Understand and benchmarkyour valuation

By calculating your own valuation, you'll have a deep understanding of all its components. Benchmarks make sure your assumptions are rock solid.

Apply a combination of perspectives

By integrating various approaches — qualitative, quantitative, and market-based methods — Equidam ensures you calculate a robust and solid valuation that reflects true market conditions and future potential.

Produce clear and detailed reports

Generate detailed and visually appealing reports that present complex valuation data in a clear, concise manner. Perfect for sharing with partners, potential buyers, and stakeholders to provide transparency and foster trust.

Provide context with benchmarks

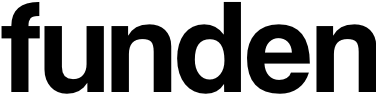

Benchmarks allow you to compare your company's performance and valuation metrics with similar companies in your sector to provide context, solidify assumptions and get a 360° of your valuation.

Powered by private market data

Equidam uses data on the global private market from Crunchbase™ to provide comparable valuations for our industry leading qualitative methodology.

Using research-backed risk factors about company success, we have enhanced traditional qualitative methods that provide a valuable perspective on companies of any stage.

Utilize the largest valuation data set

Benchmark your company against the largest database of valuations and gain insights from comparable data on projections, funding rounds, and more.

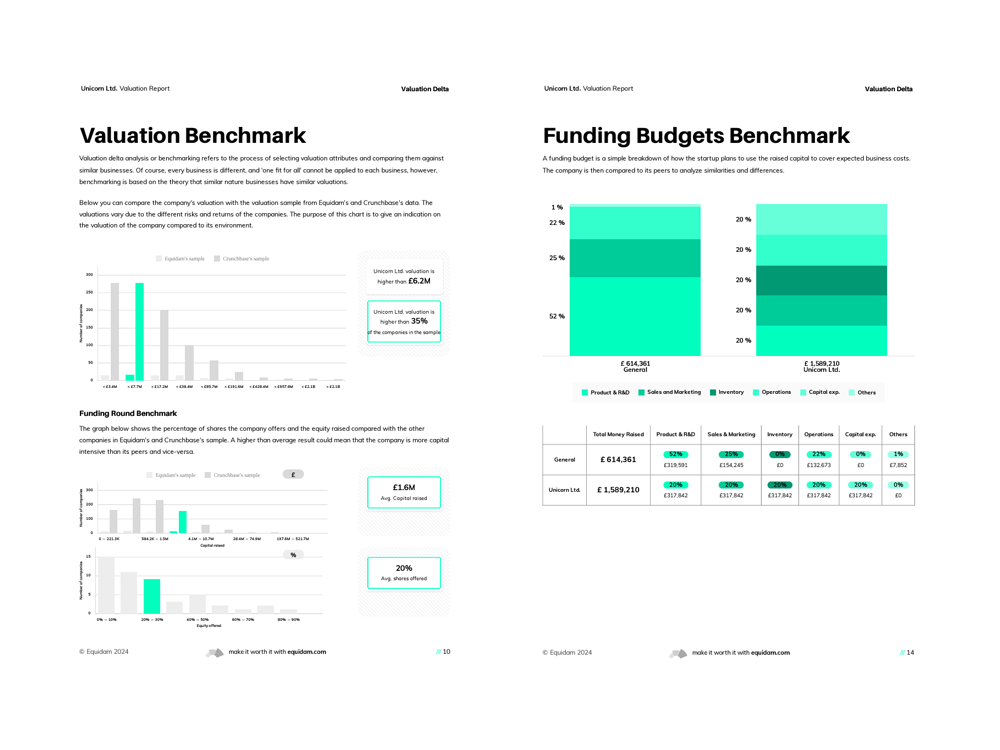

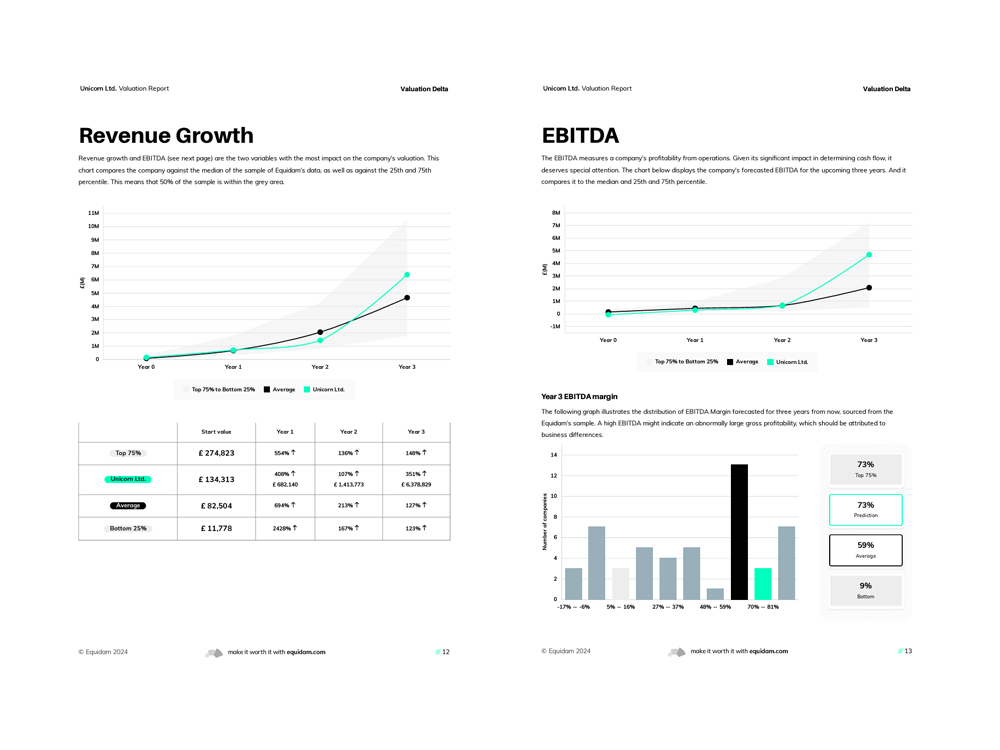

Valuation and funding benchmarks provide a data-driven view of a company’s market position and help set realistic goals.

Comparing projections with industry peers helps founders understand growth potential and profitability, ensuring achievable financial targets.

50,000

Valuation Reports Generated

140,000

Startups Valued

2,000

Investors use Equidam

25

Accelerator Partners

Advanced valuation methodology, made practical

You provide the inputs, Equidam provides the background data and calculates the valuation with 5 valuation methods. Simple, but powerful.

Qualitative inputs

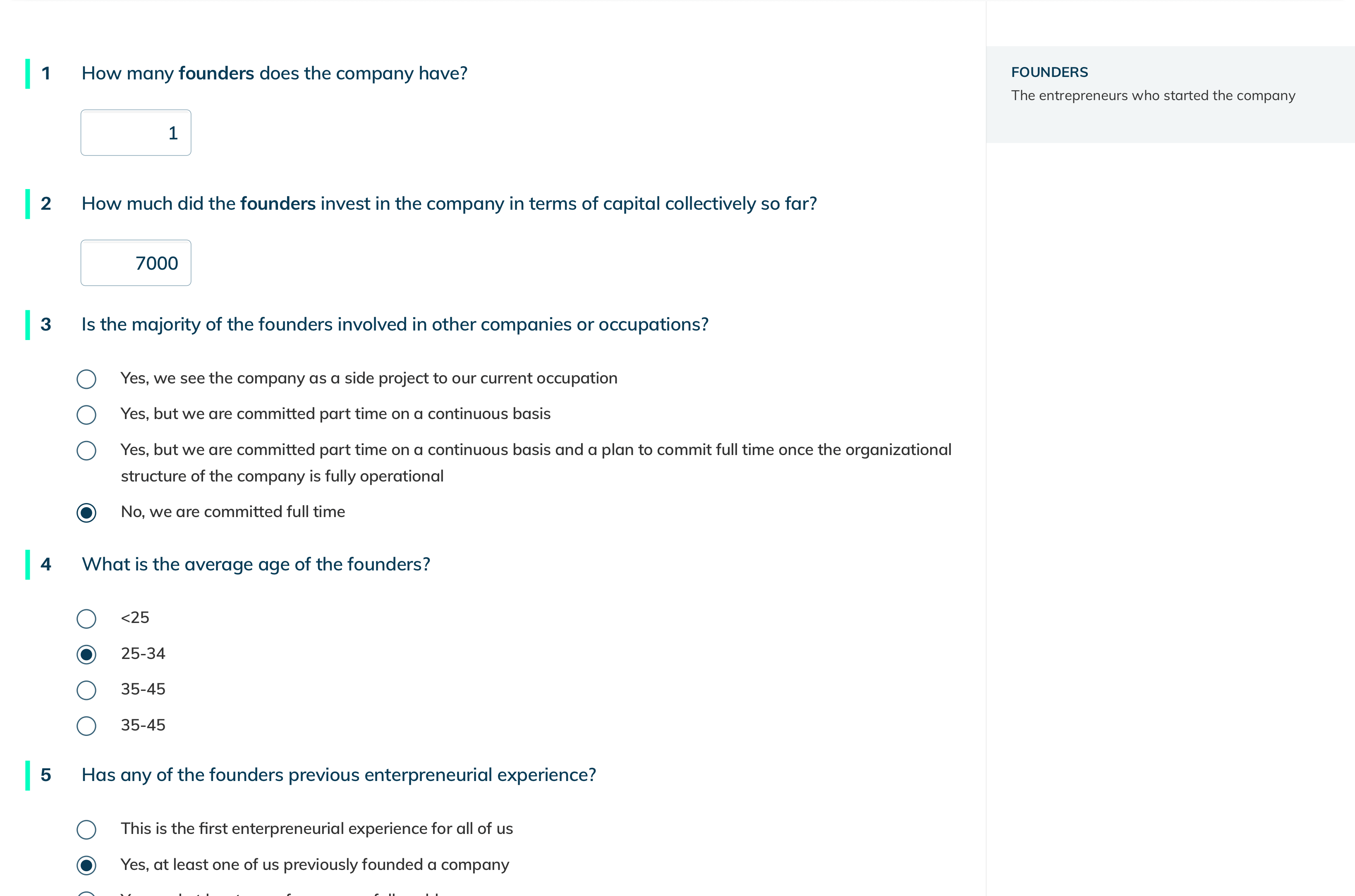

On Equidam, you’ll be asked 34 multiple choices questions about your company. The answers will be used in the qualitative valuation methods as well as to understand the future risks of the company.

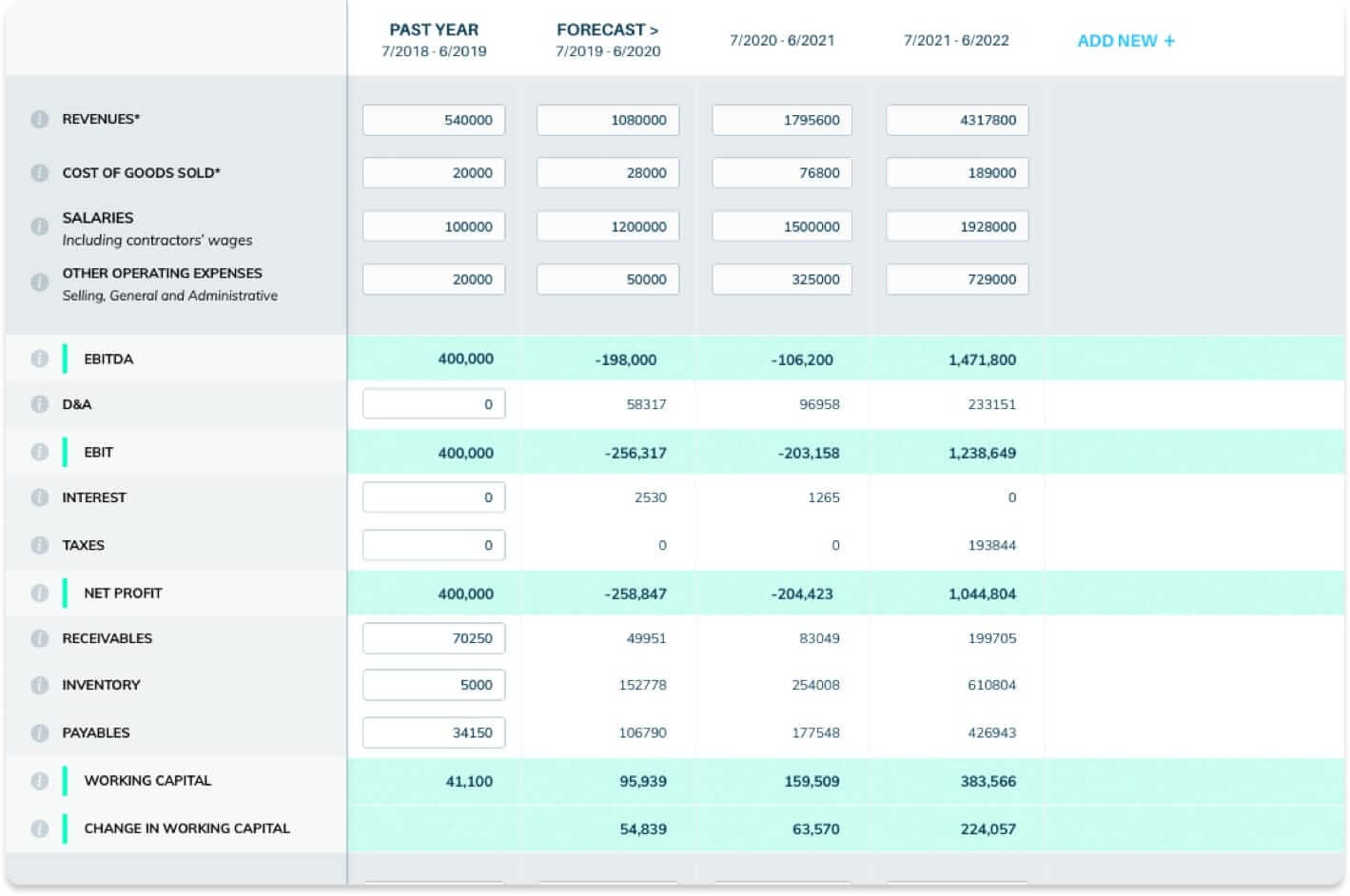

Financial inputs

When getting started on valuation, it’s good practice to have your financial projections ready. At a minimum, Equidam requires high level (revenue and costs) financial projections for the coming three years.

Exits & Aquisitions FAQs

Yes, we offer full flexibility on our plans. On top, if you feel like you made the wrong choice, we are happy to adjust the amount paid in case you decide to switch plans.

No, Equidam is not a subscription service, and all our fees are one-off and upfront. When your days expire, you’ll be able to extend the period from your account, and at any point, you’ll be able to upgrade or downgrade your account. All these actions will never be performed automatically by Equidam.

Equidam applies broadly to any high-growth potential business. The valuation applies to companies headquartered in these 90 countries. Our methods are applicable to any industry however valuation of real estate, pharma, and banking services can sometimes be challenging. If your company operates in these industries, feel free to reach out to us for further confirmation.

Through our guided procedure, we will ask you common questions about your company as well as your financial information for the past year and the future 3 years. If you are closely involved with the company, you should be able to answer our questions without any additional information retrieval. For the financials, it is generally better to start using Equidam once you have your financial projections ready. This will ensure you’ll use your access days effectively.

Our valuation platform allows users to customize the revenue and EBITDA multiples used in their valuation. This means that users can adjust the multiples based on their specific requirements and preferences.

Yes, our platform allows users to add their own revenue and EBITDA multiples. This can be useful if you have specific information that is you’d like to be considered in the valuation.

You’ll always be able to add more days later on. You will not need to pay an additional valuation fee as long the extension remains within the first 3 months of the initial purchase.

You will still be able to log in to your account and retrieve past reports and invoices. You will not be able to make changes to your valuation and generate new reports. Unless you asked otherwise, we’ll keep your data stored so that when you need your next valuation, you’ll be able to pick it up right where you left off.

The initial fee for Standard and Benchmarked valuations lasts for a period of 3 months. In case you don’t plan to quarterly update and monitor the valuation of your company, we suggest you select a number of days lower than 90. You can always purchase additional days within the 3 months period.

Yes, indeed! Throughout the access period, you will be able to change and update your company valuation as many times as you need to. Once your access days are over, you’ll be able to download reports generated in the past, but you won’t be able to make changes to your valuation and download new reports. If you wish to do so, you’ll have to purchase additional access days.

You can value unlimited companies within your Equidam account. Please note that the prices specified above are for each company. If you need to value more than 10 companies per year, please contact us!

If you’re shopping around, we recommend exploring our site a bit — you’ll find information about why to choose us, our valuation report, data sources, methodology, and more. Plus, our Help Center has lots of helpful information.

If you need to get in touch with our team, you can always do so via the chat on the bottom right corner.

We accept Paypal and Visa, MasterCard, Maestro, and American Express credit cards. In the Netherlands, we also accept iDeal.