When raising venture capital, founders often get fixated on price—the final figure on the term sheet that determines how much the investor pays for their stake in the company. It’s an easy metric to compare against peers, to boast about in press releases, and to benchmark against industry trends. But price, while important, is not what you should fixate on when negotiating a funding round.

Instead, founders should focus on negotiating value—the shared understanding between investor and entrepreneur about the company’s future potential, risk profile, and the key drivers that will determine long-term success. When founders and investors align on value, valuation becomes a logical output of that discussion, rather than an arbitrary number shaped by market fluctuations or negotiation tactics.

The Difference Between Price and Value

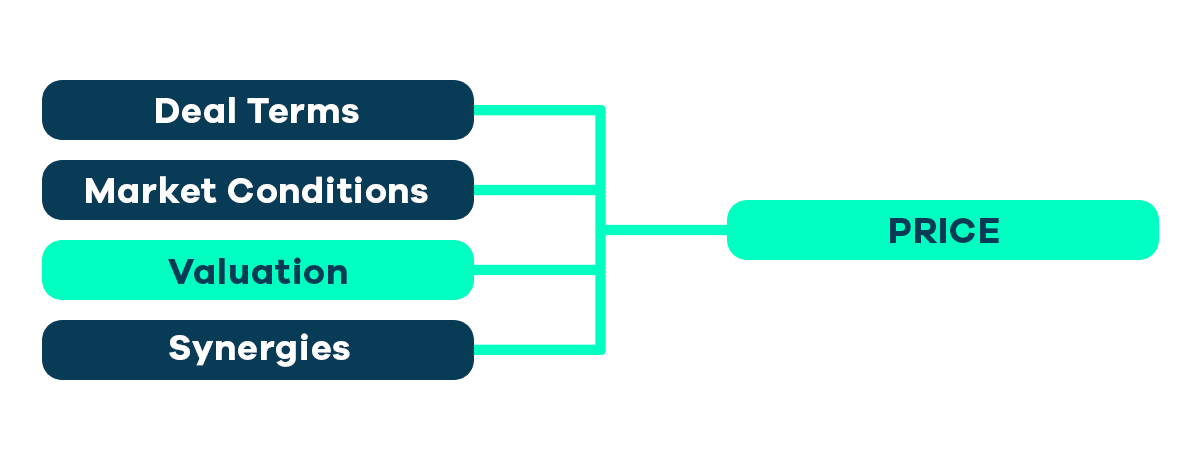

At its core, price is the number on the term sheet. It’s what investors pay to acquire equity in a price round. While price may be influenced by valuation, it is also impacted by external market conditions, investor competition, sector momentum, and deal terms.

Valuation, on the other hand, is an estimate of a company’s intrinsic worth. Think of it like an appraisal at an auction—an expert may estimate a painting’s value at $10,000, but if only one bidder is interested, it may sell for far less. Conversely, if multiple collectors drive up the bidding war, it may go for much more. The final price is shaped by who is in the room, their appetite for the asset, and the prevailing market dynamics.

In venture capital, the same principle applies. A startup’s valuation is a function of its growth potential, competitive position, financial health, and risk factors. However, the final price at which the round is completed will be shaped by broader trends—whether capital is abundant or scarce, whether the sector is in high demand, if there are synergetic effects across the investor’s portfolio, and whether the terms offered by the investor (such as board seats, anti-dilution protections, or liquidation preferences) justify a higher or lower price.

Why Negotiating Price is a Trap

Trying to negotiate purely on price leads to a back-and-forth that often lacks substance. Founders may point to similar companies with high valuations to justify their ask, while investors may counter with lower comparables to argue for a lower price. Both sides can cherry-pick data to support their position, leading to a negotiation focused on relative pricing rather than absolute value.

This approach is flawed because it ignores the underlying drivers that actually determine a startup’s long-term success in favour of factors that are largely out of the founder’s control. It’s also a zero-sum game—if an investor agrees to a higher price but feels they overpaid, they may later push for more aggressive terms, reducing the founder’s control or exit potential.

Instead of arguing about price, founders should shift the conversation to value creation. This means working with investors to develop a shared understanding of the company’s future potential and risk. A negotiation framed around value is more constructive, as it focuses on the fundamentals of the business rather than arbitrary market benchmarks.

How to Negotiate Value Instead

Rather than starting with a number, start with a discussion about the company’s growth drivers and risk factors. If both parties agree on what reasonable growth looks like, what risks exist, and how those risks will be mitigated, then valuation becomes a natural by-product of that discussion.

1. Align on Growth Potential

- Discuss the market size, customer demand, and competitive landscape.

- Outline realistic revenue projections, unit economics, and scalability.

- Share data and insights on how the business will expand over time.

2. Identify Key Risks and How to Mitigate Them

- Be transparent about challenges and unknowns—no business is risk-free.

- Demonstrate a plan for de-risking the business through execution.

- Investors will be more comfortable with a higher valuation if they believe risks are well understood and manageable.

3. Define Sustainable Competitive Advantage

- Explain how the company will maintain its edge over competitors.

- Discuss barriers to entry, intellectual property, network effects, and customer retention.

- The stronger the defensibility of the business, the more value it holds.

4. Discuss Pathways to Liquidity and Exit (Maybe)

- Some investors want to understand what you think about exit opportunities, while others want this to be your life’s work.

- If they are in the first group, be ready to clarify potential exit scenarios (acquisition, IPO, secondary sales).

- Align on a vision for what success looks like and the timeline to get there.

When founders and investors have a shared view on these elements, the valuation discussion becomes much smoother. If an investor believes in the company’s trajectory and sees a path to a strong return, they are far more likely to agree to a valuation that reflects that potential.

How Price is Shaped Beyond Valuation

While valuation is a core input into pricing, there are other factors that influence the final terms of the deal.

- Market Conditions: In capital-rich eras like 2021 (with low interest rates driving money into private markets) round prices were higher due to investor’s having to compete for access to deals. In capital-constrained eras like today, rounds are priced lower as the demand for investment is far outpacing the supply of capital.

- Sector Momentum: Companies in hot sectors (e.g., AI startups today) will command higher prices due to increased investor demand.

- Portfolio Synergies: If an investor has a strong strategic fit with the startup, they may be willing to pay a premium.

- Deal Terms: Founders that offer more aggressive terms—such as high preference multiples or strong anti-dilution protections—may get a higher price, but at the cost of future flexibility.

Understanding these dynamics helps founders negotiate from a position of strength. Rather than chasing a high price at all costs, focus on structuring a deal that aligns incentives for both sides. Valuation should be the main focus in negotiations to ensure a fair and reasonable outcome.

Understanding these dynamics helps founders negotiate from a position of strength. Rather than chasing a high price at all costs, focus on structuring a deal that aligns incentives for both sides. Valuation should be the main focus in negotiations to ensure a fair and reasonable outcome.

Avoid the Pitfalls of Over-Optimizing Price

Chasing the highest possible price can lead to unintended consequences. Some common pitfalls include:

- Overly Generous Terms: Founders who push valuation too high may have to concede on terms like liquidation preferences, which can significantly impact future exit outcomes.

- Downround Risk: If a company raises at an inflated price and fails to meet growth expectations, future investors may demand a downround, damaging morale and ownership stakes.

- Investor-Entrepreneur Misalignment: If an investor feels they overpaid, they may push for more aggressive governance controls or exit strategies that don’t align with the founder’s vision.

How Equidam Facilitates Fundraising Negotiations

Navigating these conversations about future value requires a tool that enables clarity and mutual understanding. Equidam addresses this need through its clear and transparent approach to valuation, designed to avoid abstract pricing negotiations by focusing attention on the drivers of value and key assumptions.

Key components include:

- Qualitative Comparisons: A number of qualitative data points are used to evaluate the strength of the company, covering areas such as strength of the team, market opportunity, competitive environment, product stage and rollout, and IP.

-

Financial Projections: Detail on projected revenue growth, profitability trajectories, and cash flow forecasts, enable stakeholders to assess the company’s financial outlook and scrutinise the underlying logic.

-

Ownership Structure and Funding History: Information on past funding rounds and current ownership distribution provides context on the company’s capital journey and stakeholder alignment.

-

Valuation Methodology: Five valuation methods—Scorecard, Checklist, Discounted Cash Flow with Long-Term Growth, Discounted Cash Flow with Multiple, and Venture Capital Method—offer a weighted average valuation range. Each method is thoroughly explained, including its origin, calculation parameters, and relevance, ensuring transparency in how the valuation is derived.

The resulting valuation report serves as a blueprint for productive negotiations. This transparency and the ability to test key variables and assumptions, ensures that both founders and investors can reach a shared understanding of the company’s value drivers and future prospects. Negotiations should be grounded in transparency, with the aim of aligning expectations.

Conclusion

The most successful funding negotiations are not about extracting the highest possible price. They are about aligning on value—ensuring that both founders and investors share a vision for the company’s future, agree on growth assumptions, and structure the deal in a way that incentivizes long-term success.

By focusing on value rather than price, founders can secure investors who truly believe in their business, build a strong foundation for future fundraising, and create long-term alignment that benefits all stakeholders. In the end, valuation is an output of these discussions—not just a number to be debated.