Twelve years ago, we set out to change the way startup valuation was approached. Since 2013, the Equidam platform has powered the valuations of more than 150,000 companies, primarily early-stage technology startups, who have raised a collective total of over $5 billion from investors (for context, that’s 1.6% of worldwide venture capital investment in 2023, or roughly the GDP of Fiji). During this time, we have witnessed major shifts in the startup and venture capital ecosystem, driven by the ups and downs of the global economy, fluctuating interest rates, and changing investor preferences.

We’ve evolved alongside the investment ecosystem, from the early days of the software boom to today’s more restrictive capital environment. Our approach has provided clarity through different market cycles, helping both founders and investors adapt to fluctuating valuations, waves of technology hype, and shifts in investor priorities.

The Evolution of Valuation: From Misunderstood to Mispriced

In the early days of Equidam (2012-2015), software and technology were often underpriced. As venture capital became increasingly enthusiastic about tech startups, this shifted to a phase where valuations were driven by hype and momentum, sometimes grossly exceeding reasonable expectations. We observed periods where valuations became unmoored from fundamentals, driven by narratives rather than data.

Today, we are witnessing a return to more sober, data-driven valuations, driven by a convergence of factors including rising interest rates and a capital crunch in venture. This is an environment where transparency, explainability, and data are more critical than ever before. Investors, too, have become more selective, demanding clearer justification for valuations that once relied heavily on founder charisma or hype around particular industries.

What We’ve Seen Over the Past 12 Years

Through these market cycles, we’ve observed some fundamental truths about startup valuation, investing, and the intersection of the two:

- Valuation Cycles Are Predictable: The oscillation between underpricing and overpricing, between hype-driven investment and data-backed decisions, has been a constant theme in our twelve years of experience. Yet, companies and investors who rely on data-driven approaches tend to weather these cycles more effectively.

- The Divergence of Price and Value: Valuation is inherently a forward-looking measure of a company’s worth, while price is the amount that an investor is willing to pay today. The disconnect between the two, especially during periods of market enthusiasm, has often led to inflated valuations. However, these divergences tend to correct themselves over time.

- The Harm of Hype: While certain trends and sectors benefit from hype, the vast majority of startups suffer when valuations are driven by irrational exuberance. Misaligned expectations can hurt both founders and investors, leading to failed deals, diminished trust, and missed opportunities.

- The Growing Acceptance of Data: The data that can better predict startup success has existed for some time, but only recently have investors started to embrace it. Research has shown that those investors who take a multi-perspective approach to valuation, considering methods like discounted cash flow (DCF) alongside founder attributes, experience lower failure rates. Traditional factors such as founder background or industry focus can often correlate negatively with future success, yet they remain over-emphasized in many cases.

The Rise of Data-Driven Investing

What’s becoming increasingly clear is that data-driven investing strategies are reshaping the way investors raise capital and allocate their funds. Stakeholders want to see objective, transparent frameworks for evaluating startups and their potential returns. This shift aligns perfectly with Equidam’s mission to provide a more rigorous framework to explore investment opportunities.

This approach not only reduces capital waste but also ensures that capital flows more efficiently to the right startups—those with the best chance of success, based on objective and scrutable methodology rather than subjective preferences.

Equidam’s Global Impact

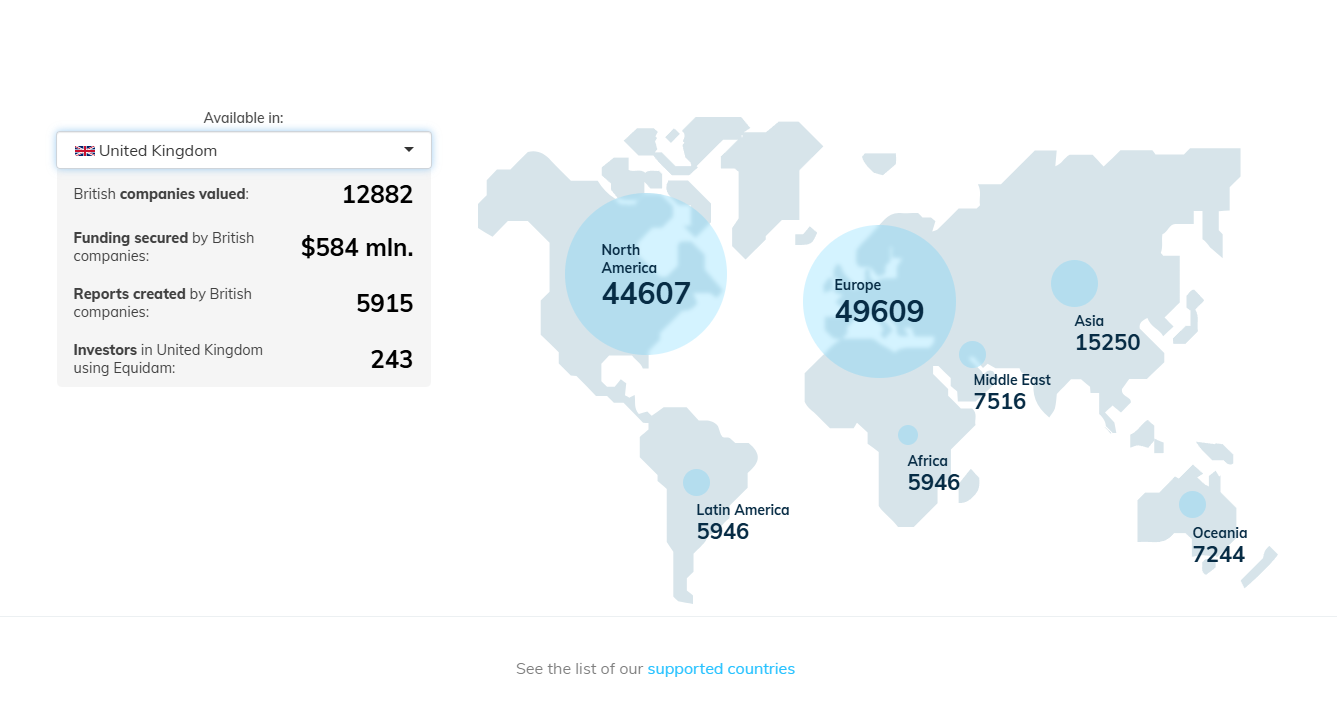

Our platform has supported companies in all corners of the world. Notably, in the UK alone, almost 13,000 companies using Equidam have raised around $58 million, while in the United States, 37,000 companies have secured approximately $88 million. We’ve also made a significant impact in the UAE, the Netherlands, Australia, Brazil, Nigeria, and beyond.

On the investor side, Equidam has worked directly with 387 investors in the US, 234 in the UK, 163 in Italy, 326 in Chile, and many more in other corners of the globe, helping them make better, more informed decisions about where to allocate capital. Our platform has produced tens of thousands of valuation reports, which have been viewed by millions.

As venture capital becomes more global and meritocratic, platforms like ours are becoming integral to the entire startup ecosystem.

Partnerships and Education

Our success has been amplified through partnerships with some of the world’s most respected accelerators, investors, and corporate partners, including J.P. Morgan, Microsoft’s programs, Virgin StartUp, Tech Nation, Dealum, Founder Institute, 1000 Black Voices and Village Capital, among others. Our educational efforts have helped countless founders and investors better understand how to approach startup valuation, ensuring more equitable fundraising processes and more accurate expectations on both sides of the table.

In the next phase of our growth, we aim to continue fostering a more efficient capital allocation process, one that accelerates technological development by ensuring that the right ideas—those most likely to succeed—receive the necessary funding. This is reflected in our commitment to fair valuation.

Looking Ahead: The Future of Startup Valuation

As venture capital continues to evolve, Equidam will be at the forefront of pushing for a more transparent, data-driven approach to investing. We believe that the future of startup fundraising will increasingly favor investors who prioritize rigorous, objective valuations over hype, and founders who can clearly articulate their long-term value propositions.

As we look back at the $5 billion in funding secured by companies using Equidam, and the 150,000 companies that have relied on our platform, we are both proud of what we’ve accomplished and excited for the future. The journey of transforming startup valuation is far from over, but together with our partners, founders, and investors, we are shaping a more equitable and efficient future for global innovation.