PARAMETERS UPDATE P6.0

On January 29, 2025, you’ll be upgraded to the latest version of Equidam with updated valuation…

Making the Most of Investor Meetings

First Principles Fundraising #5 In our First Principles Fundraising series, we’ve already…

How to Run a Tight Fundraising Process

First Principles Fundraising #4 Over the course of this series, we’ve taken a first…

How To Choose the Right Investor

First Principles Fundraising #3 In our “First Principles Fundraising” series, we’ve…

Are You Investment Ready?

First Principles Fundraising #2 In Part 1 of our First Principles Fundraising series, we examined…

Is Fundraising the Right Move for Your Startup?

First Principles Fundraising #1 For many founders, venture capital (VC) is often perceived as the…

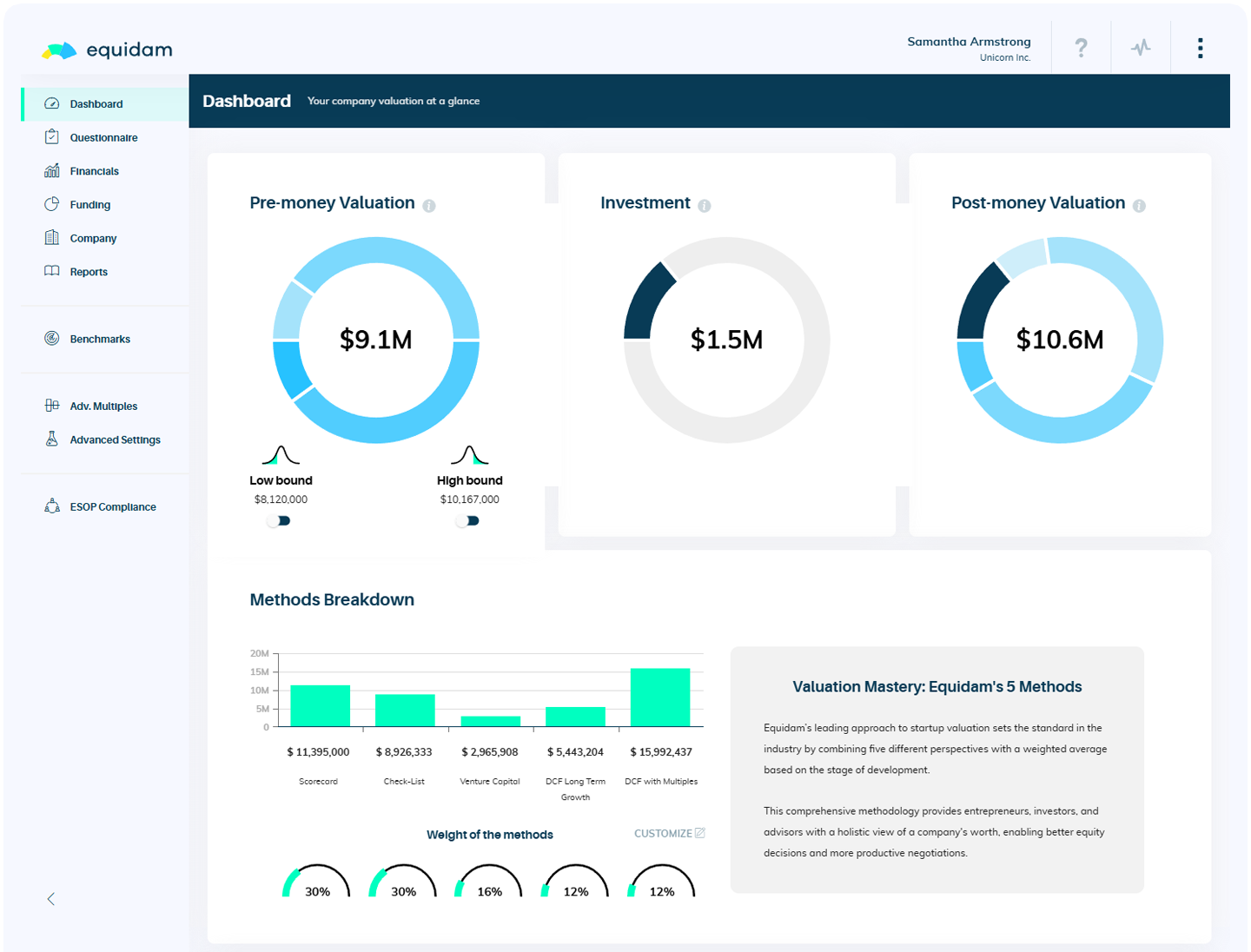

$5 Billion and 150,000 Companies Later, What We’ve Learned

Twelve years ago, we set out to change the way startup valuation was approached. Since 2013, the…

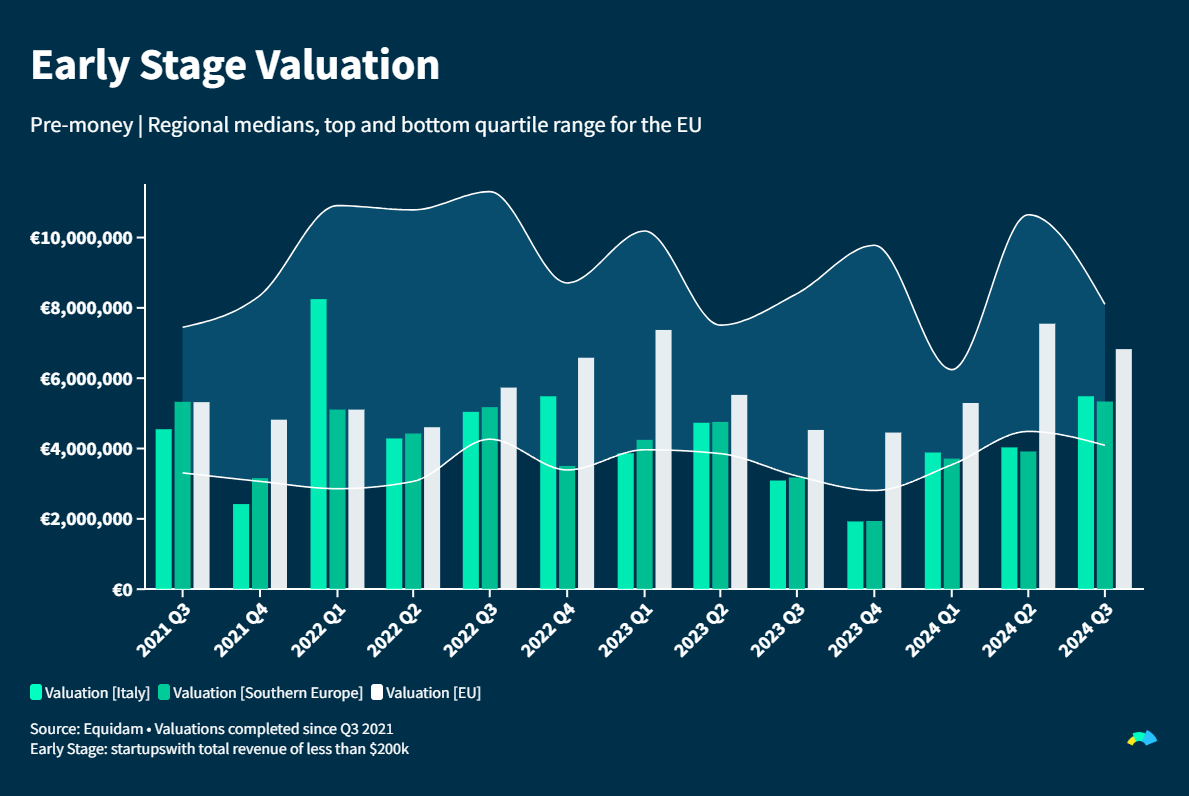

The State of Funding in Southern Europe: Insights from Rome Startup Week 2024

At this year's Rome Startup Week, a notable panel titled "The State of Funding in Southern Europe"…

PARAMETERS UPDATE P5.9

On September 25, 2024, you’ll be upgraded to the latest version of Equidam with updated valuation…