Simple, four-step process

Streamlined approach that combines technology with expert human analysis, delivering accurate valuations with minimal friction.

Data Gathering

Upload your cap table, financials, incorporation documents, and optional metrics or pitch decks.

Expert Analysis

Expert advisors from our partners review your data and perform detailed valuation using market benchmarks.

Draft Review

Receive a draft report,

schedule a call or leave comments to align with the analyst.

Final Report

Download your audit-ready PDF report with valuation summary, methodologies, and conclusions.

Data Gathering

Upload your cap table, financials, incorporation documents, and optional metrics or pitch decks.

Expert Analysis

Expert advisors from our partners review your data and perform detailed valuation using market benchmarks.

Draft Review

Receive a draft report,

schedule a call or leave comments to align with the analyst.

Final Report

Download your audit-ready PDF report with valuation summary, methodologies, and conclusions.

Value-Focused Pricing

Our transparent pricing model delivers exceptional value without hidden costs or unexpected fees.

All-Inclusive Package

One price covers your entire valuation process with no surprise add-ons. Includes draft review, revisions, and final audit-ready report.

– Expert analyst review included

– No charge for consultation calls

– Unlimited revisions in draft phase

Discounted Renewals

Receive significant discounts on annual renewals and post-funding updates, with streamlined processes that require minimal additional input.

– Preferential rates for repeat clients

– Expedited processing for updates

– Filled data from previous valuations

Value-Added Features

Our pricing includes premium features that other providers charge extra for, maximizing the utility of your investment.

– Investor-ready report presentation

– Dedicated valuation for business

– Post-valuation calls for guidance

All-Inclusive Package

One price covers your entire valuation process with no surprise add-ons. Includes draft review, revisions, and final audit-ready report.

– Expert analyst review included

– No charge for consultation calls

– Unlimited revisions in draft phase

Discounted Renewals

Receive significant discounts on annual renewals and post-funding updates, with streamlined processes that require minimal additional input.

– Preferential rates for repeat clients

– Expedited processing for updates

– Filled data from previous valuations

Value-Added Features

Our pricing includes premium features that other providers charge extra for, maximizing the utility of your investment.

– Investor-ready report presentation

– Dedicated valuation for business

– Post-valuation calls for guidance

No hidden fees, no pricing variations. Just fair valuations.

This is what makes us unique

Our ESOP and 409A valuation services are designed to make compliance simple while providing the highest quality of service.

Independent & Impartial

Independent & Impartial

External partners ensure objective valuations with no internal bias, compliant with regulatory standards.

Multiple Valuations

Multiple Valuations

Easily update your valuation after fundraising or business changes. No extra onboarding or redundant setup.

Integrated Flow

Integrated Flow

ESOP + Valuation in one seamless flow. Use your existing valuation data — no need to duplicate input or sync tools.

Human Support

Human Support

Discuss findings directly with valuation experts before finalizing. Get answers to your questions in real-time.

Transparent Pricing

Transparent Pricing

Clear costs, no bundled extras. Pay for what you need, when you need it, with pricing that scales with your business.

IRS Compliant

IRS Compliant

Our methodologies and reports are fully compliant with IRS guidelines that fit for your audits and investor reviews.

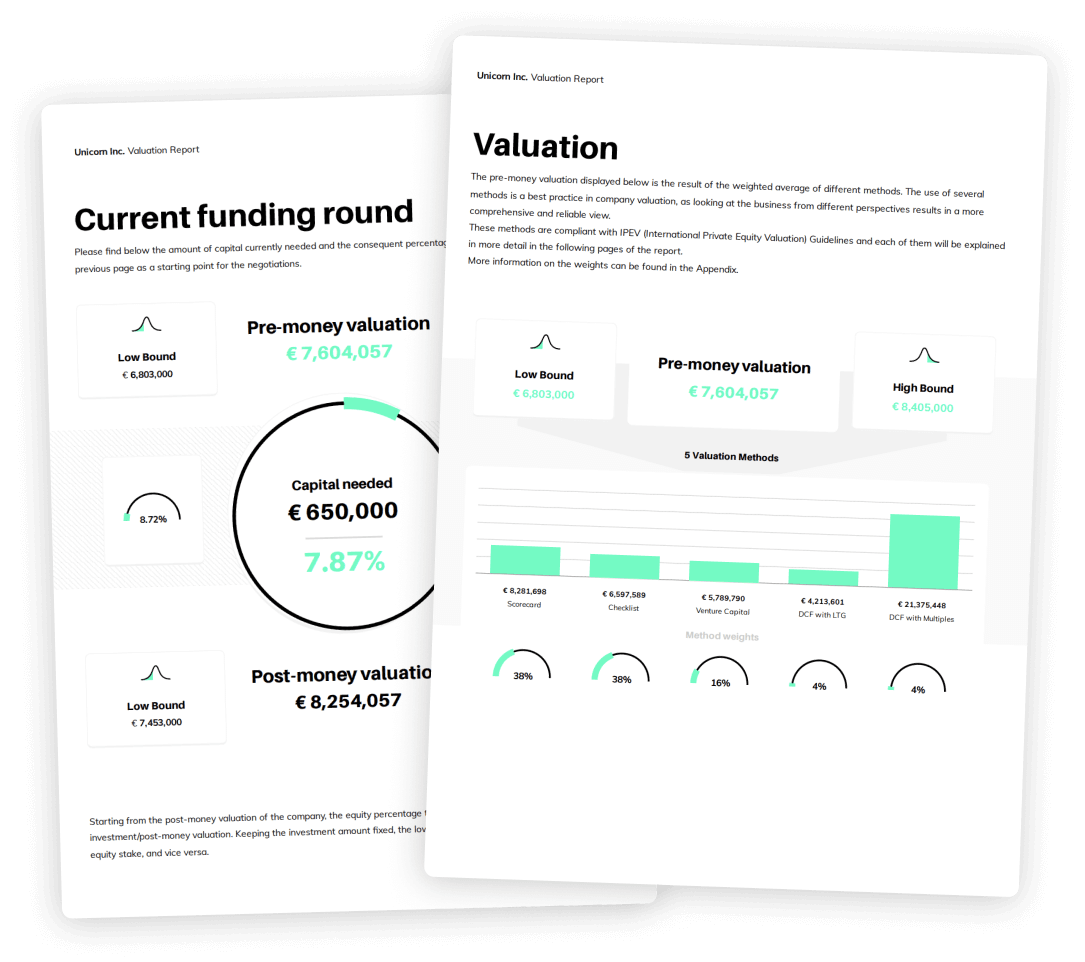

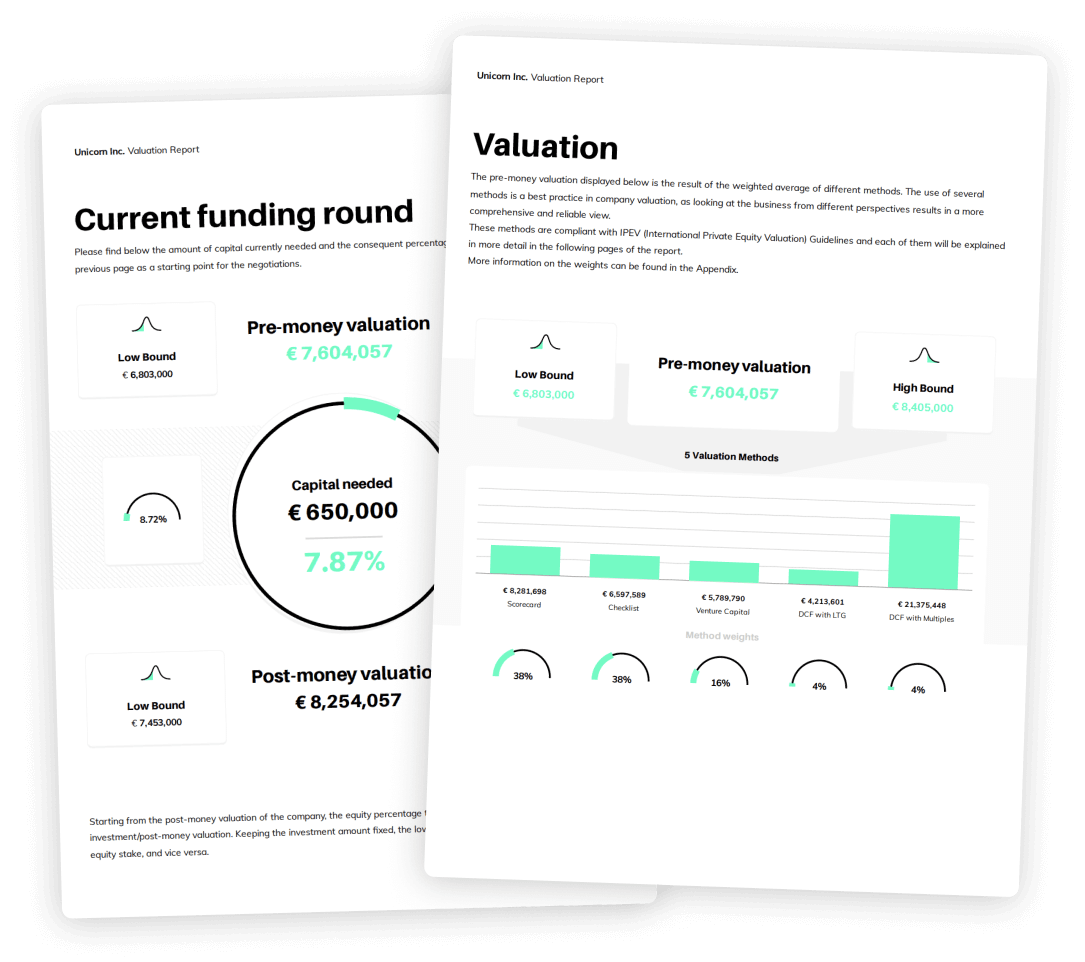

Comprehensive, Audit-Ready Reports

Our valuations deliver detailed insights into your company's worth with clear methodologies that satisfy IRS requirements and investor scrutiny.

– Multiple valuation methods for robust analysis

– Detailed market comparables and benchmarking

– Executive summary with clear valuation conclusions

– Digital and print formats with professional design

Comprehensive, Audit-Ready Reports

Our valuations deliver detailed insights into your company's worth with clear methodologies that satisfy IRS requirements and investor scrutiny.

– Multiple valuation methods for robust analysis

– Detailed market comparables and benchmarking

– Executive summary with clear valuation conclusions

– Digital and print formats with professional design

Global Coverage

Our 409A valuations and ESOP services are available across major startup markets worldwide, with region-specific expertise.

See the list of our supported countries

Instant reports for ESOP

Equidam’s self-serve valuation reports are accepted for ESOP use in the countries below. Generate them instantly, without advisors or custom processes—saving you time and money.

The same 3-step process applies in all self-serve countries:

Review company's data

Review company's data

Review your company's information and ensure all necessary data is accurate for analysis.

Download the best report

Download the best report

Choose the valuation report that best showcases your assumptions.

Implement your plan

Implement your plan

Review, approve, and integrate your valuation to grant equity compensation to employees.

Benefits:

– Faster process

– Cost-effective solution

– Simplifies compliance process

– Local tax laws considerations

Review company's data

Review company's data

Review your company's information and ensure all necessary data is accurate for analysis.

Download the best report

Download the best report

Choose the valuation report that best showcases your assumptions.

Implement your plan

Implement your plan

Review, approve, and integrate your valuation to grant equity compensation to employees.

Benefits:

– Faster process, no dedicated 409A or ESOP needed

– Cost-effective solution

– Simplifies compliance process

– Local tax laws considerations

Frequently Asked Questions

Everything you need to know about our ESOP and 409A valuation services.

A 409A or ESOP valuation determines the fair market value of your company’s common stock for tax purposes. It’s required when issuing stock options to comply with IRS regulations. Without a valid 409A, your employees could face severe tax penalties.

Typically, the process takes 7-10 business days from submission of all required documentation to the delivery of your final report. Rush options are available for time-sensitive situations.

Your 409A valuation should be updated at least once every 12 months, or after significant company events like fundraising rounds, major business model changes, or pending acquisitions.

Our partners provides expert analysts with extensive experience in startup and private company valuations. Each advisor is professionally trained and follows rigorous methodologies that comply with regulatory requirements.

While your 409A/ESOP valuation provides important insights, preferred stock (issued to investors) is typically valued differently than common stock (issued to employees). Our reports provide context on both to help with your discussions.

If you’re shopping around, we recommend exploring our site a bit — you’ll find information about why to choose us, our valuation report, data sources, methodology, and more. Plus, our Help Center has lots of helpful information.

If you need to get in touch with our team, you can always do so via the chat on the bottom right corner.

GET STARTED NOW

Simplify your ESOP and 409A valuation

Join hundreds of startups who trust Equidam for compliant, reliable valuations.