising. After receiving a substantial capital injection, founders are often pushed to invest heavily in growth areas, sometimes sidelining financial fundamentals like unit economics. This can lead to unsustainable spending and a reliance on future rounds.

Pressure from VC’s Fundraising Cycle

To justify raising a new fund, VCs often rely on their portfolio companies to show significant valuation gains early, typically within 2-3 years. For a startup, this can mean intense pressure to raise a Series A, Series B, or later rounds at significantly higher valuations, even if this doesn’t align with a founder’s growth plan. VCs may push companies in “hot” markets to capitalize on hype, driving valuations up early and fast.

This short-term needs for “mark-ups” may conflict with a founder’s sustainable growth plan. Founders should assess whether they’re in a position to handle these rapid increases in valuation. Misalignment on these short-term goals can strain the founder-VC relationship and, more critically, can disrupt the company’s operational and strategic goals.

Alternatives to Venture Capital

While venture capital can supercharge a startup’s growth, it’s not the only funding path, and for many founders, it may be unappealing or inappropriate. Fortunately, several alternative funding routes are available, each with its own pros and cons, and may better suit founders focused on sustainable growth or retaining control.

Bootstrapping:

Bootstrapping refers to financing your company with personal savings, revenue from other income sources, or reinvesting business profits to fuel growth. This approach requires a focus on profitability early on, which makes it more practical for certain types of startups, particularly in software, e-commerce, or marketplace sectors with relatively low upfront costs.

Example: MailChimp is a notable success story in bootstrapping. Initially a tool within a web design agency, it evolved organically into a standalone business without venture funding. Over 20 years, MailChimp built a loyal customer base and eventually exited to Intuit for $12 billion in cash and stock, marking the largest-ever exit by a bootstrapped company. This example highlights that a long-term, self-sustained growth approach can yield substantial returns without the pressures and trade-offs of venture capital.

- Pros: Retains full ownership and control, creates a profit-oriented culture from the start, and reduces external pressures.

- Cons: Limits scalability, particularly for capital-intensive sectors like hardware or deep tech, and can slow down growth compared to VC-backed competitors.

Bank Loans:

For startups with relatively low-risk, proven business models, a bank loan may be a viable option. Small business loans allow founders to access a limited amount of capital without diluting ownership. However, most banks are conservative and may avoid high-risk or innovative startup concepts, making this path better suited to traditional or service-based businesses.

- Pros: Non-dilutive, offers flexibility for businesses with predictable revenue streams, and can be suitable for low-risk startups.

- Cons: Often challenging for high-risk startups to secure, involves debt obligations, and may restrict founders from innovating or pivoting freely due to repayment schedules.

Grants:

Grants offer non-dilutive funding, particularly beneficial for science-focused sectors like climate tech, health tech, and other research-driven fields. Government agencies, research institutions, and large organizations frequently offer grants to support technology development, especially if the project aligns with specific research goals or societal challenges. While grants are usually modest in size, they can be instrumental in early-stage funding without the burden of giving up equity.

- Pros: Non-dilutive, can act as a credibility signal (especially if awarded by prestigious organizations), and provides foundational capital in high-risk fields.

- Cons: Typically small funding amounts, often require extensive applications, and time-consuming, with founders potentially needing to reapply repeatedly to maintain consistent funding.

Angel Investment and Crowdfunding:

Angel investors and crowdfunding platforms provide additional sources of patient capital, often suitable for early-stage companies that need external funding but prefer to avoid the pressures of institutional VC. Unlike VCs, angel investors invest their own money, tend to be more risk-tolerant, and can offer valuable mentorship, networking, and strategic insights without the short-term incentives tied to fund cycles.

Angel Investment: Angels can be excellent first-round investors, particularly if the founder is uncertain about future fundraising or plans to grow sustainably. They bring helpful networks and mentorship, and are often valuable strategic partners for specific industries or sectors.

Crowdfunding: Crowdfunding platforms like Crowdcube or Republic allow startups to raise small amounts from large numbers of people. This approach can be strategic for consumer-focused companies, giving hundreds or thousands of people a personal stake in the company’s success, building a built-in advocate base.

- Pros: Patient capital, supportive investor relationships, and often includes non-financial benefits like mentorship and strategic guidance.

- Cons: Limited funding amounts compared to VC, can be time-intensive to manage and aren’t necessarily helpful if you need to raise more capital later on.

Is Venture Capital the Right Choice for You?

Venture capital brings significant advantages to startups that are in markets requiring high growth and scalability. However, founders must be realistic about the inherent expectations, pressures, and risks, such as dilution, the need for rapid and continued growth, and the potential misalignment on strategy and timelines.

As appealing as VC funding can be, it’s only truly beneficial for those who fit the VC model. For others, alternative funding options, or a bootstrapped approach, may better align with both the company’s goals and the founder’s vision. Make the decision to pursue venture capital only after a thorough analysis of your company’s needs, market conditions, and willingness to take on the associated expectations.