What hides behind the term alternative finance? Centre for Alternative Finance of Cambridge Judge School refers to alternative finance as financial channels and tools that emerged outside of the traditional financial system. Examples of alternative financing activities include crowdfunding, peer-to-peer business and consumer lending, invoice trading, third party payment platforms and others. Alternative finance instruments are cryptocurrencies such as Bitcoin, social impact bonds and others.

Alternative Finance

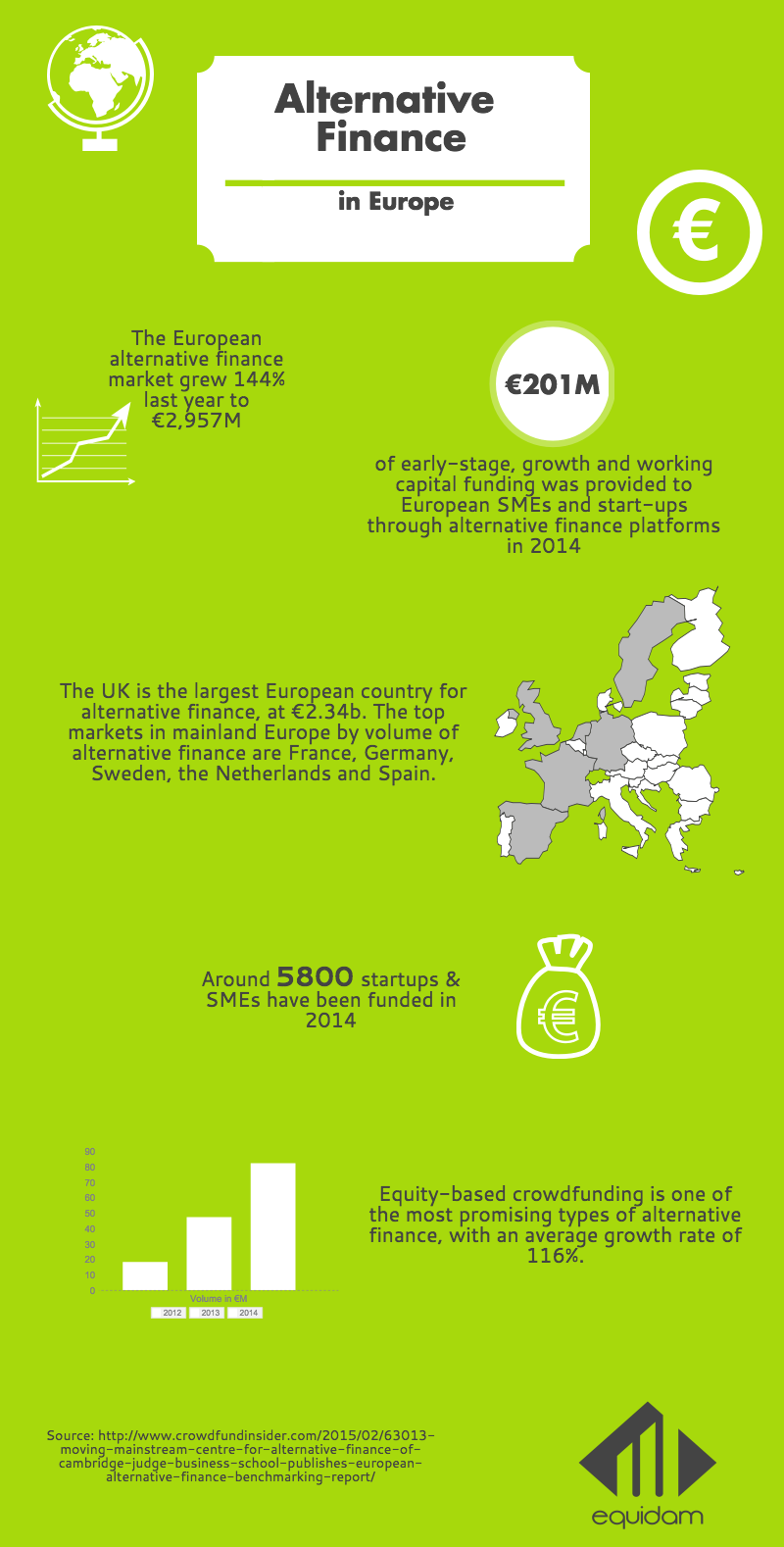

We have been witnessing the growth of alternative finance services, here in Europe, as well as, all over the world. It became obvious that there is a huge potential in this type of financing. The alternative finance market in Europe has the potential to expand to as much as €7 billion by the end of 2015. Seeing this is a huge opportunity for many entrepreneurs we decided to give you some key statistics for the industry.

The Market

The European on-line alternative finance market grew by 144% last year and was estimated around €2.96 billion. Throughout 2014 alone, alternative finance platforms have provided approximately €201 million to European SMEs and startups. Many countries in Western Europe have picked up the various forms of alternative financing. For example, the UK hosts the largest European alternative finance market, followed by France, Germany, Sweden, the Netherlands and Spain.

P2P business lending increased enormously- 272% from 2012 to 2014 across mainland Europe. Reward-based crowdfudnig and equity-based crowdfunding – both increased by more than 100% for the same period – take the following places in the ranking.The projected total transaction volume via on-line alternative finance platforms for 2015 is €1.3 billion.

So, alternative finance in Europe is on the verge of becoming mainstream in many Western European countries and we are curious to see if it will eventually replace traditional financing services.