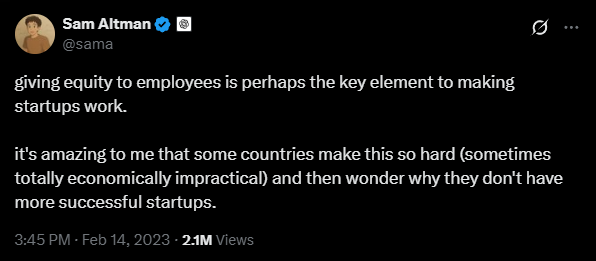

Europe is entering a new era of technological ambition. From initiatives like Project Europe and EU Inc to a growing wave of venture-backed startups, there is a renewed drive to build innovation at scale — and to do so in a way that is equitable, durable, and inclusive. At the center of this vision lies one of the most powerful mechanisms for long-term value creation in startups: employee stock option plans (ESOPs).

Startup success should be shared across the teams that build it. A well-structured ESOP not only helps early-stage companies attract and retain talent, but also creates a flywheel effect — one where today’s team members become tomorrow’s founders, investors, and mentors. It’s a strategic imperative for Europe’s competitiveness, and a fundamental component of a resilient tech ecosystem.

The Baltic Advantage

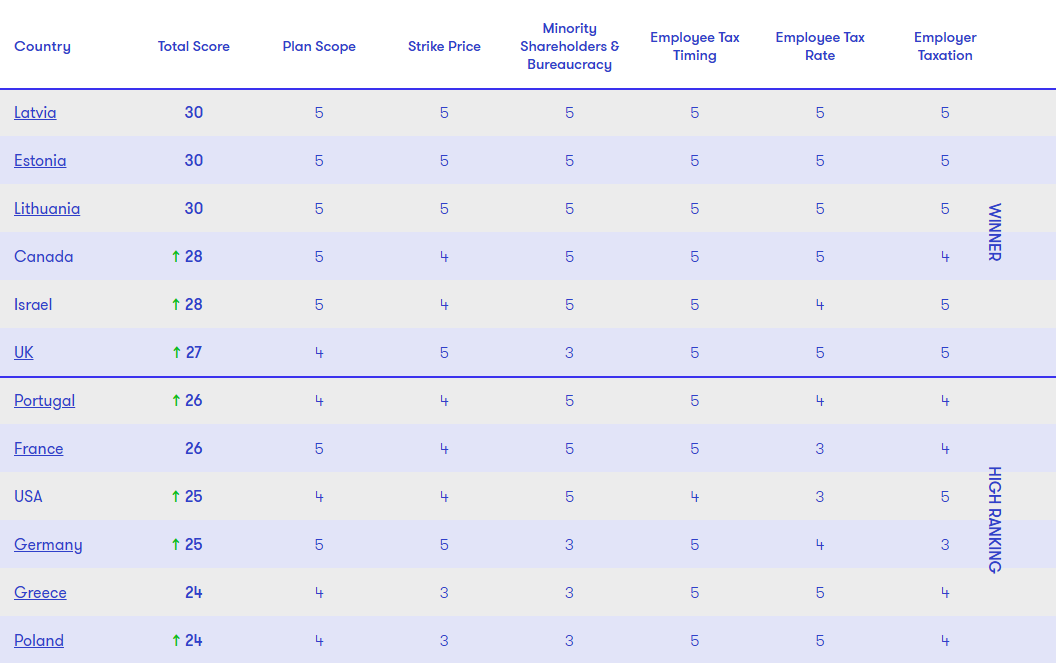

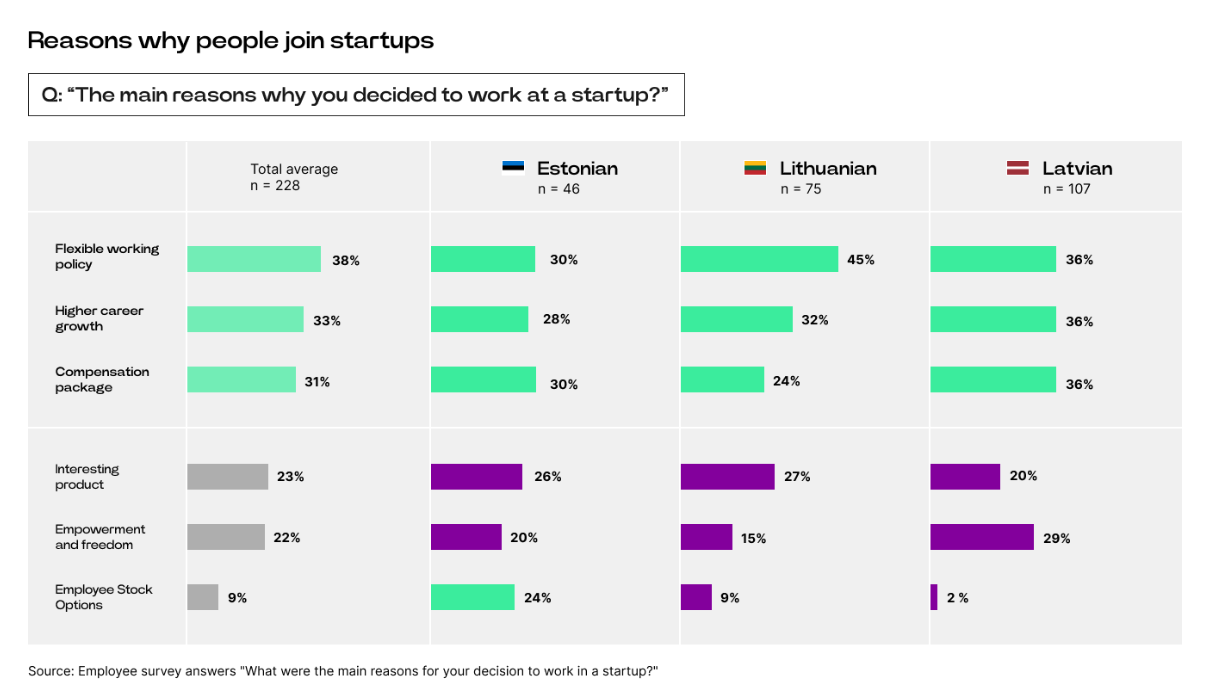

One region with extraordinary potential to lead in this area is the Baltics. Estonia, Latvia, and Lithuania consistently top the rankings in Index Ventures’ “Not Optional” report for ESOP-friendliness — a reflection of their forward-thinking policy, startup-savvy governments, and founder-friendly legislation.

ESOP Valuation in the Baltics

Founders in Latvia, Lithuania and Estonia can now use Equidam to calculate valuations for the issuance of employee equity compensation

European ESOP Stagnation

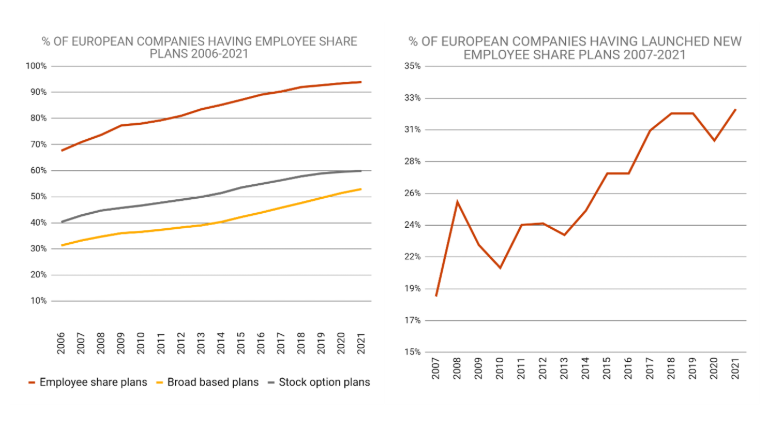

Research by Irena Arbidane and Viktorija Lavrova of PwC Latvia suggests a worrying trend: Looking at ESOP adoption across Europe, growth actually slowed after 2017 — the same year that Index Ventures first published its landmark Rewarding Talent report. Despite the friendlier policy environment, this trend also extends to the Baltic nations.

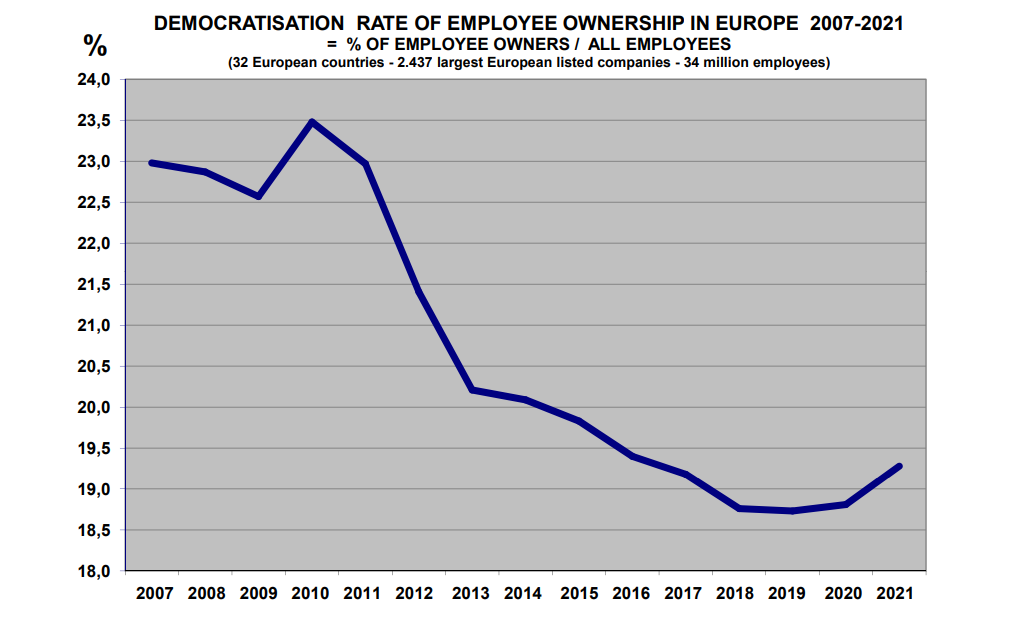

Indeed, despite years of advocacy and policy reform, employee ownership in Europe had not improved greatly up to 2021 — a reality captured starkly in the “Annual Economic Survey of Employee Share Ownership in European Countries“, by Marc Mathieu.

“It should also be noted that the share held by ordinary employees is back to the same level as fifteen years ago. This observation sanctions Europe’s failure to promote a democratic employee ownership policy. Promoting democratic employee ownership is indeed a political choice, usually supported by fiscal incentives. Without support, the average employee cannot afford to invest financially in his or her company. Few European countries do this effectively”

While slow adoption has often been framed as a policy failure, the data suggests a deeper cultural challenge. When favorable legislation isn’t met with active uptake, it becomes clear that progress requires more than tax incentives — it demands a shift in mindset, education, and company-building norms across the ecosystem.

Culture Eats Policy for Breakfast

If the Baltic countries cannot escape the wider European trajectory on employee equity compensation, then clearly better regulatory frameworks are not enough. Adoption depends on education, infrastructure, and a shift in company culture. This was echoed by Artis Kehris, Co-Founder of Latvian startup Printify, in an interview with Labs of Latvia:

“We have consulted with other start-ups, but most of them have never done it in our region. There are very few companies granting stock options for all employees… We build the company together, and we will all share a positive outcome together.”

Indeed, stock options are not just about financial upside — they are about alignment, trust, and shared purpose. As Špela Prijon, Co-Founder of EquityPeople, put it:

“You’re letting go of a part of your company in order to bring people closer to the mission. It creates a unique alignment between ‘what I’m doing’ and ‘what we’re talking about’, which is very difficult to achieve unless you have something like equity.”

Until equity becomes embedded in the DNA of European startup culture, the flywheel effect — where today’s employees become tomorrow’s founders and investors — will remain stalled.

Comparative Analysis of Startup Equity-Based Compensation

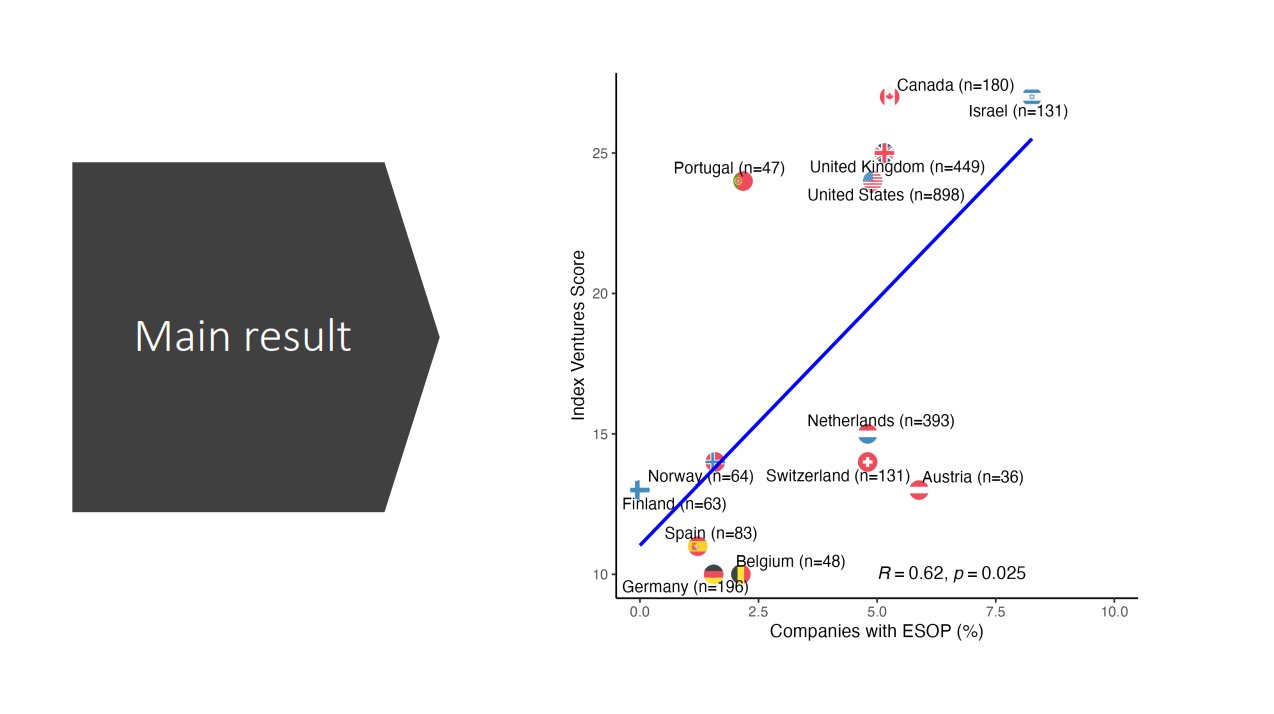

Two years ago, Equidam contributed to research by the University of Haifa and Goethe University Frankfurt on employee equity adoption (using Equidam data) relative to policy friendliness (using the Index Ventures ranking).

Despite hosting data for 1000+ startups across the Baltics, so few (relative to other countries) had issued equity to employees that these countries had to be exclude from the dataset.

The slow adoption of employee equity is not just a policy problem, it’s an attitude that needs to be addressed if Europe wants growth.

Starting the Flywheel of Employee Equity

The long-term benefits of wide ESOP adoption extend far beyond individual startups. In his study of the Baltic startup landscape, Rokas Šalaševičius, Partner at Civitta, pointed to the transformative potential of equity in attracting senior talent. Many of these professionals already understand the value of stock options and are willing to trade some salary for equity with meaningful upside.

“Employee stock options are also essential for the ecosystem’s long-term success. In the event of a major success – say, an IPO or an exit – employees can earn a large amount of money from shares they own, allowing them to become angels themselves, invest in other startups, and mentor others… sparking a so-called flywheel effect.”

What’s more, when startup success is shared, it creates a cascading effect: employees become angel investors, advisors, and second-time founders. As Andrei Dudoiu, President of the Board at SeedBlink, noted:

“A majority of business angels worldwide were once employees who benefited from ESOPs… No salary can ever match the long-term rewards of an ESOP given to an employee in a startup that skyrockets to success.”

The example of UiPath — where early employees saw life-changing returns — is just one of many that underscore this potential. As Dudoiu put it, “It’s that simple: share the work; share the worth.”

Both EU Inc and Project Europe have employee stock ownership at the center of their efforts to strengthen Europe’s startup ecosystem — but from two distinct angles:

- EU Inc focuses on structural reform, calling for standardized investment processes, simplified cross-border operations, digitized incorporation, and most critically, a unified approach to employee stock option programs across member states. The goal is to make it easier for startups to share success with their teams, regardless of where they’re based in Europe.

- Project Europe, meanwhile, is focused on the consequences of slow ESOP adoption: a talent gap that is holding back the continent’s ability to scale startups. Without meaningful equity participation, successful employees often leave the ecosystem after an exit, lacking the capital — and sometimes the incentive — to reinvest their experience as founders, operators, or investors.

Both initiatives are tackling different parts of the same problem, and should be supported by a broader cultural shift. Europe must also overcome its hesitation around equity — and embrace it as a core component of how value is created and reinvested in its innovation economy.

Equidam’s Role: Education and Infrastructure

Equidam is tackling the ESOP challenge in the Baltics on two key fronts:

- Education & Coaching: Through partnerships with equity experts like EquityPeople, we are equipping founders with the knowledge to structure and manage ESOPs effectively — from pool sizing to long-term budgeting. This is critical to helping startups design equity programs that are fair, scalable, and investor-ready.

- Infrastructure & Access: One of the biggest historical barriers to ESOP adoption in Europe has been the cost and complexity of valuation. Equidam solves this with a transparent, standardised, and audit-ready valuation platform that enables founders to issue stock options with confidence and compliance.

Valuation for ESOP issuance around the world

A Strategic Imperative for Europe

The future of Europe’s startup economy depends on more than just capital. It depends on the circulation of experience, trust, and shared success.

This is not just a policy gap — it’s a missed opportunity.

The vision laid out in the Draghi Report calls for renewed investment in growth, innovation, and self-sufficiency. To achieve this, Europe must enable its tech workers — not just founders and investors — to participate in the upside of startup success.

We are committed to helping make that happen. By reducing friction, raising awareness, and closing the gap between intention and action, we aim to support a new generation of companies where value is created — and shared — by all.