For early stage startups seeking investment, especially pre-revenue companies, there’s a common debate about the necessity of financial projections. Some argue that projections are unreliable due to the inherent uncertainty of young companies, and the number of assumptions that they have to model.

However, there’s a compelling case for the resolution and coherence they add to a pitch, helping founders to translate their vision to prospective investors.

To quote U.S. President, Dwight D. Eisenhower:

“In preparing for battle I have always found that plans are useless, but planning is indispensable.”

A well designed model has a number of implications:

- You’ve thought through revenue growth

- You understand the concurrent growth of costs

- There’s some rationale to your fundraising target

- You know what it takes to achieve your ambition

- You understand the economics of venture-scale startups

Covering all of these points, as a part of a coherent package, including your pitch deck, valuation and all related correspondence, will build confidence with prospective investors.

Below, we’ll go into more detail on the aspects involved, and some important principles to understand for both formulating and utilizing projections properly. If you’re facing doing projections for the first time, or are looking for more specific guidance on the projections themselves, check our our template and resource center, here:

Get started with our financial projections template

The Importance of Coherence

Fundamentally, investors are looking for coherence. This means that every aspect of the company’s operations, growth strategies, and risk assessments should align with an underlying rationale — what is often referred to as ‘the story’ in a startup pitch. When founders present a coherent picture, it builds investor confidence and conviction. It demonstrates that there is both solid reasoning and competent management behind the company.

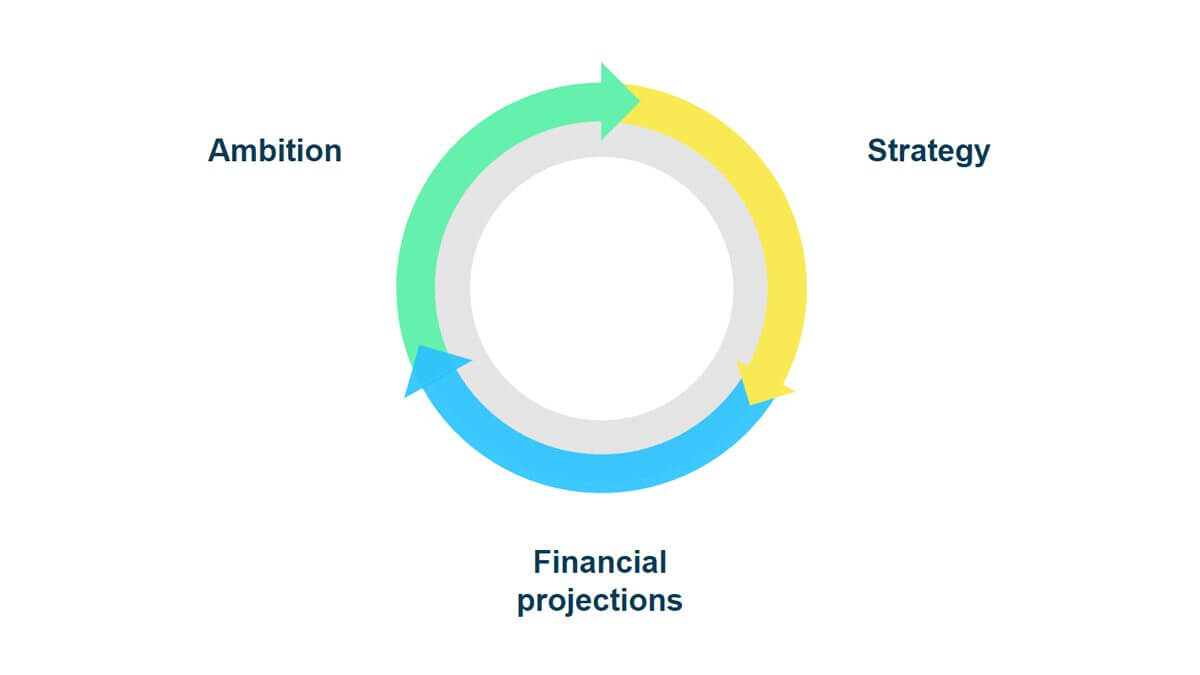

Founders typically start their journey by focusing on an ambition, some way they aim to make the world a better place. As this ambition develops, it is translated into a strategy, covering aspects like product development and go-to-market plans. However, many founders stop at this stage, missing a crucial step: converting the strategy into financial projections.

Turning strategy into financial projections involves translating strategic plans into dollar terms. This process adds a valuable perspective, enhancing the overall coherence of the business plan. By doing so, founders can show that they understand what it takes to build a scalable business, including revenue targets, growth-related costs, and the key levers of growth.

Preparing for Uncertainty

As mentioned above, a common concern is that projections are built on too much uncertainty to be useful, when in fact it is that uncertainty which can make them invaluable.

Solid financial projections, which have been through that iterative loop covering strategy and ambition, provide a foundation that better prepares the company for future challenges. If a change in strategy is necessary, having a good grasp of the underlying financial model helps founders to understand the operational and economic impacts of adaptations, putting them in a better position to choose the best path forward.

Demonstrating Your ‘Growth Engine’

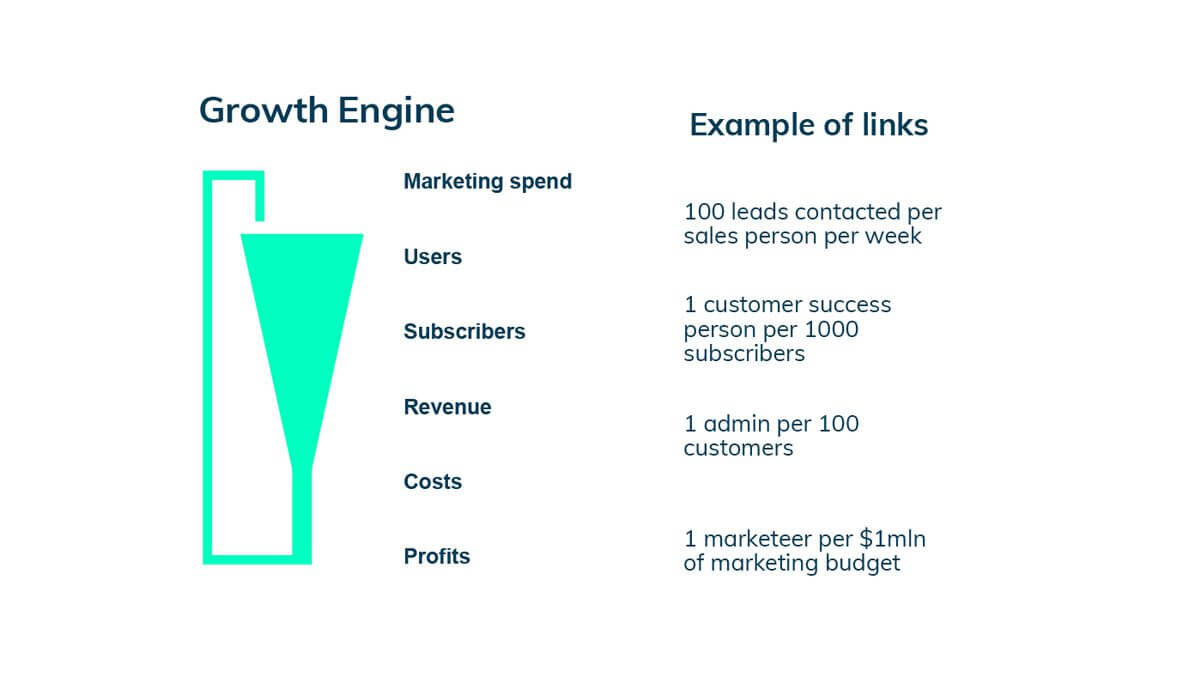

A well-constructed financial model typically starts with the company’s growth engine. This involves a logical flow from marketing spend to profits, ensuring that every step is backed by a clear rationale. The part that is often missed, is considering how growth in revenue converts to growth in costs. That may be via links like additional marketing staff to support a larger marketing budget, country representatives for market expansion, or customer support staff to support a larger customer base. Creating links which tie costs to revenue allows you to paint a much clearer and more rational picture of the future.

Your projections will have a few critical variables, typically around customer acquisition cost or conversion rate. Making these critical variables adjustable allows investors to see different scenarios and better understand how they influence the future of the business. Left to assume alternative scenarios, rather than experiment through adjustment, investors will typically bias towards more negative outcomes.

Adding Confidence with Benchmarks

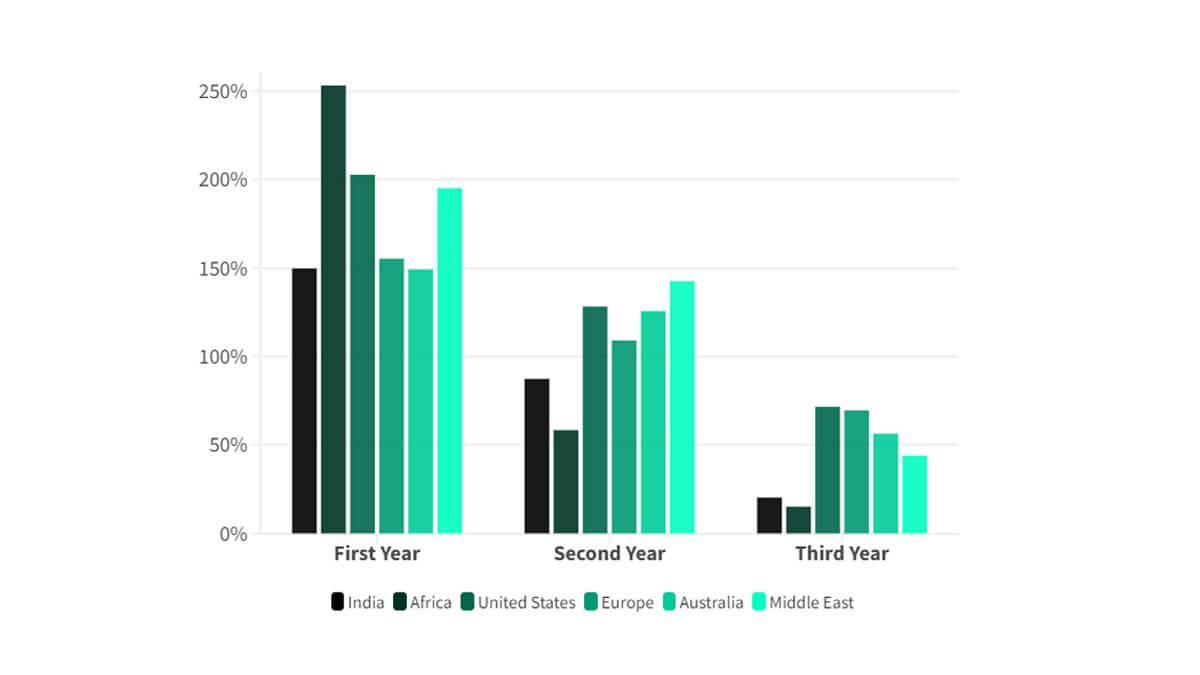

Incorporating benchmarking data, such as average growth rates and the performance of the fastest-growing companies, can add context and confidence to the projections. However, your projections should remain a coherent reflection of your vision, so be careful not to let yourself be overly influenced by peer-performance or averages. Your exact product or service offering, and how it is developed and delivered, will have a direct influence on your growth trajectory. The role of benchmarks is just to help investors understand how your startup is positioned relative to others, and why.

Conclusion

In summary, financial models and revenue projections are invaluable tools for pre-seed companies. They help create a coherent and compelling narrative, build investor confidence, and prepare the company for future uncertainties. By translating strategic plans into financial terms, founders can effectively showcase their understanding of what it takes to achieve their ambitious goals and manage growth.