“There is a doom loop around Europe and we need to change that. The brain drain to the US is very real and it’s going to really damage the future of Europe unless something changes.”

Harry Stebbings, Founder of 20VC and Project Europe

Europe is not short on ambition. From deeptech hubs in France to fintech leaders in the UK, the continent is bursting with innovation and world-class talent. But there’s a persistent ceiling to success—a glass lid that stops momentum from turning into legacy.

Unlike in the US, where Silicon Valley has created a self-sustaining engine of growth, Europe lacks a systemic track record of producing large-scale, global tech winners. Spotify and Revolut stand as rare exceptions, not part of an established pattern.

A significant reason why? European tech companies are not distributing the proceeds of success, keeping talent in the tech ecosystem, and planting the seeds for future growth.

A Broken Incentive Structure

In the Bay Area, early employees often walk away from successful startups with life-changing wealth. Their reward for taking a risk is not just a bigger paycheck, but the freedom to invest, advise, or start something new.

Europe, by contrast, traps its best talent in a cycle of stagnation. Employees who help grow unicorns don’t receive enough upside to justify taking a risk again. If their company exits, the income they relied on vanishes—along with the incentive to try again. Most retreat to safer havens: large corporates, consulting, or worse—out of the ecosystem entirely.

This isn’t just a loss for them. It’s a massive missed opportunity for European innovation.

The Boom Loop We’re Missing

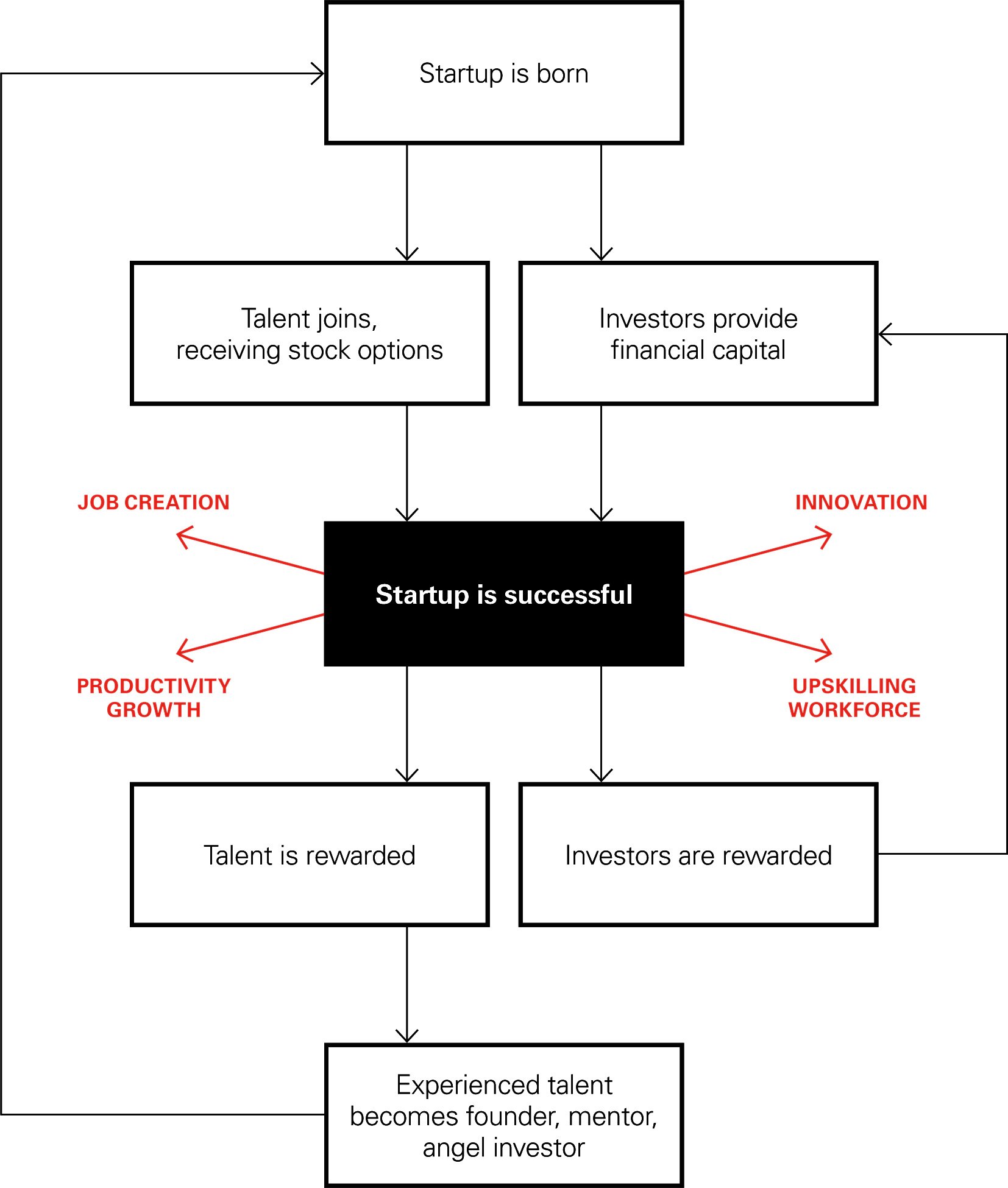

When employees are well-compensated with equity, they stay in the ecosystem. They seed and start new companies. They join ambitious early-stage ventures. They help other founders scale and localise effectively—especially across Europe’s fragmented markets, where operational knowledge is essential.

It’s already happening on a small scale. The Revolut mafia has spun out over 100 startups and funded 60+ others. But this kind of recycling of knowledge and capital is the exception, not the rule.

Europe needs more Revoluts. More Shopifys, Klarnas, and Datadogs. More alumni networks that compound progress instead of resetting it.

“Technology companies can create huge economic prosperity by making sure that the wealth they create is shared fairly amongst those who helped build that success. And giving employees a part of the upside is also key to continuing the flywheel of success in European tech; the operators of today are the founders and angel investors of tomorrow, helping seed the next generation of companies.”

Finn Murphy, General Partner at Nebular

source: Rewarding Talent

An Equity Culture Problem

Regulation often takes the blame. And yes, the tax treatment of stock options in many countries is a mess—heavily taxing illiquid instruments as income is irrational. But the deeper issue is cultural.

European founders and boards are often reluctant to give employees a meaningful stake. Sometimes this is due to their own experience: they didn’t get equity when they were employees, so they don’t pass it forward. Other times it’s because they assume talent won’t value options—or won’t understand them.

But this creates a cycle of underperformance. If employees don’t see examples of equity payouts, they undervalue it. If they undervalue it, companies offer less. And on it goes.

Compare that to the US, where employees expect options—and understand their worth. Facebook’s IPO created over 1,000 millionaires. Google had over 1,000 employees with $5M+ payouts. That fuels a long-term flywheel of startup activity. Europe is still waiting for that moment.

“If employees of a successful startup get rich overnight in an exit, they tend to actually reinvest their new wealth into the ecosystem, by either founding a startup themselves or investing in startups. So in Europe, we need to make better policies to allow for these employee participation funds.”

Yoko Spirig, Co-Founder of Ledgy

Towards a More Equitable Future

There are actionable solutions that Europe can adopt today:

- Set expectations with transparency

Founders need to be as fluent in explaining equity to employees as they are to investors. It’s part of the compensation package—and a key lever for alignment and retention. - Properly budget equity pools

Too many founders make hasty decisions about equity early in the life of their startup, and find themselves without an adequate pool to share with employees later. Start budgeting for the kind of company you want to build, from day one. - Make use of tax optimised schemes

Most countries have some form of tax optimised scheme for employee stock option plans, like EMI in the UK or ESS in Australia. Even in the US, it is worth understanding what protections a 409A provides and how to ensure sustained compliance. - Adopt best practices from the US

Stock options should vest over four years with a one-year cliff. Founders must understand strike prices, exercise windows, and taxation implications—and communicate them clearly to employees. - Protect employees at exit

Too many employees lose their vested but unexercised options in M&A deals because they can’t afford to exercise or weren’t given sufficient rights. This has to change. - Push for policy progress

Index Ventures’ Rewarding Talent report showed countries like Estonia, the UK, and France leading the way in progressive ESOP regulation. Others must follow. A pan-European framework could be transformative.

This Is a Foundational Moment

European tech is at a tipping point. Valuations are rising. Exits are becoming more common. Competition for talent is global. Initiatives like Project Europe and EU Inc are finally driving the narrative towards growth. If we want the best people to bet on European startups, we have to make that bet worthwhile.

By fixing equity culture and stock option practices, we can unlock the next phase of growth: a boom loop where experience, capital, and innovation circulate endlessly.

Because the real return on employee ownership isn’t just individual wealth. It’s systemic momentum.

It’s the flywheel.

It’s the next generation.

It’s the Europe we’re trying to help build.

This article draws on insights from Finn Murphy’s post “European tech companies should be minting more millionaires” (March 2025), Index Ventures’ Rewarding Talent handbook, and broader data on employee equity practices across Europe and the US.