The current fundraising environment

There’s never been so much capital available for startups… and there has never been so many startups chasing it. The environment has grown rapidly, benefitting founders around the world.

Despite that, there’s evidence to suggest that the number of pre-seed rounds has actually decreased. There is an increase in capital and an increase in capital per deal, but a decrease in the overall number of pre-seed deals. So what’s behind this?

The main opportunities are always going to have abundant capital, and will happily stay private for as long as they want. But what is happening at seed and pre-seed? In our opinion, there’s a few factors at play here:

- Fewer deals are making the news, and fewer deals are being disclosed at all. A 200k pre-seed just doesn’t generate the excitement that it might have done five years ago.

- Startups in pre-seed or seed stage aren’t as capital intensive as they used to be. It’s more common to self-fund until Series A.

- Non-equity options like revenue financing are also a good early-stage choice, while valuations are low, which means those startups don’t appear in fundraising databases, and don’t have declared valuations.

- Finally, as valuations increase, and the average capital per round increases, angels simply cannot participate in as many rounds as they would in the past.

Looking at average valuation in the UK, we saw that the average valuation has gone up about 10x over the last 7 years, and the average funding round size has more than doubled. Why? Was it market variables multiples, financial discounts, etc?

It actually seemed to be driven by founders simply being more ambitious, more confident, and having a better understanding of their risks. This was reflected in their projected revenue over three years.

Averages don’t tell you the whole story

To answer why this is happening now, we propose that it’s not that startups are now overvalued. Instead, it’s that startups have been undervalued for a long time. Not because the potential was misunderstood – that a sufficiently innovative and successful startup can capture an entire industry – but because the risks were overestimated.

Now that the risks are better understood, alongside the established potential, the valuations have risen to where they should have been.

Tech startups are launching at an accelerating pace, so the fundraising ecosystem is becoming much more competitive. The capital being distributed has increased, but the number of startups being funded has not increased at quite the same pace.

But the potential to take over an industry is still there, and that’s what VCs are betting on. That’s why valuations will not come down for the top companies.

There are also a lot of smaller startups who are not necessarily out to take over the world, staying leaner and more capital efficient, who may not raise capital or may raise capital from other sources, and we don’t see those in these statistics.

Fundraising performance in 2021

If we look at the UK in 2021, relatively recent data, we had 1663 funding rounds 32B raised, a lot of series A, 48 IPOs. The bottom line is that it was roughly double the activity of 2020, and 2020 shouldn’t be seen as just COVID induced lows – it was a good year for startups overall.

The whole amount of funding available for startups is exploding, worldwide, and in the UK.

Do named rounds really exist anymore?

Not really, or certainly not as clearly as they ever have before. We see £10M seed rounds where that would have been a healthy series A in the past. It may be misleading to focus on these common ‘named rounds’, so for the purpose of this article we’ve taken a slightly different approach.

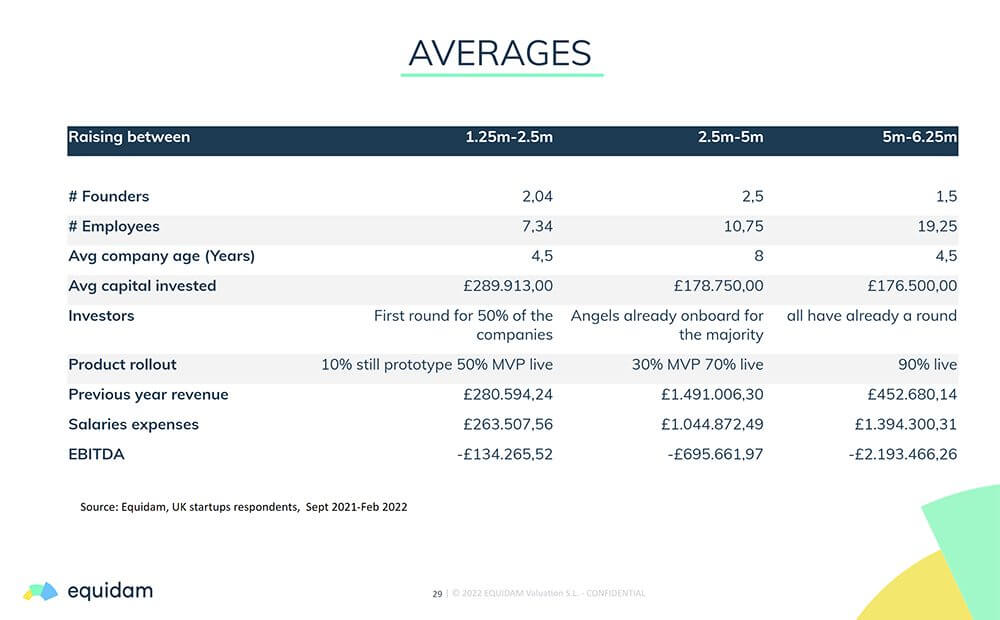

We looked at our data from the last 6 months, split into three categories that cover early-stage rounds and different stages of product roll-out:

- Group 1: Raising 1.25 – 2.5M

- First round for 50% of the companies. 10% still in the prototype stage, 50% with an MVP, 40% live.

- Group 2: Raising 2.5 – 5M

- Majority already have business angel investors onboard. 30% are still in MVP stage, 70% have a live product.

- Group 3: Raising 5 – 6.25M

- All have raised capital previously. 90% have a live product, 10% still with an MVP.

The number of founders dipped slightly in the third group, which may indicate that the accepted standard number of founders has been better established in recent years – or perhaps that founders sometimes leave after a number of years.

Age of the company was much higher than we expected for these rounds. This might represent the bias of the media and popular databases in highlighting the best companies which grow the most rapidly – which are not representative of wider performance. In general it does seem to take longer for a company to raise a round of these sizes.

It’s interesting to see that employee growth is fairly linear across these three stages, while salaries increased significantly from the first group to the second. This indicates an increase in compensation at that stage for early employees who helped the company hit those milestones.

Conclusion

There are insights to be derived from a much deeper pool of startups than the ones who publish their rounds through press-releases, or disclose them on startup databases. The multi-million dollar pre-product fundraising rounds are an exception (if not an anomaly), and shouldn’t be treated as any kind of benchmark for success.

It’s absolutely fine if you take a bit longer to start looking at raising institutional capital, and – even you might feel like you aren’t raising as much as your peers – you only need to raise what you need, when you need it.