Are you issuing a convertible note? Are you doing it to avoid the headaches of setting a valuation on your startup? Well.. think again! Convertible notes bring their own set of calculations and negotiation and for the sake of yourself and your startup, you should pay as much attention to them as to any valuation negotiation.

A lot has been said about the pros and cons of convertibles. One pro is the fact that no valuation needs to be calculated, when we all know that everybody makes their own valuation assessment to determine the percentage of ownership upon conversion.

Indeed, in most cases, the terms of the convertible hide valuation information and make it just more fuzzy. A lot of articles have warned entrepreneurs about wrong usages of this instrument. The general consensus seems to be around a limited usage of them, with some corner cases, like bridge financing, for which they are perfect.

But if you must use them, you should at least be aware of the most common terms and their implications on the future of your stake and your company.

But what is a convertible note?

A convertible note is a contract between the company and an investor that stipulates that the investor provides the company with capital in the form of debt. The second and most important stipulation is then the conversion. When a predetermined “trigger event” happens, the debt gets converted into equity (in other words the notes get converted into shares) and the convertible note holder becomes a shareholder.

As a private contract between two parties, almost any clause can be applicable. Through the years and the usage of the instrument, contracts got more and more standardised and now contain certain common terms and themes. However, bear in mind that uncommon clauses can still be added by both parties and that the final contract might look quite far from the standard one.

So what are these convertible note pricing concerns?

As any financing contract, its clauses carry consequences for the financing of the firm, and it’s future cap table.

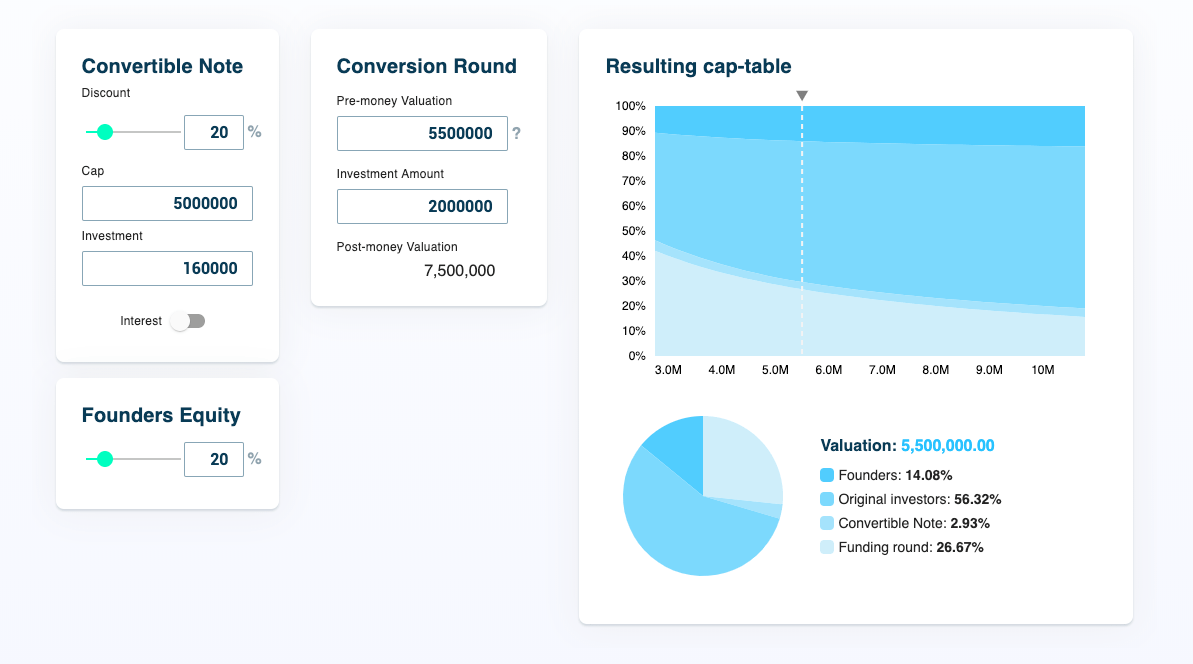

The amount invested by the investor (or investors) is converted at a certain valuation upon the trigger event. That valuation is usually the lowest between the pre-money valuation of the trigger round and the “Cap” of the note. To this value, a “Discount” is applied, that constitutes the premium for the risk that the convertible note holders are bearing in respect to the investors in the trigger round.

After the discount is applied, the percentage of ownership of the convertible note holders is then calculated based on how much money the debt is worth.

Keep in mind that this could be different from the actual amount of money invested by the convertible note holders, as an interest could be applied. In some cases, as investors are actually providing debt to the company, they will require an interest on it. Usually the interest is denominated on a yearly basis and then paid out according to the number of months between issuance and conversion.

Why do these calculations matter?

When investors convert their debt into equity, they will receive shares of the company. This will of course have impact on your stake. Your stake will also be diluted by the investors in the trigger round. Meaning that your final equity position could vary quite a bit by changing the cap, the discount and the valuation of the trigger round.

Checkout all scenarios and average discount rates on our brand new Free Convertible Note Calculator

Both you and your investors should do some scenario analysis on what are the outcomes for different levels of these inputs.

On top of this, you probably have an idea regarding the trigger valuation. And so does your investor. The relationship between the final equity stakes are then pivotal to understand.

The higher the final valuation, the lower the stake for the convertible note holders. This unless the valuation is above the cap. In this case, convertible note holders will receive the same equity stake, thus ideally benefitting from a higher valuation, as their shares will be worth more.

This implies that investors interested in buying convertible notes will keep the cap low, and the discount high. While you and the founding team will strive for the opposite.

Data on early stage discounts and caps is not readily available, making the misinformed entrepreneur the less informed part. In all these operations, it is always better to consult with other founders, lawyers or advisors on these terms to avoid surprises in the future.

When discussion on the cap gets central in the negotiation, a lot of questions about valuation will surface. Also for this part of the discussion, we entrepreneurs are usually less informed than the other part. And also for this part we should check with other founders, lawyers or Google.

To get an idea and learn more about you valuation, get started with Equidam!

Conclusion

Convertible notes are generally constituted of simpler calculation and math. They are more flexible contracts compared to shareholder agreements and other things. However, for the most part, they hide a lot of complexity and leave it for future discussions. Use them with discretion and try to forecast as much as possible the different outcomes.

Your evaluation process as well as your fundraising principles for convertibles notes in early stage are interesting!

But as you say it is more difficult to get investors or investment funds to join. Also, would it not be more judicious, or even purely intelligent, for Equidam to create a stock exchange in the form of a platform to offer these opportunities to investors. A process for an win-win deal…

Hi, thanks for your message! Happy you find our content interesting.

We are currently focusing on making the communication more transparent among investors and entrepreneurs, instead of facilitating the transactions per se. We do cooperate with some partners that may solve your need, so feel free to reach out for more information!

Thanks for suggestion, we always appreciate ambition and entrepreneurial spirit!

Thanks- Great reading. It clarifies several things. I would still like to see a “real example”. A story with numbers. Are you able to prepare that for a future post? 🙂

Thank you very much for your feedback! It is a nice idea, we are on it!