After a decade of helping founders, investors and advisors to close fairer fundraising deals, Equidam has released a new suite of valuation benchmarking tools called Valuation Delta™.

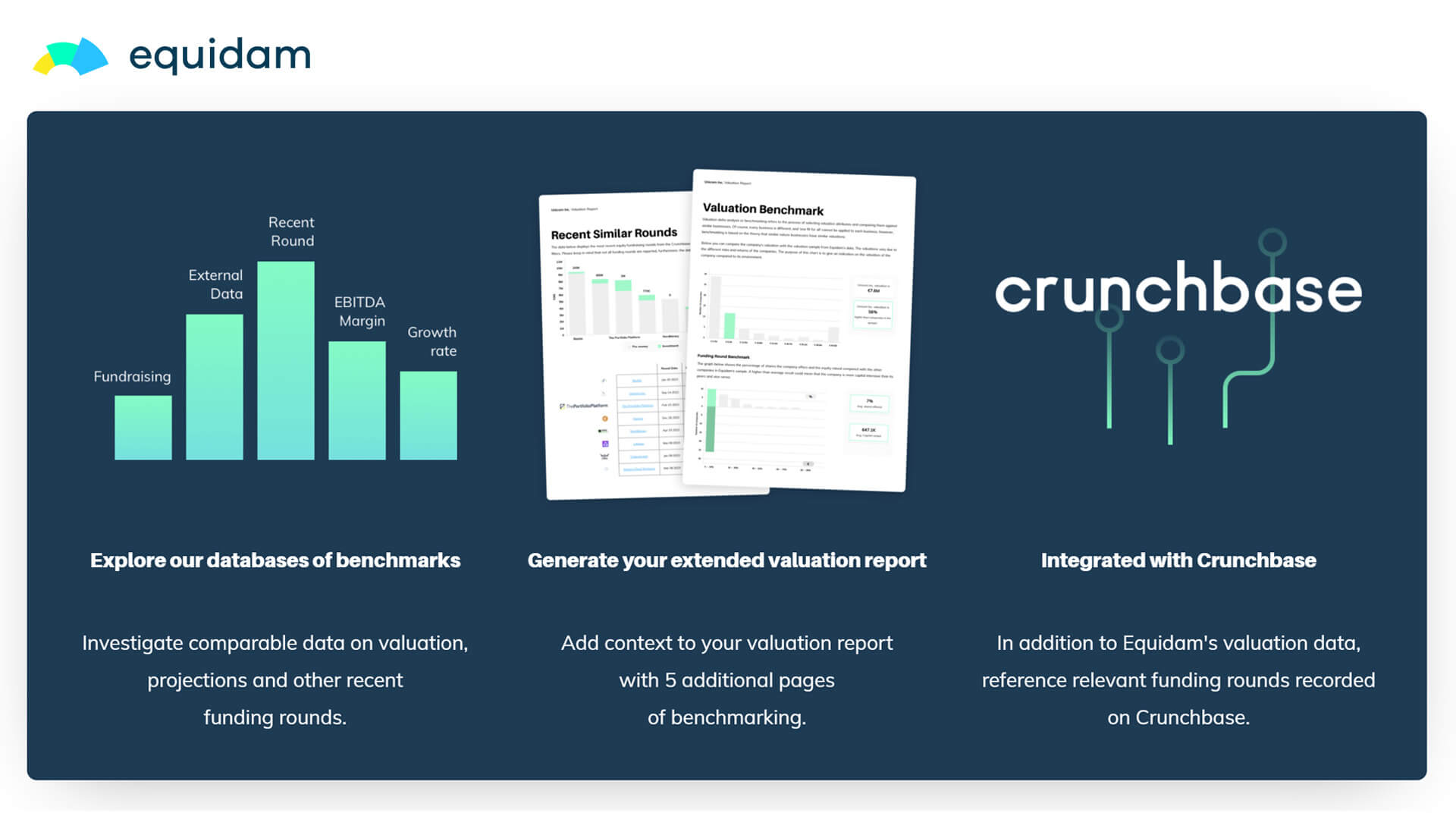

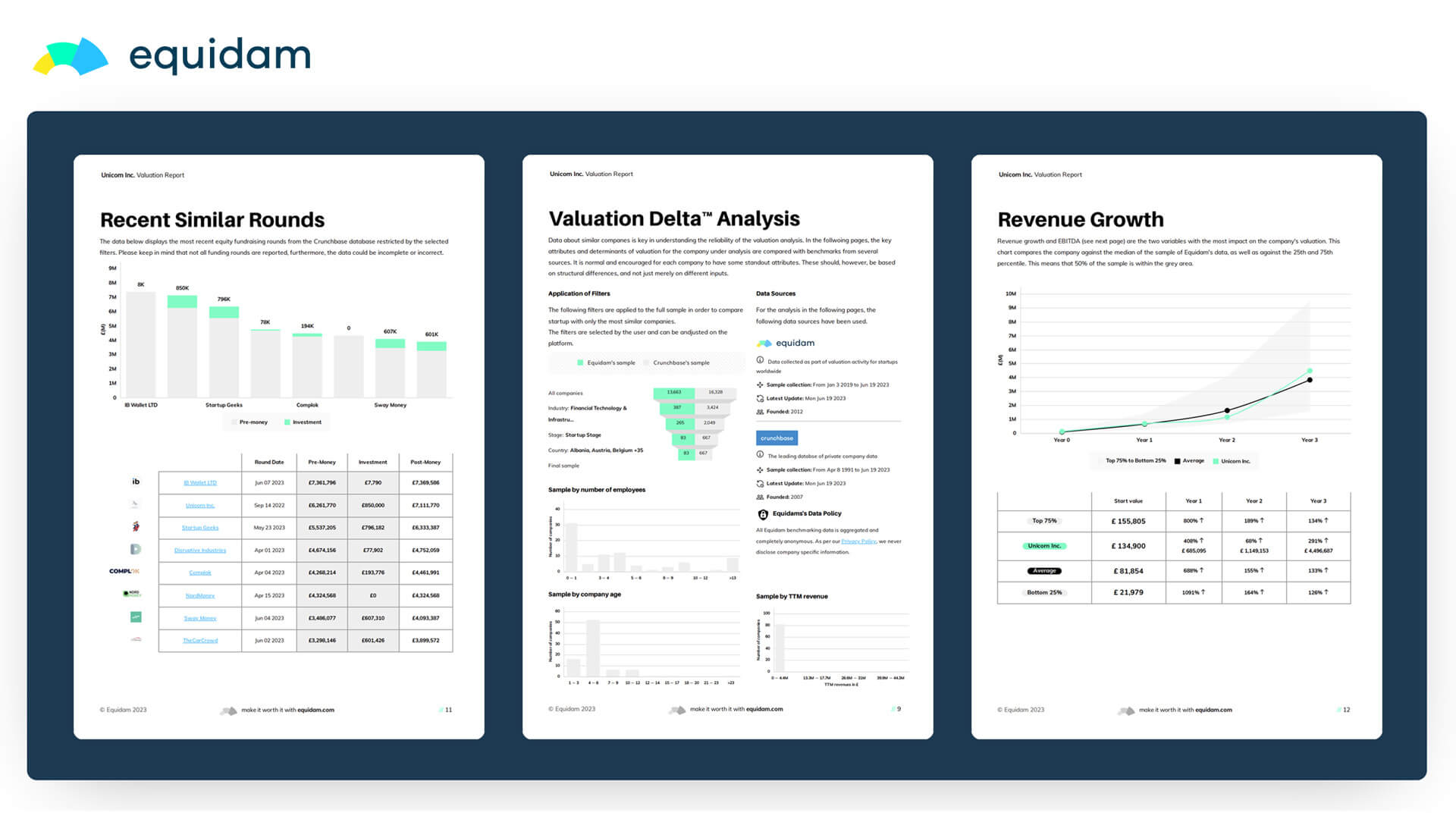

The last 18 months has been a rollercoaster for the startup equity market. A range of factors can be blamed, but a primary candidate is the lack of visibility on early stage deals. Addressing this, Equidam is opening up data from the 140,000+ valuations which have been completed on their platform, enriched with market data provided by Crunchbase. When you complete a valuation on Equidam, you now have the option to access Valuation Delta™, a suite of benchmarks on valuation, revenue, EBITDA and funding budget. This allows users to sanity check their assumptions and discuss valuation with greater confidence and context.

“The benchmarks provided in our Valuation Delta module are game changing for startup founders who have never had access to this kind of data before,” explained Daniel Faloppa, Equidam Founder & CEO. “What is the usual revenue growth for a payments company in Europe? What do valuations look like in the hospitality sector in the US? What’s the typical round size for an African agritech startup raising its first round? By adding this context we can enable better equity decisions for startups.”

Opaque practices in early stage investing, combined with the recent period of low interest rates, produced a perfect storm in the venture industry which wasted a tremendous amount of investor capital. At the same time, many entrepreneurs which fell outside of the usual investor model were unable to secure the funding needed for their ventures. Moving towards a standardized and objective view on value provides the venture market another path forward, avoiding these pitfalls.

“By increasing transparency in startup valuation, Equiam aims to enable fairer startup funding, reducing bias, ultimately making sure capital is allocated to the ideas that advance humanity the furthest,” added Faloppa.

Daniel Faloppa, Equidam CEO, walks you through the Valuation Delta™

This is the latest in a string of releases, including the recently announced Advanced Multiples module, upload for financial projections, and multi-seat capability for professional users, all aimed at making startup valuation a more practical and standardized process for the venture industry. Enabling the fairer allocation of investment, and better outcomes for all participants. And there’s much more to come.