Equidam collaborates with advisors and consultants worldwide, supporting their work in delivering robust, data-driven valuations for young, high-growth ventures. Whether it’s for fundraising, M&A, or other strategic purposes, these valuations require a nuanced understanding of the unique risks and potential rewards inherent in early-stage companies.

To better equip professional service providers in this environment, we’ve enhanced our valuation reports with three newly customizable sections. These updates are designed to improve transparency and enhance clarity, while providing advisors the flexibility to communicate the value of their services directly within the report.

New Customizable Sections for Enhanced Context and Transparency

1. Include the engagement letter and your scope of work directly in the report

The “About This Report” section is designed to allow advisors to provide a comprehensive overview of the specific scenario driving the valuation. With up to 4,000 characters of content, advisors can detail the unique circumstances, objectives, and methodologies behind the report. This addition empowers clients to understand the particular nuances and requirements that shape the valuation, whether it’s for fundraising, compliance, M&A activity, or strategic planning.

2. Showcase your company and service offerings

A strong relationship between advisors and clients is built on trust. The new “About This Advisor” section allows advisors to introduce their practice in greater detail, showcasing their expertise, mission, and track record. By elaborating on their services, values, and specialized focus areas, advisors can build confidence with readers, aligning their unique approach with the needs of clients.

3. Personalise disclaimer and valuation caveats

Transparency is key in the valuation process, especially when complex legal and methodological considerations are involved. The enhanced Disclaimer section now offers up to 4,000 characters to outline any specific legal constraints, disclaimers related to the methodology used, or terms governing the use of the report. This addition ensures that all stakeholders are aligned on the scope, assumptions, and limitations of the valuation, reducing potential misunderstandings and fostering greater trust.

Tools for Startup Valuation Professionals

These new sections are the latest in a series of improvements Equidam has introduced to support advisors in delivering valuation as a service, particularly for early-stage companies. Over the past years, we’ve rolled out several impactful features that significantly enhance the flexibility and depth of our platform:

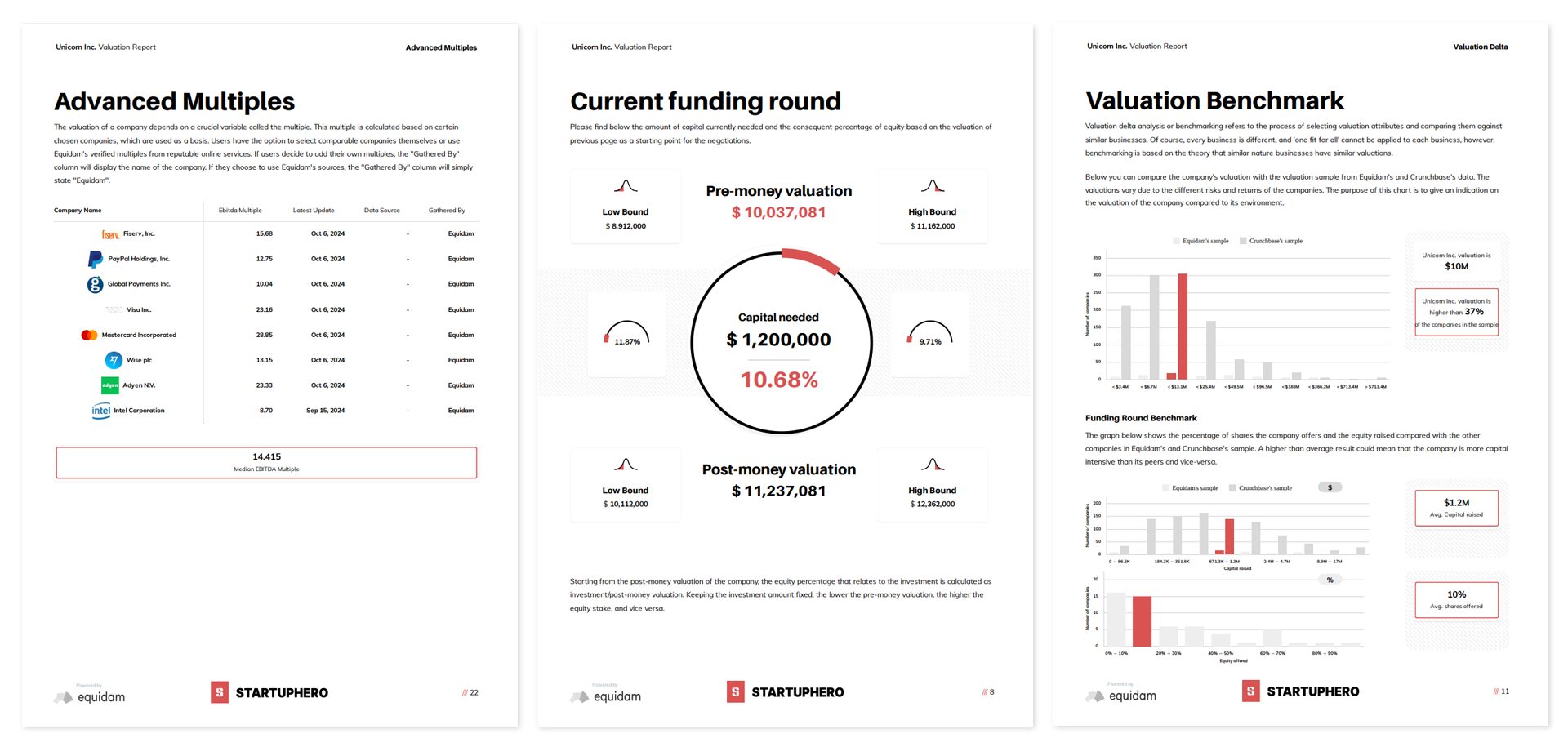

- Advanced Multiples Section: Advisors can now build custom lists of public comparables to derive revenue or EBITDA multiples, tailoring these to the specific industry or market segment of the startup.

- Excel Upload for Financial Forecasts: By enabling the direct upload of detailed financial forecasts via Excel files, advisors gain greater control over projections. This feature simplifies collaboration across teams and allows for the creation of multiple scenarios, ensuring a more accurate and robust valuation process.

- Multiple Seats for Collaborative Access: For advisory practices with multiple team members, we’ve introduced multi-seat access. This feature allows different users to seamlessly collaborate on valuations, enhancing efficiency and consistency, particularly when working on complex or high-volume cases.

- Flexible Pricing Models for Advisory Firms: Recognizing that advisory practices vary in size and focus, we’ve introduced new pricing models tailored to the specific needs of firms working with early-stage startups. These models provide the flexibility needed to address the unique challenges of valuing innovative, high-growth ventures that often deviate from traditional business models.

Empowering Advisors to Deliver Tailored Valuation Services

These updates are designed with one goal in mind: to empower advisors and consultants in providing highly customized, precise, and contextually rich valuation services to their clients. As the landscape of early-stage investing becomes more complex, these tools ensure that advisors can deliver the nuanced insights that founders, investors, and stakeholders require to make informed decisions.

By combining new customization options with existing advanced features, Equidam continues to set the standard for delivering high-quality, adaptable valuation tools. We remain committed to supporting the growth of the advisory community and the early-stage companies they serve.

For more information on how these updates can benefit your practice, check out our solution for professionals and get in touch to learn more.