Model, Build, Benchmark

Financial projections are particularly challenging for startups. Building a model of the future that is practical and credible requires a clear understanding of growth and market dynamics. We've broken the process down into three key steps.

Step 1: Model your growth engine

Before you can begin building your financial projections, you first need to understand the goal of the exercise, and how to get the most out of it. There are three key aspects of this process:

Building confidence

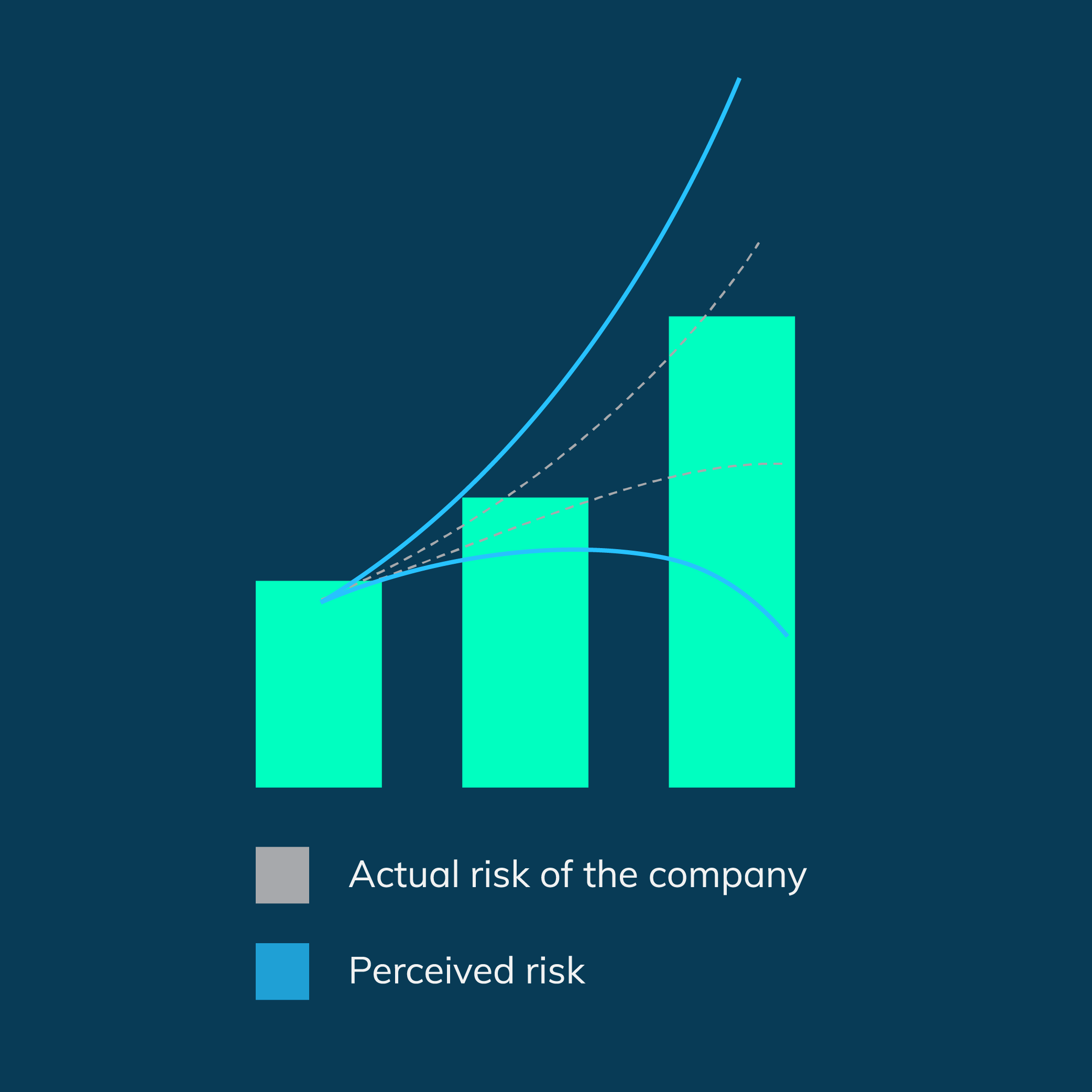

Clear financial projections help to illustrate your roadmap for growth, building confidence by reducing the perceived risk

Closing the loop

Iterate through the loop of ambition, strategy and financial projections to ensure maximum coherence in your pitch to investors

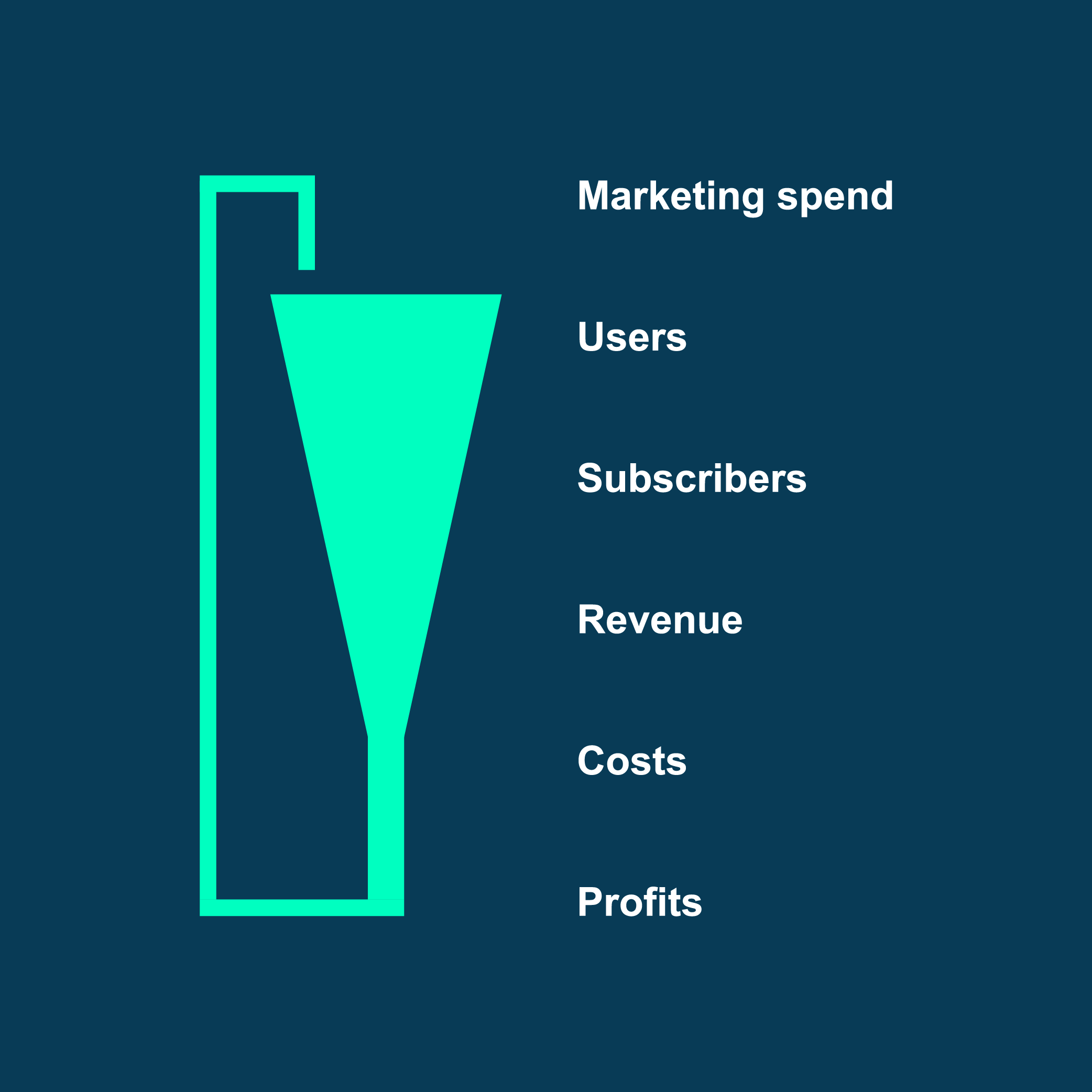

Logic-based growth

Using logic to connect revenue growth with future costs allows you to clearly articulate the economics of your growth strategy

The goal of projections is to build confidence through coherence and transparency. For early stage companies, the purpose is not to provide an accurate forecast of the future, but to clearly lay out the drivers of growth, how costs will scale, and offering a clear reflection of what your vision looks like in numbers.

While you reduce actual risk through hitting milestones, proving assumptions and generating revenue, you reduce perceived risk through coherence. Think carefully about the story you are telling about future growth, and how to solidify that as much as possible.

Closing the loop on ambition, strategy and projections allows you to make sure you are providing that coherence, with each component in alignment. How does your ambition translate into a go-to-market or expansion strategy? How does your strategy convert into numbers? Do those numbers stack up against your original ambition?

In translating your strategy to projections, consider logic-based connections between revenue and costs, e.g. number of sales people per 100 leads, number of customer success representatives per 1000 customers, number of marketing managers per $1,000,000 of market budget etc.

Step 2: Build your projections

While you can build your model directly on Equidam, it's often easier to start in the spreadsheet software of your choice. For that purpose, we developed a comprehensive and user-friendly template.

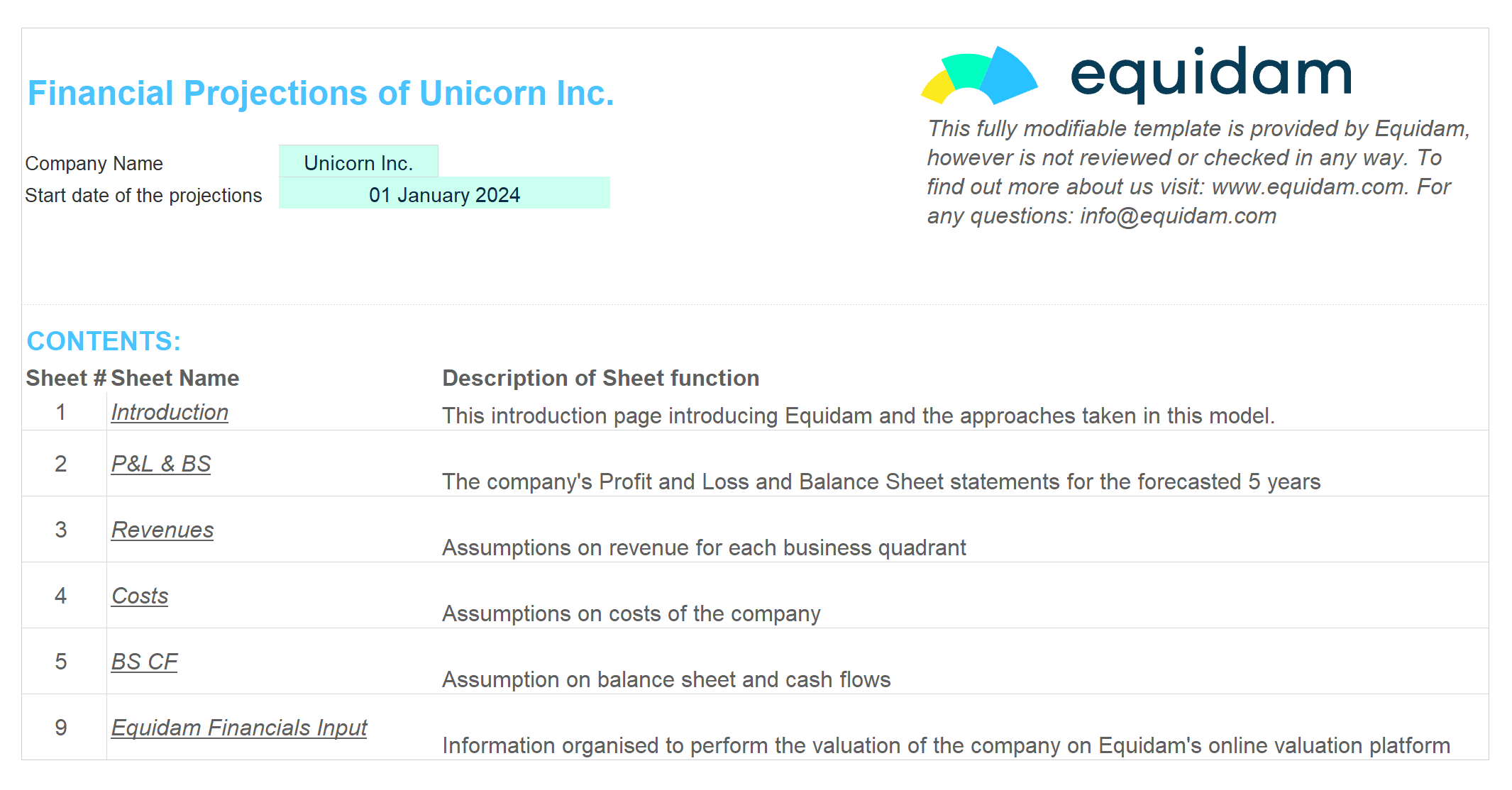

Financial Projections Template

Most templates are either overly complex or incomplete, so we tried to go further — providing all the required functionality while and limiting the complexity as much as possible.

Whether you have recurring revenue or one-off transactions, you can build those into this spreadsheet along with the associated costs, to create a clear model with easily adjustable assumptions.

Explained inputs

You need to insert inputs only in the cells marked in green. In case you have any doubts, you will find notes and explanations on the right side. Everything else is already set!

Summary tables

They are automatically updated based on your inputs on other sheets. In this way, you can have a complete overview on your financials with minimal effort.

Upload to Equidam

Upload the Equidam Financials Input tab to our platform to immediately see how the numbers influence your valuation, and iterate from there.

The Workshop

Watch our workshop on the principles of startup valuation, including building projections.

Step 3: Benchmark your growth

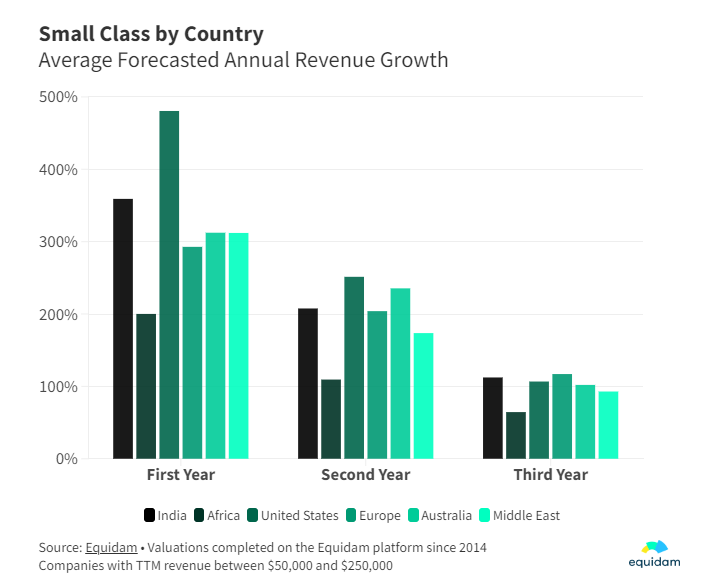

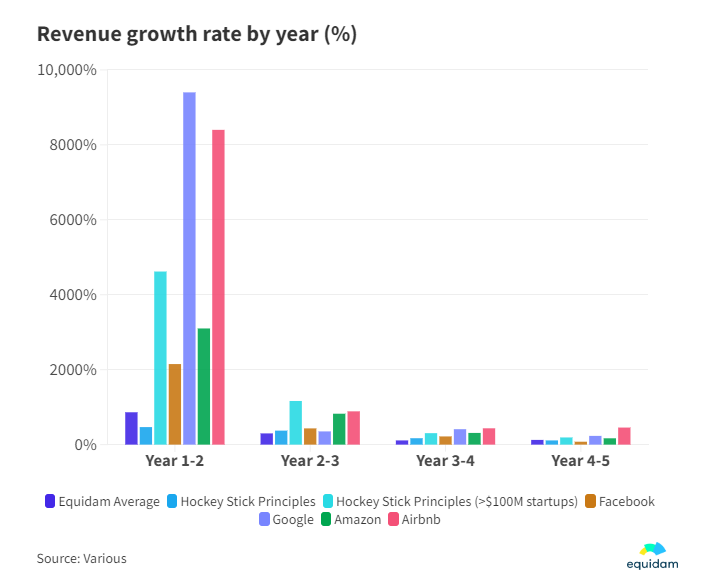

Reference benchmarks from average growth rates, as well as the fastest growing startups of all time, to sense-check your assumptions and add context.

Average growth rates

Average growth rates across large and small class companies, in different regions and industry classifications, based on historical data on Equidam.

Fastest growth rates

Growth rates from the fastest growing companies of all time, compared with research on top performing startups, and Equidam averages.

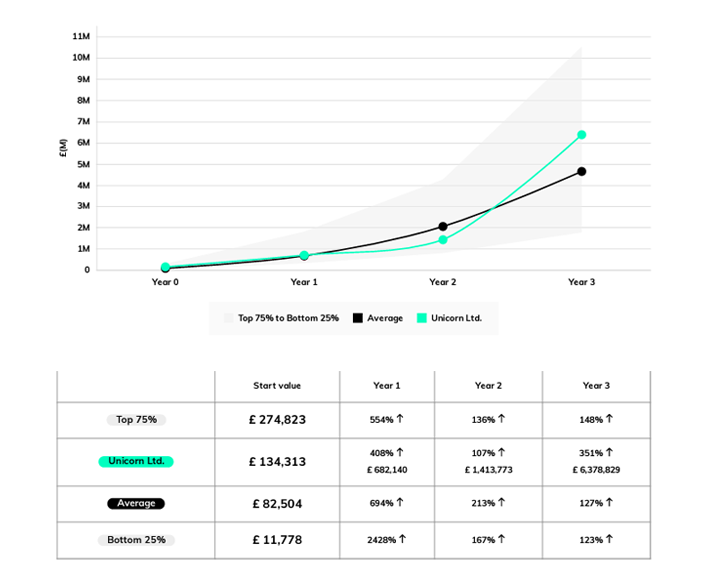

Tailored benchmarks

Equidam's Valuation Delta® platform produces tailored revenue and EBITDA benchmarks based on industry, stage and geography.

Do you need further help? Talk to our partners

We have a number of partners in our network that can help you build comprehensive financial projections.

Additional resources

We have a variety of articles covering the best practices for building financial projections